Vol. 40 (Issue 38) Year 2019. Page 25

NIGMATULLINA, Gulnara R. 1; GIRFANOVA, Irina N. 2; HAZIEVA, Aigul M. 3; ABLEEVA, Alisa M. 4 & SALIMOVA, Guzel A. 5

Received: 12/08/2019 • Approved: 30/10/2019 • Published 04/11/2019

4. Research methods and methodology

ABSTRACT: The given paper presents the results of economic and statistical analysis of the structural and dynamic development of extrabudgetary funds of the Russian Federation, as well as the impact of factors on receipts of mandatory social insurance funds. The authors focus on extrabudgetary funds, the most important element of the social insurance system. The particular importance of the chosen research target is due to the fact that the state extrabudgetary funds are the only form of social protection of the population. |

RESUMEN: O presente artigo apresenta os resultados da análise económica e estatística do desenvolvimento estrutural e dinâmico dos fundos extra-orçamentais da Federação Russa, bem como o impacto dos factores nas receitas dos fundos obrigatórios de segurança social. Os autores centram-se nos fundos extra-orçamentais, o elemento mais importante do sistema de segurança social. A importância particular do objectivo de investigação escolhido deve-se ao facto de os fundos extra-orçamentais do Estado serem a única forma de protecção social da população. |

A modern system of social protection of the population as an effective mechanism of social, economic and financial relations of extrabudgetary funds is being developed in the Russian Federation. Development of the existing extrabudgetary sphere involves remodeling of legal relations and implementing effective policies to improve the population welfare in the form of social guarantees.

Extrabudgetary funds are a part of the state financial system to build, use and redistribute funds to ensure the welfare of participants in social policies (Fornero, 2015). At the moment there are three federal extrabudgetary social insurance funds in the Russian Federation, as in most countries of the world: FSS (social insurance fund), PFR (Pension Fund), FOMS (federal mandatory health insurance fund).

A new model of extra-budgetary funds redistribution and a personalized approach started in Russia in the early 1990s as course of introducing a market economy due to changes in the state policy. In the early 1990s, the Soviet Union legislator made a decision to divide the state social insurance system into the pension insurance system and the social insurance system (in the narrow sense).

Decentralization in the sphere of social insurance meant, first of all, the abolition of the former system of financing and the establishment of new, extrabudgetary relations. The rigid link between the social insurance budget and the state budget that had existed during the Soviet period was severed and a decentralized extrabudgetary system with differentiated insurance rates was introduced. As extrabudgetary funds gained experience as independent financial entities, they also became more autonomous as administrative institutions. The country has passed the first stages of reforming the system of social protection of the population with both positive and negative results. These common and distinctive preconditions can provide important experience and forecasts to develop the system in the future.

In scientific research, social insurance and support in transitional and developing economies have been widely studied both in terms of theory and practical application.

In most countries contributions are collected by central government institutions. Local or regional governments are engaged in contribution collection only in some countries. As a rule, there is a national agency that collects social taxes and accumulates funds in trust funds. Mostly these are tax services.

Reforms of the Russian social insurance system are discussed by domestic and foreign scientists.

Today, pension systems having been operating in most countries for more than 40 years are sufficiently mature. This means that the majority of employed are covered by pension plans and entitled to full benefits. The population has grown old and the share of people contributing to the pension scheme is decreasing. This is the way the pension insurance is disclosed in Müller K. studies (Müller, 2014). Problems and results of pension reform are revealed by Pallares-Miralles M., Romero C., Whitehouse E. (2012), Williamson B. J. (2006). They identified issues of funds redistribution, share participation in pension savings development.

Principles, analytical errors and pension reform development policy are widely discussed by Barr N., Diamond P. (2009). Góra M., Rohozynsky O., Sinyavskaya O. study prospects for pension reforms in Russia and Ukraine (2010).

Remington T.F. discloses political influence in the world on the results of the pension reform of Russia and China (2015). Fornero E. discusses the rationale for reforming the pension system (2015). Wagner H. considers pension systems in the EU countries (2005).

Grishchenko N. stands out a special opinion on the domestic pension insurance system (2016). The scientist identifies conditions for preferential pension provision.

In fact, many developed countries have adopted a pension system that combines state-managed pension schemes with privately managed workplace pension plans and personal savings accounts to meet the needs of middle-and higher-income groups. However, the decisive role in ensuring the income of pensioners belongs to the state distribution (solidarity) pension system.

There are also a lot of works on health insurance. Thus, Borda M. reveals the role of private health financing in Central and Eastern Europe (2008). Cook L. considers inequality, informality and failures of reforms in the field of mandatory health insurance (2015).

Golinowska S., Sowa A., and Topor-Mądry R. (2006), Sagan A., Panteli D, Borkowski W., Dmowski M., Domański F., Czyzewski, M., ... Busse R. (2011) discuss health systems in Central and Eastern European countries such as Bulgaria, Estonia, Poland, Slovakia and Hungary. They highlight the main aspects and differences of health systems.

Health system reforms in Central and Eastern Europe and the former Soviet Union are studied by Kutzin J., Jakab M. & Cashin C. (2010), Rechel B. & McKee M. (2009), Wagstaff A. & Moreno-Serra R. (2010). The scholars focus on the fiscal balance, the need to decentralize the budgets of the extrabudgetary sphere.

Nemec J., Sankar S. S., Kostadinova, T., Small, I., Z. Darmopilova study the experience of foreign countries in the field of healthcare financing (2013). Thompson V. describes transformations in the health insurance system of the Russian Federation (2007).

Antia F., Lanzara A. P. depict the Chilean, Uruguayan and Brazilian systems (2011). Brodmann S., Jilloson I., Hassan N., ouline changes in social insurance in Jordan (2014). Sanchez Martin A.R. gives special emphasis to the Spanish pension system (2010). A Cai Y., Cheng Y. (2014), Remington T. F. (2015) focus on pension reform in China. Maśniak D., Lados D.J. reveal development of the social security system in Poland and Hungary (2014).

Bielawska, Guardiancich, Fultz E., Schmähl W., Horstmann S. provide an overview of the insurance systems in European countries (Bielawska, 2014).

The basics of applicable research and forecasting models are described in works of I. Gabitov, E. Khasanov, I. Chudov and others (Mudarisov et al., 2017; Gabitov et al., 2018; 2018b).

The present premium system is 26%, namely 20% to the Pension Fund, 2.9% to the social insurance fund and 3.1% to the mandatory health insurance fund.

The transition from taxes to insurance payments in 2010 allowed to balance the pension system of the Russian Federation. The present-day analysis of socio-economic development in the Russian Federation shows is a minimum deficit of extrabudgetary funds associated with accumulated liabilities.

The given paper relies on the works of the above-mentioned authors and their scientific schools. The results do not contradict the general economic laws. They provide an overall picture of budgets for each state extrabudgetary social insurance fund.

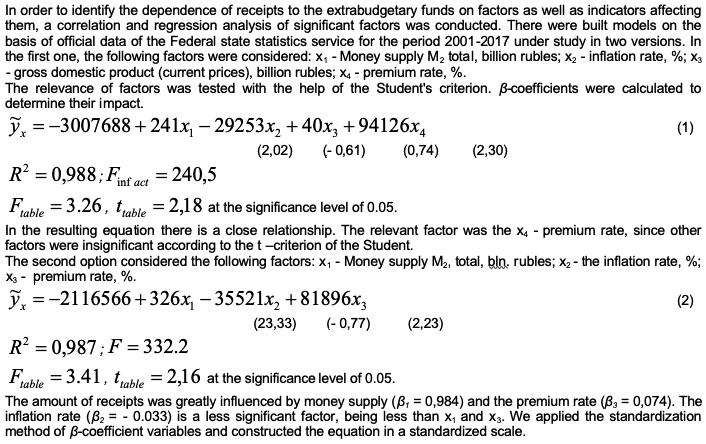

The used analysis methods are fundamental and reliability of the results is undeniable for being based on the official data of the Federal state statistics service. There are developed two multiple correlation and regression models of payments to extrabudgetary funds of the Russian Federation and factors having a significant impact are identified.

The aim of the research is an economic and statistical analysis of the factors influence on contributions to the state extrabudgetary social insurance funds and the forecast of receivables in the short term.

The studies were conducted in accordance with statistical, econometric, computational and constructive research methods as well as comparative forecasting based on the obtained models. To take into account the influence of factors on the receipts to the state extrabudgetary social insurance funds, an economic and statistical analysis was conducted on the basis of official state statistics for the period 1995-2017. The first stage of the study on receipts and expenditure was performed according to time series for each individual fund. In the second stage, trends in receivables and spending were built separately for each fund as well. Then, based on the obtained trends a forecast for receipts and expenditure of extrabudgetary funds was built, the cause-effect relationships of stable trends were identified.

At the final stage, multiple correlation and regression models were constructed based on the average annual data of the Russian Federation for 2001-2017. They were designed separately for every fund in two options. In the first one, the following factors were considered: x1 - Money supply M2 total, billion rubles; x2 - inflation rate, %; x3 - gross domestic product (current prices), billion rubles; x4 - premium rate, %. The second option considered the following factors: x1 - Money supply M2, total, bln. rubles; x2 - the inflation rate, %; x3 - premium rate, %.

The calculations are made according to the official Russian Federal Statistics Service, section Finances on receipts and expenditure of state extrabudgetary funds.

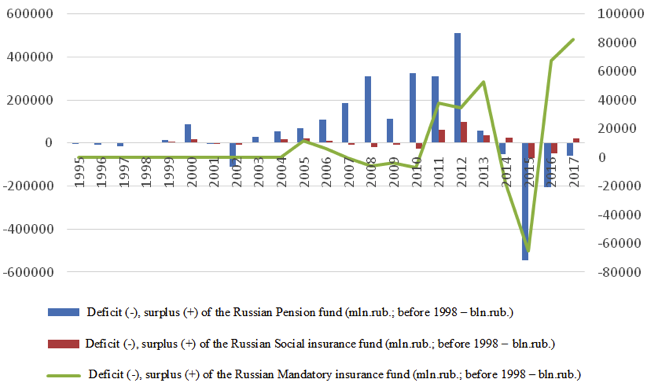

In the course of the study, three extra-budgetary funds were analyzed: Pension Fund of the Russian Federation, social insurance fund, and mandatory health insurance fund. Figure 1 presents receivables and spending of the funds. The source of information is the data of the official Federal state statistics service that is to provide objective and complete statistical information to the authorities and management, the media, the population, the scientific community, commercial organizations and entrepreneurs, international organizations. The system of state statistics, including the Federal office and the territorial bodies of the Russian Statistics Service, located in all regions of the Russian Federation, is used to solve this problem.

Figure 1

Dynamics of extra-budgetary funds budget deficit

(surplus) (million RUB.; before 1998 - bln. RUB.)

Figure 1 shows that the main changes in the dynamics take place in the Pension Fund. Until 2000 there was budget deficit, since 2001, 2003-2013 – surplus and in 2014-2017 – deficit. A significant deficit was in 2015. It amounted 5433636 million rubles; in 2016 the deficit was 204425 million rubles.

The social insurance and mandatory health insurance funds maintain a relatively stable level of low deficit.

The highest deficit In the social insurance Fund is observed for the period from 2007-2010, but a significant deficit was in 2015 (70859 million rubles).

There can be distinguished three periods of budget deficit in the mandatory health insurance fund: the first period in 1995-1998; the second period in 2007-2010; the third period in 2014-2015.

These changes can be associated with a set of specific factors, that will be discussed hereafter in the second part of the given paper. The next step was to build trends in receipts and expenditures separately for each fund. On the basis of the obtained trends, we predict the volume of receivables and spendings in subsequent periods.

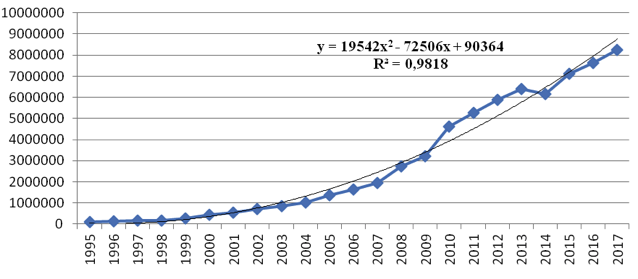

In 2017, the share of the pension Fund budget in GDP of Russia (in current prices) was 8.9 % in receipts, and 9.0 % in expenditure. Change tendencies in receivables and spending of the Russian Pension Fund are clearly illustrated in built trends for the study period 1995-2017. A polynomial trend was built in Excel that showed most accurately the trend of changes in receipts and expenditure of the Pension Fund (figure 2).

Figure 2

Receipts of the Russian Pension

Fund in 1995-2017, million rubles

The R-squared value is 0,9818 indicating good agreement between the trend line and the source data. The forecasts must be accurate.

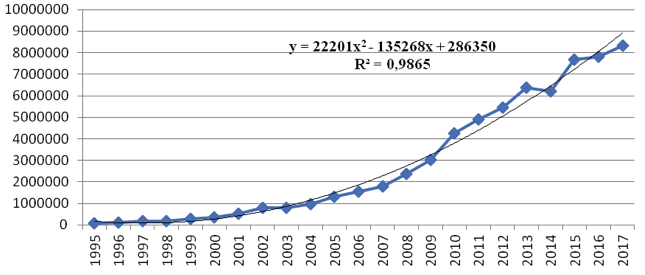

The change in the expenditure of the Pension Fund is described by the equation in the form of a second-order parabola approximating the actual data by 98.7 % (figure 3).

Figure 3

Expenditure of the Russian Pension

Fund in 1995-2017, million rubles

Since obligations of the state extend social coverage of the population, it is of particular interest to compare trends in receipts and expenditure of the Social Insurance fund. The social insurance fund is being built up from premiums, tax payments, deposits and other financial investments, from the Federal budget, as well as other arrivals.

As to expenditure, the following costs were considered: financing pension and benefits payments to the population; financing payments of benefits in excess of the established rates, sanatorium treatment and improvement at the expense of the Federal budget; financing the Executive Management of the Fund; other expenses.

The receivables of the mandatory health insurance fund include: premiums, tax payments; incomings from the Federal budget; other arrivals.

A polynomial trend of receipts and expenditure of the mandatory health insurance fund is built in Excel. The spending trend is represented as a parabola of the second order, approximating the original data at 93.1 %. It indicates the minimum approximation error. There are calculated pointwise values of forecast receipts and expenses of the funds.

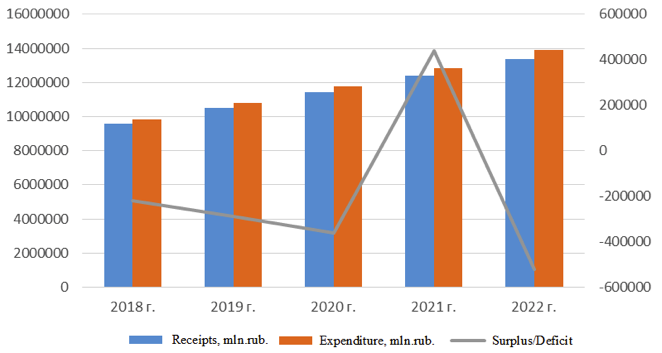

The Pension fund budget is approved by the State Duma of the Federal Assembly of the Russian Federation. It is done by a separate law adopted together with the Federal budget. Accordingly (Federal law No. 363, 2017), there are approved total revenues and expenditures of the Fund budget for 2018-2020. The budget deficit is expected to be 106 573.9 million rubles in 2018, 73 843,6 million rubles in 2019 and 44 596,3 million rubles in 2020.

Our forecasts also stipulate the budget deficit in the Pension fund of the Russian Federation being rising year after year (figure 4).

Figure 4

Forecast of receipts and expenses of the Russian

Pension Fund in 1995-2017, million rubles

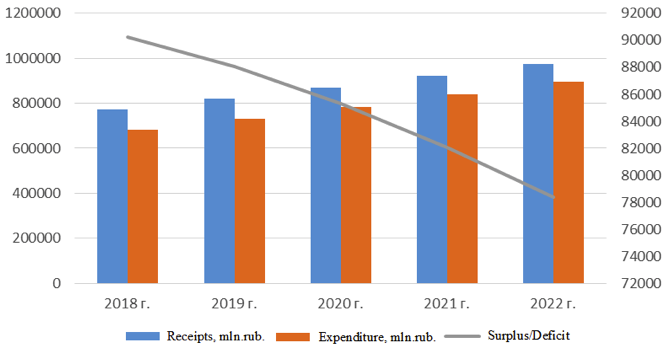

In accordance with (Federal law No. 363, 2017) main characteristics of the budget are defined. They show yearly increase of the budget deficit. However, the opposite trend is observed for the predicted values (figure 5).

Figure 5

Forecast of receipts and expenses of the Social

Insurance Fund in 1995-2017, million rubles

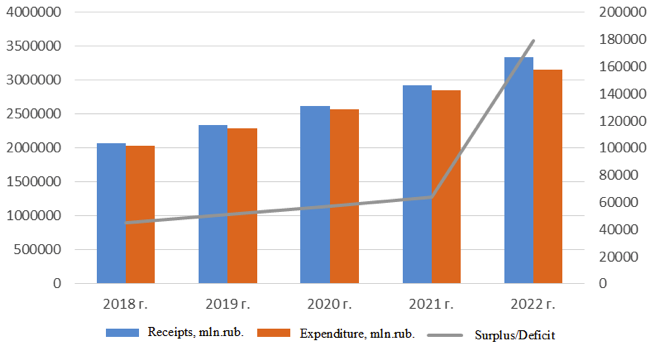

The main budget characteristics of the federal mandatory health insurance fund are approved by the federal law (Federal law No. 363, 2017). According to the federal law (Federal law No. 363, 2017) there is a decrease in the budget deficit. By 2020 the budget is planned to achieve a balance.

The forecast values indicate possible budget surplus (figure 6). This forecast was calculated based on the received polynomial trend of receipts and expenditure of the Mandatory Health Insurance Fund in Excel.

Figure 6

Forecast of receivables and spending of the Mandatory Health

Insurance Fund of the Russian Federation for 1995-2017, mln. RUB.

Accordingly, making up the budget with a surplus also entails negative consequences, as it leads to a decrease in the efficiency of budgetary funds, as a consequence, an increase in the burden on the economy. Therefore, a balanced budget is an ideal option, but it is not easy to achieve in a real economy. A balanced budget is the basis for the proper functioning of extrabudgetary funds. However, if even a small part of the budget is not balanced, this may result in a delay in funding social insurance, failure to meet deadlines, the non-payment problem. The ideal option would be, of course, a completely deficit-free budget, where the amount of expenditure is fully consistent with the amount of incomings. However, in a real economy, it is not easy, and sometimes impossible, to achieve. If a budget with a deficit is unavoidable, sources of financing for the budget deficit have to be brought in to balance.

In accordance with Chapter 34 "Insurance premiums" of the Russian Tax code as well as the world practice, employee benefits are recognized as the basis to calculate insurance premiums. Thus, the monetary income of the population is a direct factor affecting the amount of payments to social insurance and security funds.

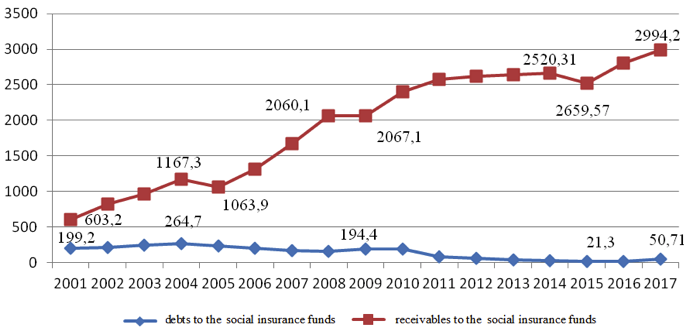

Figure 7 demonstrates debt-to-income ratio of extrabudgetary funds.

Figure 7

Dynamics of debt and receipts to extrabudgetary social insurance funds, billion rubles

(according to the official Federal state statistics service of the Russian Federation)

The data shows that the population's cash income in 2017 increased by 12.3 times compared to 2001, while receivables to social funds increased by 5 times. The debt rate tends to decrease since 2005 and by 2016 reached its minimum for the period being 15.2 billion rubles or 240.8 million dollars compared to the level of 2001. In 2017 the debt on payments to state extrabudgetary social funds amounted to 803.3 million dollars excluding inflation (the dollar-ruble exchange rate in Russia is 63.129 rubles per 1 dollar as of July 24, 2019). To a greater extent, these changes were due to the application of effective state policy in relation to extrabudgetary funds. Namely, increase in premium rates to 34% and heavier penalties for concealing premium basis.

It should be noted that the amount of current obligations to pay premiums includes debts of previous periods as well. Therefore, besides meeting current liabilities, receivables to extrabudgetary funds take into account the debts paid in previous periods, including fines and penalties. Accordingly, as in the world practice, it is necessary to rely on the amount of obligations of the current period.

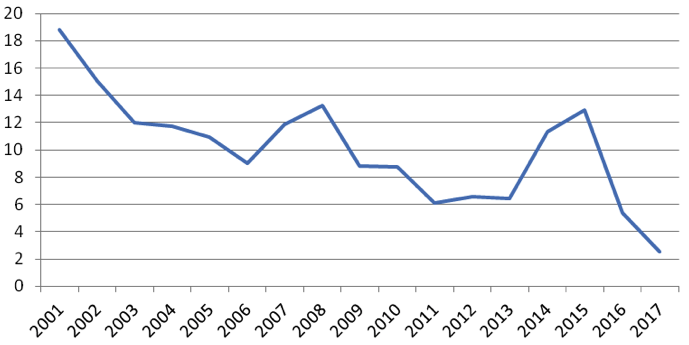

When comparing the share of receipts and the share of debt to the total amount of cash income of the population, there is revealed a downward trend. This may be due to an increase in the share of tax-exempt activities and a regressive scale used. Money incomes of the population have a steady growth in comparison with the base year 2001 (to the base period). But there is a trend to reduce their share (to the previous period) when calculating the chain growth rates of this indicator. The inflation rate is abrupt for the period under study, but it significantly decreases from 84.5% in 2001 to 2.5% by 2017. However, the share of money incomes of the population is inversely related to the inflation rate (figure 8). Thus, with a decrease in inflation, there is an increase in money incomes of the population.

Figure 8

Inflation rate in the Russian Federation, %

Since 2001, the inflation rate has been gradually decreasing and by 2017 it was 2.5 %.

Thus, among the factors considered, the money supply turned out to be the determining one in terms of the beta coefficients, while the non-significant factor was the inflation rate.

Thus, the initial group of factors is the amount of receipts and expenditure for each extrabudgetary fund separately, as discussed above.

Thus, based on the results of the study, it can be concluded that the most significant factors that determine the level of recevables to the state eextrabudgetary social insurance funds are the following:

The studied factors are not static and change under the influence of legislation (insurance premium rate), the results of economic production (gross domestic product and income of the population), changes in the general level of prices (inflation rate).

The conducted analysis made it possible to identify significant factors affecting the level of receipts to the state extrabudgetary social insurance funds. This provide a way to study insurance premiums as an object of accounting in terms of practice and develop ways to improve their calculations.

According to the received forecasts, it should be noted that there will be a budget deficit the Pension Fund and its further growth, while in the social insurance and the Federal mandatory health insurance fund there will be a surplus.

Antia, F., & Lanzara A. P. (2011). Multi-pillared social insurance systems: The post-reform picture in Chile, Uruguay and Brazil. International Social Security Review”, 64(1), 53-71.

Barr, N., & Diamond, P. (2009). Reforming pensions: Principles, analytical errors and policy direction. International Social Security Review, 62(2), 5-29.

Bielawska, K. (2014). Sustainability of structural pension reforms in the CEE countries – experiences and lessons. Insurance Review, 4, 111-122.

Borda, M. (2008). The role of private health financing in Central and Eastern Europe. Economics, 83, 100-109.

Brodmann, S., Jilloson, I., & Hassan, N. (2014). Social Insurance Reform in Jordan. Awareness and Perceptions of Employment Opportunities for Women. Social Protection & Labor. World Bank, Washington, DC.

Cai, Y., & Cheng, Y. (2014). Pension reform in China: challenges and opportunities. Journal of Economic Surveys, 28(4), 636-651.

Cook, L. (2015). Limitations of universal health care in the Russian Federation: inequality, informality and the failures of reforms in the field of obligatory medical insurance. UNRISD, prepared for the UNRISD project "Universal social security in developing economies", working papers.

Federal law No. 363 (2017). "On the budget of the Pension Fund of the Russian Federation for 2018 and for the planning period 2019 and 2020".

Fornero, E. (2015). Economic-financial literacy and (sustainable) pension reforms: why the former is a key ingredient for the latter. Bankers, Markets & Investors, 134, 6-16.

Fultz, E. (2002). Social security reforms in Central and Eastern Europe: How effective, equitable and secure. In ISSA European regional meeting, Budapest.

Gabitov, I.I., Badretdinov, I.D., Mudarisov, S.G., Khasanov, E.R., Lukmanov, R.L., Nasyrov, R.R., … & Pavlenko, V.A. (2018). Modeling the Process of Heap Separation in the Grain Harvester Cleaning System. Journal of Engineering and Applied Sciences, 13, 6517-6526.

Gabitov, I I., Juxin, G.P., Martynov, V.M., Galiullin, R.R., Kostarev, K.V., Negovora, A.V., & Baltikov, D.F. (2018b). Modeling the Power Plant Operation to Optimize the Technological and Design Parameters of the Gas Generator Unit. Journal of Engineering and Applied Sciences, 13, 8857-8864.

Golinowska, S., Sowa, A., & Topor-Mądry, R. (2006). Health and health systems in Central and Eastern Europe: Bulgaria, Estonia, Poland, Slovakia and Hungary. Enepri research report No. 31.

Góra, M., Rohozynsky, O., & Sinyavskaya, O. (2010). Pension reform options for Russia and Ukraine: a critical analysis of available options and their expected outcomes. ESCIRRU Working Papers, 25, 1-66.

Grishchenko, N. (2016). Pensions after pension reforms: a comparative analysis of Belarus, Kazakhstan, and Russia. Procedia Economics and Finance, 39, 3-9.

Kutzin, J., Jakab, M., & Cashin, C. (2010). Lessons from health financing reform in Central and Eastern Europe and the former Soviet Union. Health Economics, politics and law, 5(2), 135-147.

Martín, A. R. S. (2010). Endogenous retirement and public pension system reform in Spain. Economic Modelling, 27(1), 336-349.

Maśniak, D., & Lados, D.J. (2014). Pension Reforms in Poland and Hungary from the Legal Perspective – similarities and differences. Insurance Review, 4, 123-142.

Moreno-Serra, R., & Wagstaff, A. (2010). System-wide impacts of hospital payment reforms: evidence from Central and Eastern Europe and Central Asia. Journal of Health Economics, 29(4), 585-602.

Mudarisov, S., Khasanov, E., Rakhimov, Z., Gabitov, I., Badretdinov, I., Farchutdinov, I., ... & Jarullin, R. (2017). Specifying Two-Phase Flow in Modeling Pneumatic Systems Performance of Farm Machines. Journal of Mechanical Engineering Research and Developments, 40(4), 706-715.

Müller, K. (2014). Pension Privatization and Economic Development in Central Eastern European Pension Reform. Reforming Pension in Developing and Transition Countries. Palgrave MacMillan, 41-68.

Nemec, J., Tsankar, S.S., Kostadinova, T., Maliy, I., & Darmopilova, Z. (2013). Health financing: what can we learn from the experience of Central and Eastern Europe? Administrative culture, 14 (2), 212 – 23.

Pallares-Miralles, M., Romero, C., & Whitehouse, E. (2012). International Patterns of Pension Provision II: a Worldwide Overview of Facts and Figures. Social Protection Discussion Paper 70319, World Bank, Washington, D.C.

Rechel, B., & McKee, M. (2009). Health care reform in Central and Eastern Europe and the post-Soviet space. Lancet, 374 (9696), 1186 - 1195.

Remington, T. F. (2015). Pension reform in authoritarian regimes: Russia and China compared. unpublished paper. http://polisci.emory.edu/home/documents/papers/pensionreform-%20authoritarian-regimes.pdf.

Sagan, A., Panteli, D., Borkowski, W., Dmowski, M., Domanski, F., Czyzewski, M., ... & Ksiezak, M. (2011). Poland health system review. Health systems in transition, 13(8), 1-193.

Thompson V. (2007). Health care reform in Russia: problems and prospects. OECD Department of Economics. Working papers. No. 538, OECD publishing, Paris.

Wagner, H. (2005). Pension Reform in the New EU Member States. Will a Three-Pillar Pension System Work? Eastern European Economics, 43(4), 27-51.

Williamson, B. J. (2006). Political Economy of Pension Reform in Russia: Why Partial Privatization? Journal of Aging Studies, 20(2), 165-175.

1. Department of accounting, statistics and information systems in the economy, Federal State Budgetary Educational Establishment of Higher Education «Bashkir State Agrarian University», Ufa, Russian Federation, nigmatullinagulnara3@gmail.com

2. Department of accounting, statistics and information systems in the economy, Federal State Budgetary Educational Establishment of Higher Education «Bashkir State Agrarian University», Ufa, Russian Federation

3. Department of accounting, statistics and information systems in the economy, Federal State Budgetary Educational Establishment of Higher Education «Bashkir State Agrarian University», Ufa, Russian Federation

4. Department of accounting, statistics and information systems in the economy, Federal State Budgetary Educational Establishment of Higher Education «Bashkir State Agrarian University», Ufa, Russian Federation

5. Department of accounting, statistics and information systems in the economy, Federal State Budgetary Educational Establishment of Higher Education «Bashkir State Agrarian University», Ufa, Russian Federation