Vol. 40 (Number 25) Year 2019. Page 30

FERNANDEZ, Alejandra 1; REYES, Alejandro 2 y ALVAREZ, Fernando 3

Received: 08/04/2019 • Approved: 11/07/2019 • Published 22/07/2019

5. Conclusions and future work

ABSTRACT: MSEs have limitations associated with financial resources, management and insufficient infrastructure to carry out their activities. To contrast the hypothesis, a regression model was proposed, using a generalized additive model (GAM). This study shows that Mexican entrepreneurs perceive financial problems as the main set back that prevents them to make a profit, followed by external factors like violence and/or insecurity and economic conditions of the Country, representing the major issues being faced. |

RESUMEN: Las PYMES tienen limitaciones en recursos financieros, sistemas de gestión y cuentan con una infraestructura insuficiente para desarrollar sus actividades. Para contrastar la hipótesis de trabajo se planteó un modelo de regresión, mediante un modelo aditivo generalizado (GAM). El estudio arroja que los problemas financieros (FIF) son la principal dificultad que los microempresarios en México perciben que impiden obtener utilidades, seguido de los factores externos (FEX), representan la mayor problemática enfrentada. |

Micro and Small Enterprises (MSEs) are the sector and type of business that supports the so called “developed” and "developing economies" or "emerging economies ", as is the case of Mexico. MSEs have also been widely recognized as the sector that generates the greatest number of jobs in every country in the world, especially those that make up the “third world”.

There exist environmental factors that affect the closure of micro and small enterprises. Historically, we can affirm that Mexico is, from an entrepreneur’s point of view, a country made up of micro and small enterprises not only occupying its industrial sector but the majority of its economic activities which also includes services, commerce, transportation, tourism, agriculture, livestock, etc.

At present, very little literature within entrepreneurial and management sciences, as well as relatively little theoretical and empirical studies address the importance of MSEs in the economy and society in any country in the world (from a scientific perspective) even when researchers, academics and professionals in the field have acknowledged the importance of these types of businesses. Nevertheless, MSEs have been considered as one of the economic pillars of growth and development in the economy since these enterprises not only provide jobs to an elevated number of families but also to the members, who manage, produce and market their products and/or services they generate.

One of the main particularities that characterize and sets an MSE apart from other types of enterprises is its organizational structure, which is similar to that of a family. The owner manages the enterprise and its workers were its family members. They do not have an established work schedule and they do not receive a formal salary for their work. Therefore, the formalization of MSEs is not very common in Mexico as in various countries in Latin America. The majority of these types of businesses carry out their economic activities as informal economies, which lack financing on behalf of public and private banking institutions, becoming easy prey to loan sharks or loans with extremely high interest rates. MSEs commonly specialize in providing a specific product or service and generally concentrate their efforts in the development of this product or service in a limited commercial area and the benefits obtained are constrained by their low capacity of production. The day to day entrepreneurial activities performed by MSEs in Mexico, as in any other Latin American country is limited in human, technical, and financial resources. They usually depend on the managers and/or owner’s knowledge, capacities, abilities and experience. A company's growth and development are closely linked with the perception of their owners’ entrepreneurship. Those that survive are those that are willing to take risks and innovate on their products or services. As mentioned, during last decade, there has been a significant decrease of MSEs’ participation in the marketing of goods and services in the formal market. Consequently, this has affected the economy and the Mexican society in general. In this same period, there was a substantial increase in convenience stores and supermarkets in the Mexican economic activity. In 1999, MSEs in Mexico occupied a total of 43.3% of the establishments in the market; by 2008, they represented only 32.3% (Alonso, 2010). This represents a reduction of just over 10% of MSEs.

Let us remember that MSEs perform a very important role in a country’s economy: generating income and job opportunities and its contribution to its economic and competitive growth. Throughout the years, researchers have queried the functions MSEs have due to their operational complexity caused by the diversity of commerce, the quantity of economic units and socio-economic and cultural characteristics of their managers (Mayson, 2011) among others.

As mentioned, micro enterprises lack a formalized administrative process when planning their organization. They work under an empirical system that is neither substantial nor formally written. Alarming data indicate that the life expectancy of enterprises in Mexico stands at 7.8 years. This requires that we determine the factors for an enterprise’s closure and compare them to those that continue functioning.

In addition to these factors, there exist indicators from the National Institute for Statistics and Geography (INEGI, 2012), which mention that the main reason for an activity or business to start is to supplement a family´s income. The main problem is a decrease in sales. The 5% of economic units think they will not continue with their commercial activity, 69% do not visualize important changes within their enterprise, which brings us to ask: Why did they start their businesses? (Fontinelle, 2017). What causes them to close?, What do they think they could have improved if the economic unit had continued functioning? This research was approached through a quantitative method with an exploratory scope. This study is aimed towards the investigation of factors that can have a direct impact of MSEs’ closure in a particular context.

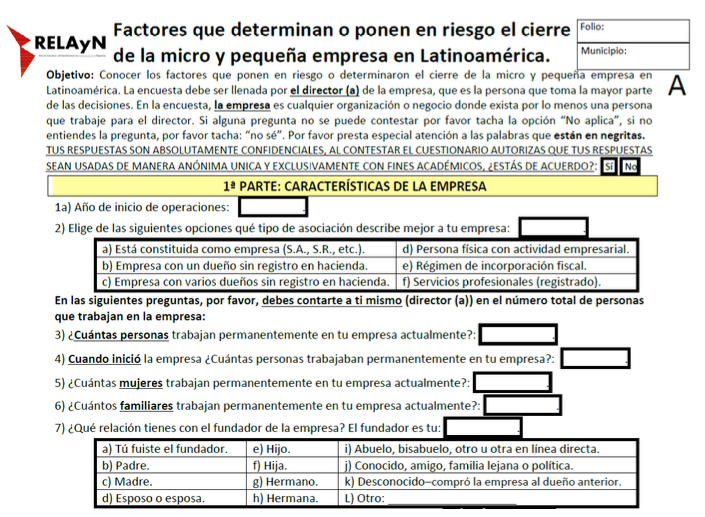

The overall objective is to determine the factor or factors that contribute to the closure of micro and small enterprises. Two almost identical questionnaires were created and applied to closed and functioning enterprises (see Figure 1). In addition functioning enterprises were asked how they perceived their risk of closure (some risks have a significant effect on how they perceive their environment and some do not).

Figure 1

RELAyN questionnaire to Identify factors to determine

closing/risk of closing for MSEs in Latin America. RELAyN, 2018

Today, literature can be found on entrepreneurial and management sciences where researchers, academics and professionals discuss the importance of increasing studies in MSEs that imply a measurement of the main variables that affect them. Due to the fact that these enterprises are fundamental, not only to the development of a country’s economy, but also to its social development, the definition of the variables will allow the most exact measurement of the issues that MSEs currently face and they will be used in an information-gathering instrument since the analysis of the information obtained will depend greatly on the information obtained.

The investigation was approached with a quantitative method from an exploratory scope; this study aims to explore factors that may influence the closure of MSEs in a particular context. The factors considered were: financial factors (FF), factors related to marketing (MF) and personal and administrative factors (SF), external factors (XF) and, finally, Technology Factors (TF).

The hypothesis, which is considered for this research, is:

1. Hypothesis:

2. H1. Personal and administrative factors (SF) are the main reasons for closure of SMEs

3. Ho. Personal and administrative factors (SF) are not the main reasons for closure of SMEs

To contrast the hypothesis, a regression model was raised using a generalized additive model allowing us to use different types of variables, which are ideal for this analysis. The model uses a smoothing function and a conventional parametric component so this method can be considered to have a semi parametric approach.

We applied 36,934 questionnaires to MSE’s directors of which 1954 were discarded; 33.3% were applied to closed enterprises. The average age of a functioning enterprise on our sample was 10.5 years with a median of 7 years; the average duration of a closed enterprise was 5.6 years, with a median of 3 years. The longest running enterprise in this study had been operating for 84 years. Regarding the legal regime, 5,105 were corporations, 13,835 were legally registered businesses of other kind (e.g. personal businesses, tax paying professionals, etc.) and 16,040 were without government registration.

Our research was performed on enterprises of 50 people of less with the following distribution:

2 people: 14,825

3 to 5 people: 14,695

6 to 10 people: 3,615

11 to 20 people: 1,198

21 to 30 people: 337

31 to 40 people: 162

41 to 50 people: 148

The model will evaluate five factors, which are perceived as threats or reasons for an MSE's closure by entrepreneurs and considering the type of enterprise.

To determine the causes of an MSE's closure, RELAyN directors performed a quantitative study where categories emerged and were grouped into five variables. A final questionnaire was created and a pilot test was carried out. Through this pilot test and with the use of a factorial analysis, five variables corroborated the theoretical variables coinciding with five factors that were found which were taken from questions 43 and 44 (Peña, Aguilar, & Posada, 2017). They are:

Two, almost identical types of questionnaires were created, which were applied to open and closed enterprises. The fundamental difference of these questionnaires was the verbal tense since the closed enterprises were asked in reference to its last season of operations and the open enterprises were asked in present. In addition, open enterprises were asked if they felt at risk of closure. Items asked are shown below, for each item respondent select a number in a scale of 3 (It influenced a lot) to 1 (It did not influence), or select 0 if do not know /does not apply item.

In the next section, select how much this cause, influenced the closing of your company, circle the answer you considered.

In case you do not apply the question or do not know what it refers to, select the option "I do not know".

In some cases the question contains several issues, please answer in a global way.

It influenced a lot (3)

Influenced (2)

It did not influence (1)

I do not know / does not apply (0)

FINACIAL ASPECTS

The income was not enough to subsist.

The various debts.

The lack of capital to invest.

The excessive payment of taxes.

Lack of money to invest in advertising and publicize the company.

The price increase in fuels.

Inflation in general.

MARKET ASPECTS

The location where my company was located.

The products and / or services of the competition were better.

Marketing and advertising were not sufficient or effective.

Low or no sales.

PERSONS Y MANAGEMENT

Lack of experience in the management of the company.

The lack or deficient planning of the company.

The lack of academic training to run the company.

Lack of time to take care of my children, husband, family.

The turn of the company was no longer of my interest.

The lack of training of my workers.

The various problems with my workers.

EXTERNAL FACTORS

The increase of costs in the suppliers.

The increase in the exchange rate.

The problems of insecurity and / or violence.

The political conditions of the country.

The economic conditions of the country.

The lack of sources of financing.

The price increase in fuels.

Inflation in general.

TECHNOLOGY

The fact that my product, machinery or technology was no longer suitable for the current market.

Not knowing how to use technology that I needed to stay in business.

The failure to develop or implement changes in my products, processes and machinery.

To gather the data, a large group of professors from 73 research groups, participated in the application of questionnaires in their cities during February, 2017. Data for the current paper was taken from the 2017 research project and the protocols can be read in Peña, Aguilar y Posada (2017), which in turn is based on Posada, Aguilar y Peña (2016).

The characterization of MSEs in this research considered 36,934 samples disseminated throughout Mexico and Colombia and under the context of five segmented variables with information provided by MSEs.

To contrast the hypothesis, a regression model was raised using a generalized additive model (GAM). This model allowed us to use different types of variables, which are ideal for the analysis being performed. The model uses a smoothing effect and a conventional parametric component, and as a result, this method can be considered to have a semi parametric approach. The advantage of this method is that, even when we consider non-parametric characteristics of the input and output variables, it yields variables for p for each item and r^2 for the model, and therefore enabling us to interpret it the same way as other regression models.

The model was evaluated with five factors perceived as risks or threats for closure by MSE entrepreneurs and, considering the type of enterprise (see Table 1), we can observe how responses made by “safe open enterprises” differ from those that are “closed” but not with the enterprises that are “at threat of closure”. It becomes relevant that enterprises that perceive financial factors as their main risk factor tend to give greater importance to the way they perceive their environment. A model is annexed which includes the following co-variables; director’s age, age squared, level of studies, level of studies squared, size of the company and as dummy variables marital status (with partners vs other civil status) and the type of company (corporations vs. other states).

Table 1

Generalized additive model of risk factors/causes of closure

in the way in which the environment is perceived

|

Estimate |

Std. Error |

t value |

Test(>|t|) |

(Intercept) |

3.167 |

0.015 |

218.24 |

0.000 |

SF. |

-0.027 |

0.009 |

-3.14 |

0.002 |

TF. |

0.012 |

0.006 |

1.90 |

0.058 |

XF. |

0.195 |

0.008 |

24.30 |

0.000 |

FF. |

0.234 |

0.009 |

26.45 |

0.000 |

MF. |

-0.026 |

0.009 |

-2.97 |

0.003 |

TE2AS |

0.205 |

0.011 |

19.48 |

0.000 |

TE2AR |

0.178 |

0.018 |

10.15 |

0.000 |

Own elaboration, with data obtained (from the RELAyN questionnaire), to identify

the factors that determine or put at risk the closure of MSEs in Latin America, 2018.

The model describes a 12.42% deviation and an R^2 adjusted to 0.124, which indicates a good fit of the model and makes the interpretation of the results relevant.

In Table 2, descriptive statistics of the results are included for each variable in the systemic analysis.

Table 2

Causes of Closure Statistics

Variable |

Average |

Std. Dev. |

Cronbach |

FF. |

1.67 |

0.8 |

0.874 |

MF. |

1.57 |

0.7 |

0.760 |

SF. |

1.34 |

0.8 |

0.900 |

XF. |

1.72 |

0.8 |

0.921 |

TF. |

1.21 |

0.9 |

0.895 |

Own elaboration, with data obtained (from the RELAyN questionnaire), to identify the

factors that determine or put at risk the closure of MSEs in Latin America, 2018.

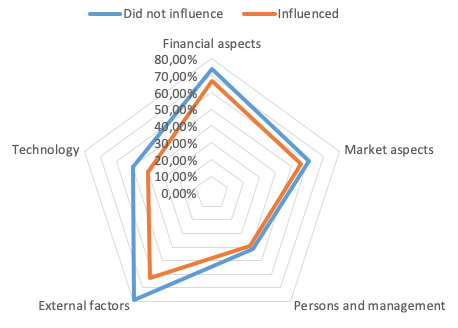

As shown in table 2, external factors and financial factors are main causes of Closure. Graphically these results are shown in Figure 2.

Fig. 2

Factors to determine closing/risk of closing for MSEs.

Own elaboration, with data obtained

(from the RELAyN questionnaire) to identify

the factors that determine or put at risk

the closure of MSEs Latin America, 2018.

As can be seen in Figure 1, External factors (XF) and Financial Factors (FF) are the main reasons for closing/risk of closing, both open and closed MSEs.

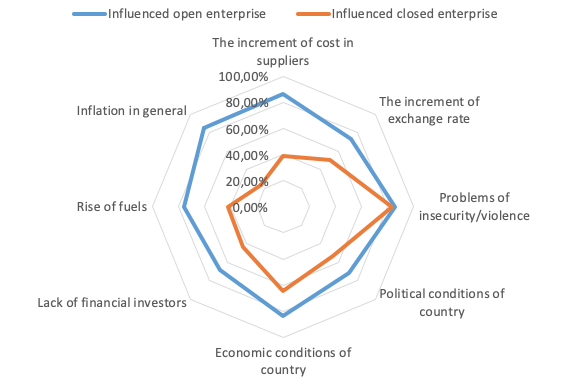

Fig. 3

External Factors

Own elaboration, with data obtained (from the RELAyN questionnaire) to identify

the factors that determine or put at risk the closure of MSEs Latin America, 2018.

In Figure 3, are analyzed external factors, main reasons are problems of violence/insecurity and economic conditions of country, both for open and closed MSEs. RELAyN, 2018

The characterization of MSEs in this research considered 36,934 samples of micro enterprises disseminated throughout the country and under the context of five segmentation variables with information provided by micro enterprises which have been divided under two headings. One of which contains all of the variables that refer to the profile of the organization such as: the enterprise’s geographical location, position, type of premises it occupies, its birth, registration, and permanent workers. The other variables that were used to measure the environment of closed MSEs. In previous tables, results of the application of the descriptive statistics are shown through a regression model using a generalized additive model (GAM).

The research was performed using a quantitative method with an exploratory scope. During this research, five factors that caused the closure of MSEs were explored; in addition, a hypothesis was raised. To test it, a regression model was used by applying a generalized additive model (GAM), since this model allows us to use variables of diverse types like those required for this research.

Regarding the main problems Mexican MSEs face, according to the results obtained, we are able to conclude that external factors (XF) 1.72 average, and financial problems (FF) 1.67 average, leads us to infer that these two represent the biggest problems faced by micro-entrepreneurs in Mexico today, therefore Ho is true. Financial Factors has pursued micro-entrepreneurs for decades and it is confirmed in this study. On the other hand, we cannot set aside personal and administrative factors (FIP) that, when compared with the variables of its geographical location, address, type of premise, type of owner, the owner’s gender, age and academic training, appear to be the most important. This leads us to infer that these are variables greatly impact on Mexican micro-enterprises. It is also important to note that one of the most notable characteristic of established MSEs in Mexico is their short life span. We will conduct future research to identify demographic characteristics of entrepreneurs and will identify vulnerabilities in specific sectors

Alonso, R. (2010). Minisúpers afectan a tienditas. El Universal (22 de febrero de 2010).

Aguilar, O. C., Posada, R., & Peña, N. B. (2016). El estrés y su impacto en la productividad. Estudio en los directivos de las micro y pequeñas empresas en México. México DF: Pearson Educación.

Fontinelle, A. (2017). Starting a Small Business . Consulted in : https://www.investopedia.com/university/small-business/

INEGI (2012). Encuesta Nacional de Micronegocios (ENAMIN). Consulted (2018) in: http://www.beta.inegi.org.mx/proyectos/enchogares/modulos/enamin/2012/

Mayson, S. (2011). A review essay of ethics in small and medium sized enterprises: A global commentary, edited by Laura J. Spence and Mollie Painter-Morland (Dordrecht, Netherlands: Springer, 2010). Business & Society, 50(4), 696-702.

Peña, N. B., Aguilar, O. C., & Posada, R. (2017). Factores que determinan el cierre de la micro y pequeña empresa: Comparativo entre las empresas activas e inactivas en México y Colombia. Ciudad de México: Pearson Educación.

Posada, R., Aguilar, O. C., & Peña, N. B. (2016). Análisis sistémico de la micro y pequeña empresa en México. México, DF.: Pearson Educación.

RELAyN (2018). Questionnaire to identify the factors that determine or put at risk the closure of MSEs Latin America. Red Latinoamericana de Estudios en Administración y Negocios.

1. Maestra en Administración (Negocios Internacionales) por la Universidad Internacional; Profesora de Tiempo Completo de la Universidad Politécnica del Estado de Morelos (UPEMOR)

2. Maestro en Administración por el Instituto Tecnológico y de Estudios Superiores de Monterrey (ITESM); Profesor de Tiempo Completo de la Universidad Politécnica del Estado de Morelos (UPEMOR)

3. Maestro en Gestión Pública Aplicada por el Instituto Tecnológico y de Estudios Superiores de Monterrey (ITESM); Profesor Auxiliar de la Universidad Politécnica del Estado de Morelos (UPEMOR). Email: falvarezganem@gmail.com