Vol. 39 (Number 33) Year 2018 • Page 22

N. IVASHKOVA 1; R. SIDORCHUK 2; I. SKOROBOGATYKH 3

Received: 05/03/2018 • Approved: 12/04/2018

ABSTRACT: The objective of this study was to test the relationship of multi-aspect distributors/consultants’ involvement depending on the popularity of MLM companies (brands) operating in the Russian market with business attractiveness – the commercial value of MLM companies’ supply based on the empirical data obtained during the research, and to analyze secondary data and results of the netnographic research. The study was performed by combining several methods: desk studies, netnographic research, and a quota survey. The ethnographic research implied analysis of utterances about the MLM companies’ activities in the Russian market in social networks by keywords; these opinions also contained utterances about the attitude to various forms of selling cosmetic products, including through distributors/consultants of MLM companies. The survey was held in Moscow. The structured questionnaire was a survey tool. A total of 91 female respondents participated in the study, since women most often purchase cosmetics (including for men). All respondents came under the age limit in the range of 18 to 46 years. The links between emotional, cognitive and behavioral involvement and the popularity of companies (brands) were revealed, with the attractiveness of business – the commercial value of supply, and competitive advantages. Adaptation of the well-known methods of marketing research, reinforced by the inclusion of the modern method of netnographic research, confirms the survey results that the involvement of current consumers of MLM cosmetic products in the Russian market to conduct business in MLM companies grows depending on the company’s brand, comprehensibility and transparency of the model of compensation schemes. |

RESUMEN: 1886/5000 El objetivo de este estudio fue probar la relación de la participación de los distribuidores / consultores multifacéticos en función de la popularidad de las empresas de MLM (marcas) que operan en el mercado ruso con atractivo comercial: el valor comercial del suministro de las empresas de MLM basado en datos empíricos obtenidos durante la investigación y para analizar datos secundarios y resultados de la investigación netnográfica. El estudio se realizó combinando varios métodos: estudios de escritorio, investigación netnográfica y una encuesta de cuotas. La investigación netnográfica implicó el análisis de enunciados sobre las actividades de las empresas de MLM en el mercado ruso en las redes sociales por palabras clave; Estas opiniones también contenían declaraciones sobre la actitud hacia diversas formas de vender productos cosméticos, incluso a través de distribuidores / consultores de empresas de MLM. La encuesta se realizó en Moscú. El cuestionario estructurado fue una herramienta de encuesta. Un total de 91 mujeres encuestadas participaron en el estudio, ya que las mujeres con mayor frecuencia compran cosméticos (incluidos los hombres). Todos los encuestados estuvieron por debajo del límite de edad en el rango de 18 a 46 años. Se revelaron los vínculos entre la participación emocional, cognitiva y conductual y la popularidad de las empresas (marcas), con el atractivo de los negocios: el valor comercial del suministro y las ventajas competitivas. La adaptación de los métodos bien conocidos de investigación de mercado, reforzada por la inclusión del método moderno de investigación netnográfica, confirma los resultados de la encuesta que la participación de los consumidores actuales de productos cosméticos de MLM en el mercado ruso para realizar negocios en empresas de MLM crece dependiendo de la marca de la empresa, la comprensibilidad y la transparencia del modelo de esquemas de compensación. |

In the business model of Multilevel Marketing (MLM), the development of interaction with distributors/consultants is the most important component of companies’ sustainable growth. This interaction should be based on the principles of evaluating the multi-aspect marketing parameter of the consultants’ involvement in the business, depending on the popularity of the MLM corporate brand. This is most clearly shown by the example of the market of perfumery and cosmetic products in Russia, since even in difficult crisis times this market shows a relatively stable position, being the 4th market in the world. In addition, it is in this market in Russia that the most successful global MLM companies operate: Avon, Oriflame, Mary Kay, etc., as well as the domestic company Faberlic.

Direct sales are one of the oldest and most effective tools of the marketing complex. This approach has transformed into the network marketing or multilevel marketing (MLM) (Albaum and Peterson, 2011). The MLM method received a powerful impetus for popularization owing to Amway’s experience in the 1950s (Biggart, 1989). Despite the wide spread in the business practice, there are certain gaps in the definition of the concept of direct sales in the marketing theory (Peterson and Wortruba, 1996), which creates additional terminological uncertainty in the use of terms network marketing and MLM as synonyms. Another important gap is the lack of coverage in the literature of the issue of developing relationships with distributors/consultants. Noting the important role of consultants, the authors focus on the ethical and technological aspects of the MLM model in their studies (Albaum and Peterson, 2011; Droney, 2016), explore the compensation component (Coughlan and Grayson, 1998), analyze the common and distinctive features of the evolution of traditional marketing and MLM (Hossan et al., 2012), analyze the historical trajectory and perspective of MLM development (Keep and Van der Nat, 2014), opportunities for personal development, development of individual competencies and consultants’ employment (Choudhary and Kamal, 2013; Li et al., 2016), motivational factors of consultants (Jain et al., 2015; Srilekha and Suma Rao, 2016), but the issue of the influence of consultants’ involvement in the MLM business remains unanswered.

In Russia, the cosmetic market is one of the most attractive businesses for the MLM development. In the Russian market of perfume and cosmetics, companies such as Avon, Amway, Herbalife, Mary Kay, Oriflame, Faberlic and some other smaller companies operate in the direct sales segment using the MLM business model.

Despite certain changes in the Russian economy, which are accompanied by a decline in sales in some sectors of the consumer market, the Russian cosmetics market remains the largest market in Eastern Europe and the 4th market in the world (Vasyukov, 2015). Orientation to the consumers’ values is a key factor for the success of the leaders of the Russian cosmetics market, including companies operating in the direct sales sector. As shown by the rating of the Top 100 network companies on trade turnover (2015), the global economic crisis has had a negative impact on the international trade turnover of companies: in 2015 the decrease in turnover was demonstrated by Avon by 31%, Oriflame by 20% and Amway by 12%. Analytical reviews of the Direct Selling Association (DSA) show that over 6 months of 2015 the total sales of cosmetic products by the direct selling method fell by 2%. The total sales of these companies amounted to 69.4 billion rubles over the first half of 2015, which is 1.1 billion rubles less than the figure for the first half of 2014 (Shokareva, 2015). Nevertheless, at the beginning of the next year, the situation improved slightly and following the results of January-September of 2016 the sales volume of DSA Member Companies grew by 10% and amounted to 87.2 billion rubles (Prime EIA, 2016).

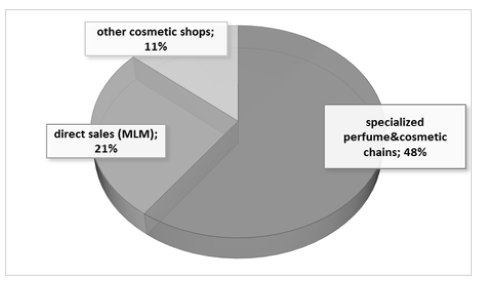

In 2015, according to Discovery Research data, the volume of the Russian perfumery and cosmetics market totaled 371 billion rubles, which is 6% less than in 2014. In recent years, in Russia such a sales channel for cosmetics and perfumes as networks of specialized stores has been rapidly growing, accounting for 48% of sales in 2015. Despite the development of network trade in cosmetics and perfumery through specialized stores, the sector of direct selling through distributors/consultants remains an equally important distribution channel for Russia (21% of the total market in 2015). In 2015, 11% of the specialized perfumery and cosmetic shops are not part of the networks (Fig.1).

Fig. 1

Main channels of distribution for Cosmetic and Perfume products in Russia in 2015

(Source: Report of Discovery Research Group, 2017)

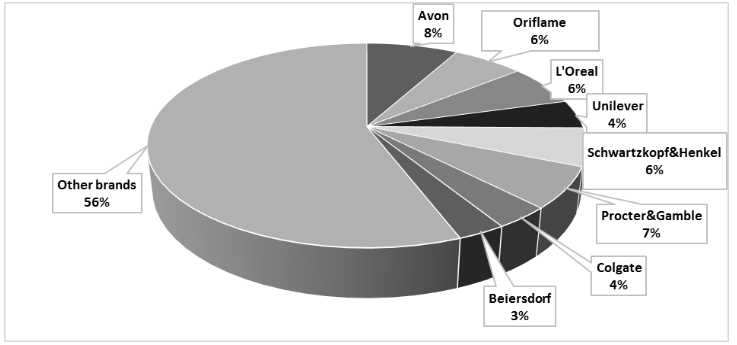

There are quite a large number of brands of cosmetics and perfumes in the Russian market, according to the information of the global research company Nielsen, the market share of individual cosmetic brands is distributed as shown in fig.2.

Fig. 2

Market shares of the main Cosmetics and Perfume brands

(Source: Nielsen company Report: Cosmetic and perfume market in 2015)

The data of this diagram show that the global MLM Company Avon is the undisputed leader in this market (8%). The second place is confidently occupied by another global giant Procter and Gamble (7%). The Oriflame brand, which also operates on the MLM (or direct sales) business model, occupies 6% of the Russian market share at the same level with another global giant, L’Oreal, and with the well-known Schwarzkopf and Henkel Concern (6% of the Russian market share).

The total sales of these companies amounted to 69.4 billion rubles in the first half of 2015, which is 1.1 billion rubles less than in the first half of 2014 (Shokareva, 2015). According to the results of January-September 2016, the sales of the DSA Member Companies increased by 10% and amounted to 87.2 billion rubles. At the same time, according to the Direct Selling Association (2016), the number of distributors (distributors/consultants) decreased: in 2015 this indicator was reduced by 6.6% and by 8% in January-September 2016, reaching the level of 3.15 million people. Such a reduction in the number of consultants, in our opinion, creates negative prerequisites for the MLM business development. In the conditions of the existing competition in the cosmetic market, from our point of view, the potential for increasing direct sales growth is to form and develop relationships with distributors/consultants.

In this regard, it seems to us important from a scientific and methodological viewpoint to consider terminological definitions of network and multilevel marketing and to study the factors that influence the formation of distributors/consultants’ involvement in interaction with the MLM companies.

The aim of the research is to define the terminology of network and MLM marketing concepts and to study the factors of involving distributors/consultants of cosmetic products in the Russian market as exemplified by the international MLM companies based on a set of methodological approaches.

The above allowed us to formulate the hypothesis of our study (H): Factors, influencing the distributors/consultants’ involvement in cooperation with the MLM companies, are the popularity of companies (brands), the business attractiveness (or commercial value of supply), the competitive positions of the company (brand). The combination of these three key success factors promotes a high degree of consultants’ involvement and increases the effectiveness of the company’s market activities based on the synergistic effect.

The methodology of the study was based on classical methods of marketing research as those cited by Malhotra and Birks (2007): desk studies, questioning, comparative analysis of data, etc. In addition, the netnographic research technique (analysis of utterances in social networks) was applied in the study in accordance with the methodology proposed by Kozinets (2002). To analyze the utterances in social networks, content analysis was used.

The literature analysis shows that in the last decades the world scientific and business community is increasingly interested in network interactions in the economic activity (Zueva, 2005). The role of network relationships among individuals and the possibility of increasing the efficiency of economic activities of organizations that arrange their network interaction is of special interest (Skorobogatykh, 2011). In our work, the ‘network’ is understood as a form of social and economic interaction of individuals. It should be noted that in the modern scientific and business literature there is no consolidated opinion that unambiguously defines the concepts of ‘network marketing’, as well as the connection or differentiation of this concept and the concept of ‘multilevel marketing’ (MLM), which creates methodological problems for developing an unambiguous representation of this form of sales and business model (Haritonova, 2006). At the same time, it is possible to note a certain unity of various authors who refer ‘network marketing’ and MLM to one of the forms of marketing communications – personal sales. Thus, in the Marketing Dictionary (Collin and Ivanovic, 2003) the term Multilevel Marketing (MLM) is identified with the term network marketing and is defined as a marketing campaign conducted outside the store chain. Referring to the term ‘personal selling’, it should be noted that in the classical theory of marketing, it is included in the so-called ‘marketing mix’ representing “the aggregate of the managed parameters of the marketing activity of the organization in the group of marketing tools related to the ‘promotion complex’” (Golubkov, 2012). Accordingly, personal sale is defined as “one of the tools in the product promotion complex that is an oral presentation of the product in conversation with one or more potential buyers for the purpose of selling it”, which corresponds to the essence of the sales process in the MLM business model.

At the same time, a significant difference of MLM from the ‘classical’ method of personal sales is the possibility of one party receiving income from the sales of other participants. This possibility is interpreted by Richard Poe (2012) as follows, “any method of marketing that allows independent sales representatives to recruit other sales representatives and to draw commissions from the sales of those recruits.” In turn, some studies suggest distinguishing the concepts of ‘network marketing’ and ‘multilevel marketing’ (Safonova, 2007). In our study, we divided the definitions of the concept of ‘Network Marketing’ and MLM in the following way: Network marketing is a special form of interpersonal communication of individuals in the process of personal sales, based on interaction by means of verbal and non-verbal signals to initiate an exchange process with the goal of selling a certain product in out-of-store retail.

Whereas, multilevel marketing (MLM) is a form of network marketing in which participants can raise revenues not only through a personally organized and perfect transaction for a product sales, but also trough deductions from transactions made by other participants attracted by them.

Thus, the above definitions allow us to justifiably talk about referring ‘network marketing’ and MLM to the sphere covered by marketing as a scientific and educational discipline. The modern concept of relationship marketing implies the involvement of buyers in the process of interaction with the seller company and its brand. The marketing value (human value) becomes an important characteristic of this interaction in marketing (Sidorchuk, 2015). A paradigm for the functioning of MLM companies is built on this, and the involvement of distributors/consultants is the main factor in ensuring the efficiency and development of their business.

The mechanisms of the MLM business model functioning are described in sufficient detail in the literature. In particular, in the comprehensive research work of Biggart (1988), the history of MLM, the structure of the company’s organization and management issues are analyzed in detail. Special attention is given to consideration of the reasons for choosing the work in MLM business by the consultants. At the same time, the factors determining the degree of consultants’ involvement are not described in the manuscript.

In other studies, for example, in the paper by Msweli and Sargeant (2001), when analyzing the factors contributing to the long-running work of consultants with the MLM company, the researchers are studying “internal marketing” at the MLM companies. They analyze factors that should increase the duration of the consultants’ work in the business. The described structure of factors, such as a fair system of payments and non-financial rewards, does not enable to be sure of a high degree of involvement on the part of consultants. The analysis of the personal characteristics of the consultants and the “Guarantor-Consultant” relationship system conducted in the work also does not give an answer that these relations influence the involvement of the consultant. In turn, studies of the motivations of various segments of distributors/consultants who work in direct selling companies on the principles of self-employment and interest in developing their own business presented in the works of Nuccio (1966) and Peterson and Watruba (1996) also do not allow singling out unambiguously factors that ensure the consultants’ involvement.

The analysis of other works that deal with compensation models for consultants, as well as with the methods and techniques for organizing the multilevel marketing business (or direct sales business) also do not provide an answer to this question (Coughlan et al., 2006, Coughlan and Kent, 1998; Keep and Van der Nat, 2014; Albaum and Peterson, 2011; Koehn, 2001; Bloch, 1996)

Summarizing the conducted analysis of the literature, it should be noted that, in our opinion, not only the involvement of end users, but also the motivation to involve consultants is an important aspect of the MLM work that enhances the efficiency of the business model. Here it is necessary to take into account that due to ‘addiction’ to marketing impacts, many classical marketing tools cease to influence the consumers’ motivation. Thus in our study (Sidorchuk, Skorobogatykh et al., 2016), it was shown that gradually, while moving along the life-cycle curve, even time-tested and instrumentally thought-out loyalty programs aimed at ensuring the involvement of consumers cease to operate. Therefore, we believe that the use of MLM direct sales methods through the implementation of the concept of distributors/consultants’ involvement is one of the most promising ways to develop all types of sales.

While carrying out this research, the authors proceeded from a multi-aspect approach to the degree of involvement which emphasizes emotional, cognitive and behavioral involvement (Saks, 2006). Our interpretation of these concepts proceeds from the ideas of marketing theory. Accordingly, emotional involvement is created by the brand significance and popularity; cognitive involvement associated with brand support, is formed by such rational advantage factors as the unique “Consultant-Distributor’s Personal Success Plan”, containing the opportunities that can be achieved by buying and distributing the MLM company’s products (the main elements of motivation, rewards, business opportunities ); behavioral involvement is a consequence of emotional and cognitive involvement and it affects the consultants’ decision-making processes (behavioral involvement is strengthened during the consultants’ training in the on-site and on-line training system).

To determine the degree of popularity of the cosmetic companies operating according to the multilevel marketing business model and to assess the business attractiveness for a distributor-consultant, a comparative analysis of the results of desk and field studies was conducted.

The brand popularity was evaluated on the basis of the analysis of the results of a previously conducted survey of Russian consumers of the MLM companies’ cosmetic products through distributors/consultants according to the following parameters: the most famous brand (Top of Mind), named without a prompt (Spontaneous), named with a prompt (Prompted).

In the present study, a combined approach was applied to consistently use the desk studies (analysis of secondary data sources), netnographic research (analysis of utterances in social networks), and the field studies in the form of a quota survey based on a specially developed structured questionnaire.

The results of the following investigations are the information base for testing the hypothesis:

Netnographic research was conducted in accordance with the methodology proposed in 2002 by Kozinetz (2002) using content analysis of utterances in the social network in VKontakte that is the largest social network in Russia and CIS countries (June 2016). The method of searching for content analysis sources was based on search by keywords. The study was conducted by the lecturers and students of Plekhanov Russian University of Economics.

The potential target audiences of distributors/consultants were surveyed in Moscow in June 2016 using a structured questionnaire. To participate in the survey, 91 women aged 18 to 46 years were invited, quotas were observed for the ratio of the number of respondents in the age groups with the percentage of women in the total population of Moscow.

The study was limited by the fact that not all the companies operating on the MLM principles were selected as an object of research, but only those offering perfume and cosmetic products. The reason for this was that the Russian cosmetic market is one of the largest in the world. In addition, it is in this market that the legendary, successful global MLM companies are actively developing their business in Russia: Avon, Oriflame, Amway, Mary Kay, and Herbalife. It is also noteworthy that domestic company Faberlic is developing its business in the Russian market, which builds business according to the MLM model as well. The study was conducted in Moscow, not within the whole territory of the Russian Federation due to time and resource constraints, however, it can be assumed that the Moscow market is quite indicative for the purposes of this study aimed at assessing the impact of distributors/consultants’ involvement in the MLM business development. As part of the research, the authors analyzed the results of a study performed by the independent company Millward Brown in Russia as a whole and the results of our survey conducted by scholars and students of Plekhanov Russian University of Economics in Moscow.

The task of demographic representation was not raised by the researchers.

To organize this study, a combined approach was applied, which led to a methodology implying a stage-by-stage formulation of tasks and their solution. At the first stage, the goal was to study the influence of the MLM-company’s (brand) popularity factors on the formation of the emotional involvement of distributors/consultants. Desk studies were selected as research methods to collect secondary information on the activities of the MLM companies in the Russian market as a whole. At the same stage, the netnographic research was conducted to identify and analyze the utterances about the MLM business in social networks in the Russian segment of the Internet. Also, a survey of potential distributors/consultants in Moscow was conducted at this stage.

At the second stage of the study, the goal was to study the influence of the factors of the consultant-distributor’s business attractiveness on the formation of cognitive involvement of distributors/consultants. Netnographic research was conducted (for Russia in general, and questioning of the target audience of potential distributors/consultants in Moscow).

At the third stage the goal was to study the influence of competitive advantage factors of the MLM-company (brand) on the behavioral involvement of distributors/consultants. The desk studies on Russia as a whole were applied. Despite the fact that the research was conducted in the Russian market, it should be noted that the issues and problems of the MLM business model development are of interest to practitioners and academic experts in other developed and developing countries. The principal results on the relationship between the degree of consultants’ involvement in the MLM business, depending on the degree of brand popularity and the understanding of the business attractiveness for consultants (especially in the turbulent conditions of economic uncertainty in the market) may be interesting for other markets as well (especially for the CIS markets, and also for the markets of Eastern Europe, taking into account the cross cultural characteristics of cosmetics and perfumery consumers’ behavior in these markets).

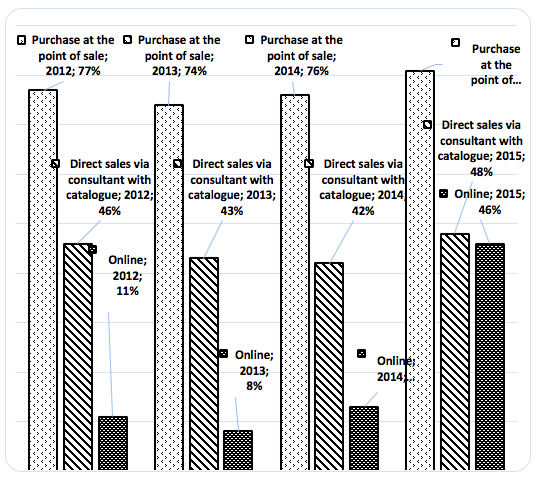

The status of the MLM companies’ cosmetic market was analyzed on the basis of the secondary data analysis. Fig.3 presents the data of a survey of Russian consumers concerning their attitude to direct sales of cosmetics received from Millward Brown and WFDSA-Word Federation of Direct Selling Associations over 2012-2015.

Fig. 3

Attitude towards various forms of cosmetics’ sales

Source: Composed by the authors based on the data of research reports of Millward

Brown GBT - Country Report for Oriflame Russia 2012, 2013, 2014, 2015 and Reports of WFDSA

Visual analysis of this chart demonstrates the growing interest in online sales, but does not abolish the important role of distributor-consultants.

Historically, the development of the direct selling business model in the cosmetics market is closely connected with the involvement of new distributors/consultants and the development of interaction with them. Efficient interaction with consultants and increase in the effectiveness of their work make the essence and the most important task of the MLM business. Precisely the distributors/consultants play a key role in conveying the value characteristics of the MLM brand to the consumers in the process of building a relationship between buyers and the brand of manufacturing companies. Therefore, one of the research tasks was to identify the relationship between the involvement of consultants and the sustainability of business development.

The use of a set of methodological approaches (Millward Brown survey, questioning of Plekhanov Russian University of Economics, content analysis of utterances in the VKontakte social network) revealed factors affecting the involvement of distributors/consultants: the popularity analysis, the business attractiveness for distributors- consultants, identification of the competitive advantages of the MLM company (brand) on this basis, construction of the processes of interaction between the consultant and the company by means of compensation plan models being unique for each company that can be referred to the marketing know-how.

Table 1 presents Millward Broun research data, characterizing the awareness of perfume and cosmetics brands by the Russian consumers. Comparison of the data broken down by the companies given in Table 1 allows us to conclude about a sufficiently high level of brand awareness for Avon and Oriflame companies. Over a number of years, these brands have taken leading positions among the most well-known brands (positions 1 and 2, respectively), and the brand awareness rate “Prompted” reaches almost 100%.

Table 1

Brand awareness in the Russian Cosmetic and Perfume market (%)

Year |

2012 |

2013 |

2014 |

2015 |

||||||||

Company |

The most famous |

Unnamed |

Named with a prompt |

The most famous |

Unnamed |

Named with a prompt |

The most famous |

Unnamed |

Named with a prompt |

The most famous |

Unnamed |

Named with a prompt |

Oriflame |

9 |

34 |

96 |

10 |

33 |

95 |

10 |

36 |

98 |

9 |

43 |

95 |

Mary Kay |

- |

10 |

76 |

- |

7 |

73 |

2 |

10 |

75 |

No data |

No data |

No data |

Yves Rocher |

- |

29 |

83 |

4 |

23 |

77 |

5 |

16 |

83 |

7 |

20 |

86 |

Avon |

11 |

34 |

97 |

8 |

29 |

96 |

11 |

33 |

98 |

15 |

51 |

96 |

Amway |

- |

7 |

69 |

- |

10 |

85 |

- |

6 |

73 |

1 |

5 |

81 |

Faberlic |

- |

7 |

84 |

- |

6 |

81 |

- |

11 |

82 |

No data |

No data |

No data |

Note: Faberlic is a Russian perfume and cosmetics company, founded in 1997.

Source: Composed by authors in the data of research reports of Millward Brown GBT -

Country Report for Oriflame Russia, 2013, 2014, 2015 (Millward Brown 2012),

(Millward Brown, 2013), (Millward Brown, 2014), (Millward Brown, 2015)

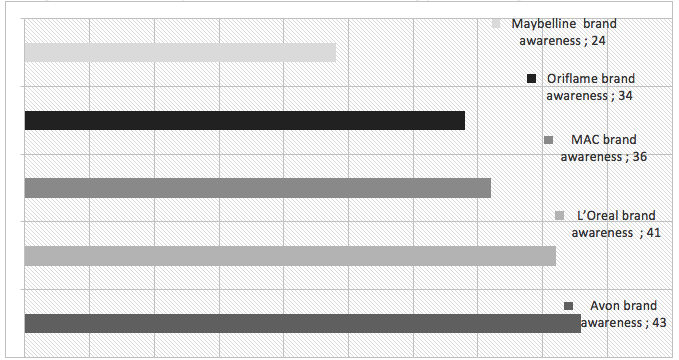

Fig. 4 shows brand awareness for cosmetic products following the results of questioning the potential target audience of distributors/consultants in Moscow in June 2016.

Fig. 4

Cosmetics and perfume brand awareness among potential target audience in Moscow-City (%)

According to the results of our survey of a potential target audience of distributors/consultants in Moscow, MLM companies Avon and L’Oreal are the leaders in terms of brand popularity; these brands are widely advertised in the mass media.

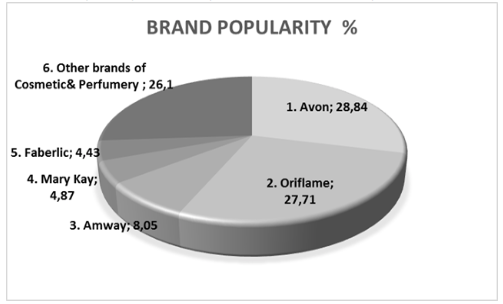

The awareness of MLM companies is indirectly evidenced by the data of the independent popularity rating of MLM-companies (MLM Laboratory, 2006-2017), which is automatically formed on the basis of data on the number of hits for wordstat.yandex.ru service requests in the Russian-language Internet segment. The rating includes 33 leading MLM companies operating in Russia. Table 2 gives data on the five most popular companies. The first two places are held by runaway brands of Avon (28.84%) and Oriflame (27.71%). This fact is illustrated by Table 3 and fig. 5.

Table 2

Russian Rating of the MLM companies based on requests for data in the

number of impressions for requests provided by the service wordstat.yandex.ru

Rating |

Company |

Popularity, % |

1 |

28.84 |

|

2 |

27.71 |

|

3 |

8.05 |

|

4 |

4.87 |

|

5 |

4.43 |

|

6 |

Other brands of Cosmetics and Perfumery |

26.1 |

To visualize the data of Table 2, a popularity rating diagram was drawn up for the cosmetics and perfume brands in the Russian market. This diagram visually illustrates the significant gap between the brands of Avon (28.84%) and Oriflame (27.71%) in terms of their popularity among the respondents.

Fig. 5

Russian Rating of the MLM companies based on requests for data in the number

of impressions for requests provided by the service wordstat.yandex.ru

The analysis of popularity of keywords-inquiries about MLM companies based on https://wordstat.yandex.ru/ (the first top ten queries – different spelling of names in the Russian and English languages) allows making a number of conclusions about the sphere of interest of potential consumers. Table 3 provides summary information on requests about MLM companies. The top ten query keywords included the following queries, namely: the company name, “Registration in ...” + “... registration”, “… Catalog”, “Buy ...”, “Become a representative of ...” + “How to become a representative of ...”.

Table 3

Final rating based in the requests of quantity of impressions

of the most popular requests of each company (June 2016)

Rating |

Company |

Number of requests by the most popular word |

Requests by a phrase “Become a representative of ...” + “How to become a representative of ...” |

Total number of requests by 10 keywords |

||

Keyword |

Number of requests |

Number of requests |

In percentage to the total |

|||

1 |

Avon |

400,179 |

6,508 |

0.8 |

788,040 |

|

2 |

Faberlic |

118,472 |

302 |

0.06 |

445,884 |

|

3 |

Oriflame |

92,301 |

282 |

0.15 |

183,759 |

|

4 |

Amway |

74,932 |

156 |

0.1 |

155,497 |

|

5 |

Yves Rocher |

37,076 |

148 |

0.15 |

96,022 |

|

6 |

Mary Kay |

31,831 |

71 |

0.14 |

50,180 |

|

7 |

Herbalife |

14,833 |

25 |

0.08 |

31,021 |

|

The name of the company (brand) is the most popular keyword; the phrase “Become a representative of ...” + “How to become a representative of ...” is the least popular of the top ten requests. Attention should be paid to the fact that the analyzed companies occupy similar places in the ranking according to the number of requests for the most and least popular words, and also for all 10 keywords. However, despite the high rating as to the total number of requests for the Faberlic Company, the interest in the distributor-consultant’s business in this company is the lowest in percentage terms. Among the leaders in the popularity of requests on the Internet Avon can be distinguished; this company takes the first line for all types of requests, and in most cases by a significant margin from the second place. Herbalife is the least popular company following the results of the Internet inquiries; it ranked last in the ratings almost for all the positions of requests.

Comparison of the results of various studies suggests that Avon and Oriflame are the most famous brands of the MLM companies in the Russian market.

The attractiveness of the consultant-distributor’s business or the commercial value of the MLM-companies’ supply is determined by the following parameters: price, discounts, the possibility of attracting new consultants for building a multilevel marketing network, the score of bonuses to the price of products, remuneration to the distributors/consultants depending on their level, motivational programs, the success plan in general. Typically, such information of companies is of a closed nature, it is essentially the know-how of a specific company. A consultant can evaluate such proposals only in the process of involvement in the company’s business.

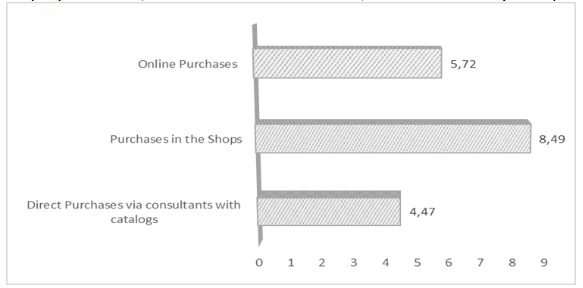

The results of the survey of a potential target audience of consultants in Moscow indicate a low interest in buying cosmetics through consultants (Table 4). “Shopping in the store” is the most preferable form of purchase for consumers.

Table 4

Attitude to the formats of cosmetic purchase (10-point scale,

where 1 – I do not like it at all, 10 – I do like it very much)

Form of Purchase |

Average evaluation |

Direct Purchase via consultants with catalogs |

4.47 |

Purchases in the Shops |

8.49 |

Online Purchases |

5.72 |

The data of this table are illustrated in fig. 6

Fig. 6

Attitude to the forms of cosmetic products purchase

(10-points scale, where 1 – I do not like it at all, 10 – I do like it very much)

Comparative analysis of the consumer survey data on their attitude to the method of direct sales of perfume and cosmetic products shown in Fig. 3 and data obtained by us (Fig.6) demonstrate a tendency to increase the popularity of online sales, the share of which is commensurable with the proportion of consumers willing to purchase through direct sales.

Our research has shown that 25% of respondents consider the possibility of cooperating as a consultant with the companies distributing cosmetics through direct sales.

The degree of the consultant-distributor’s business attractiveness was studied by the method of content analysis of utterances in social networks in June 2016. According to the results of the analysis of utterances, two groups of participants were singled out (practically the same in number of utterances): potential consultants, i.e. people who have interest in the work of a consultant-distributor; and people who work as consultants, they talk about their work experience. All utterances belong to women aged 25 to 40 years. Utterances about the interest in work are most often found in specialized groups, in thematic discussions on the topic “Register in ...” or “How to become a consultant”. Basically, such utterances are short and express either just interest or the question of what exactly should to be done in order to become a consultant. Most of these utterances are neutral. The statements of experienced consultants are often quite voluminous; in many cases they are aimed at refuting the negative attitude to the consultant’s work, to dissuade the askers from saying that this is a “dubious” occupation. Many consultants with experience tell how they started, describe the history of their success. The utterances of experienced consultants are mostly positive.

Involvement of consultants in interaction with the brand of the MLM companies can be considered as one of the strategic marketing goals of companies, since true loyalty in the conditions of saturation of the cosmetic products markets is provided rather by the involvement of consultants than their satisfaction. Behavioral involvement forms a high motivation, an active position, commitment to the brand and its seller, the desire to promote the brand.

The analysis of competitive positions of the MLM companies according to the main parameters is given in Table 5. The parameters were evaluated on a low, medium, high scale.

Table 5

Evaluation of competitive positions of MLM companies in Russia in 2014

Companies’ Parameters |

Amway |

Herbalife |

Mary Kay |

Oriflame |

Faberlic |

Avon |

Brand image |

Low |

High |

High |

Average |

Low |

Average |

Brand awareness |

Low |

Average |

Low |

High |

Average |

High |

Total communications |

Average |

Low |

Low |

Average |

Low |

High |

The product assortment width |

Average |

Low |

Low |

High |

High |

High |

Price positioning |

High |

High |

Average |

Low |

Low |

Low |

Low frequency of catalogs publishing |

Low |

Low |

Average |

High |

High |

High |

Merchandising |

Low |

Low |

Low |

High |

High |

High |

Intensity of coverage programs |

Low |

Low |

Average |

High |

High |

High |

Personal trainings, sales instruments |

High |

High |

High |

Average |

Low |

Average |

Source: Composed by the authors based on the materials of research reports

for Oriflame Sweden. (Comparison done within DS companies according to

competitor WS 22 of May, OOC research, competitor research)

The analysis of the competitive situation in the perfume and cosmetics market in Russia shows that according to a comprehensive assessment of all parameters, Avon and Oriflame are the leaders. These companies are focused on the mass segment of the market; they occupy high positions in terms of the image and brand awareness, communicative activity, the product assortment width. As a rule, at the heart of business development the MLM companies either use a stronger, more thought-out compensation plan for distributor-consultants, which is essentially certain marketing know-how of the company, or expand the offer of permanent loyalty programs built primarily for the consultants’ leadership development. Avon and Oriflame work in both directions: they offer a relatively strong compensation plan for distributors/consultants, as well as loyalty programs which include a set of incentives to increase sales, which forms the behavioral loyalty of the distributors/consultants themselves.

The analysis of the available scientific literature on the issue under study showed that on the one hand there are differences in the definition of the terms ‘multilevel marketing’ and ‘network marketing’. At the same time, both these terms describe the scope and business model, which is covered by marketing as a scientific and educational discipline. The authors have identified the opportunity to gain income not only through a personally organized and conducted transaction for the product sales, but also through the deductions from transactions made by other participants involved by them as specific features of multilevel marketing which distinguish it from network marketing. Thus, they consider the multilevel marketing as a form of network marketing.

The difference revealed by the authors enables to consider distributors/consultants as a hierarchical structure, where the involvement of each distributor-consultant is an important factor in ensuring the overall effective performance of MLM companies. Involvement is formed as a synergistic value of the consultant, in stages through brand awareness and interest (emotional involvement), willingness to cooperate and accept commercial proposals (cognitive involvement) and, finally, behavioral involvement assumes continuous cooperation with the company. This situation is indicative of maintained long-term relationships with consultants – a key component of the MLM companies’ business. is The company’s high competitive positions in terms of image and brand awareness, communication, the product assortment width, the intensity of the involvement programs (including the compensation plan, loyalty programs aimed at consultants), merchandising, the frequency of issuing catalogs, staff training, etc. are an important factor in providing the involvement of consultants. Further research in this direction can be aimed at studying special loyalty programs for consultants of MLM companies that provide synergy effects of identified factors on the consultants.

For example, involvement of distributors/consultants in interaction with the Oriflame brand predetermines the process of their inclusion in continuous cooperation with the international company Oriflame Cosmetics, which is actively operating in the Russian market, under a controlled scenario contained in the know-how used by the company in its activities. The know-how should be constantly improved because of the constant appearance of new influencing factors of the external marketing environment, of both positive and negative nature. Such factors include, for example, increased interest and confidence of Russian consumers in the online sales. The present study has shown that the share of online sales tends to grow substantially and takes a share in consumer preferences commensurable with the share of sales through the consultants. At the same time, our study failed to determine the role of consultants in online sales, which can be significant, through their implicit participation through social networks and blogs, when their sale is recorded owing to the Universal Transverse Mercator (UTM) marks, which fix the consumer’s transition to the seller’s site from a particular consultant. It can be assumed that the forms of online and direct sales will be combined (now the MLM companies also offer online sales). All this means that in the current conditions of uncertainty in the development of markets, technological development, it is necessary to develop programs for interaction with distributors/consultants on the basis of the main factors of involvement formation, and at the same time, taking into account the modification of forms of sale and modern online tools. This determines the direction of further research on the prospects for the development of sales organization form by the MLM companies.

The distributors/consultants’ business in the Russian market of perfume and cosmetics can be a good alternative to the accepted forms of career development in the conditions of market turbulence and the economic situation uncertainty. The development of interest and involvement of consultants in the MLM companies’ business model depends on the brand awareness and understanding of compensation schemes and the business model that make up marketing know-how.

This research has both scientific and practical significance for the MLM companies operating in the Russian market or in markets of the CIS or Eastern European countries with similar development to understand the need to assess the extent of consultants’ involvement in the companies’ business and to develop new models on this basis for interaction and compensation, loyalty programs, career development and other indicators of the effectiveness of consultants, on whom the stability of the MLM business model depends.

The authors express their gratitude to the students of the Faculty of Marketing of Plekhanov Russian University of Economics who took part in the study.

Albaum, G. and Peterson, P.A. (2011). Multilevel (network) marketing: an objective view, The Marketing Review, 11(4): 347-361. DOI: 10.1362/146934711X13210328715902.

Biggart, N.W. (1989). Charismatic Capitalism: Direct Selling Organizations in America. Chicago: University of Chicago Press.

Bloch, B. (1996). Multilevel marketing: what’s the catch? The Journal of Consumer Marketing, 13(4): 18-26. DOI: 10.1108/07363769610124519.

Droney, D. (2016). Networking health: Multilevel marketing of health products in Ghana. Anthropology and medicine, 23(1), 1-13. DOI: 10.1080/13648470.2015.1057104

Choudhary, R., and Kamal, H. (2013). Multilevel marketing (MLM) for socio-economic development. International Journal of Reviews, Surveys and Research, 2(1): 45-55. ISSN: 23194618-V2I1M2-012013

Coughlan, A.T., and Grayson, K. (1998). Network Marketing Organizations: Compensation Plans, Retail Network Growth, and Profitability. International Journal of Research in Marketing, 15(5): 401-426. DOI: 10.1016/S0167-8116(98)00014-7.

Collin, P.H., and Ivanovic, A. (Eds.) (2003). Dictionary of Marketing. Third edition. Bloomsbury Reference book.

Golubkov, E.P. (2012) Marketing. Dictionary of terms. Moscow: Delo I Servis. [in Russian]

Haritonova (Safonova), T.A. (2006). Revisiting the definition of the concept of “network marketing”. Prospects: Collected Scientific Articles, 6: 244-250. Nizhniy Novgorod: NISOC. [in Russian]

Hossan, F., Ahammad, I., and Ferdous, L. (2012). A Conceptual Evaluation of Traditional and Multilevel marketing. World Journal of Social Sciences, 2(4): 34-43. Available from: http://wbiaus.org/3.%20Farooq.pdf

Prime EIA. (2016). The direct sales industry in Russia to grow by 10% in 2016 - the association [Industrija prjamyh prodazh v RF po itogam 2016 g vyrastet na 10% - associacija]. Available from: http://1prime.ru/News/20161207/826897259.html

Jain, S., Singla, B., and Shashi, S. (2015). Motivational factors in multilevel marketing business: A confirmatory approach. Management Science Letters, 5(10), 903-914. DOI: 10.5267/j.msl.2015.8.006

Koehn, D. (2001). Ethical issues connected with multilevel marketing schemes. Journal of Business Ethics, 29(1/2): 153-160. DOI: 10.1023/A:1006463430130.

Kozinets, R. V. (2002). The field behind the screen: Using Netnography for Marketing Research in Online Communities. Journal of Marketing Research, 39(1): 61-72. DOI: 10.1509/jmkr.39.1.61.18935.

Li, C., Nontasak, N., and Tubsree, C. (2016). Needed Competencies for Successful Chinese Multilevel Marketing (MLM) Business Distributors: A Case Study in China. HRD Journal, 7(1), 18-35. Available from: http://www.hrdjournal.buu.ac.th/public/backend/upload/onlinejournal/file/10062016_146554505165559600.pdf

Malhotra, N.K., and Birks, D.F. (2007). Marketing research: An applied orientation. New York: Pearson Education.

Msweli, P.and Sargeant A. (2001) Modelling distributor retention in network marketing organizations. Marketing Intelligence and Planning. 2001, 19(7): 507-514. DOI: 10.1108/EUM0000000006215

Poe, R. (2012). Wave 3. The New Era in Network Marketing. New York: Heraklid Books

Peterson, R.A. and Wortruba, T.R. (1996). What is Direct Selling? – Definition, Perspectives, and Research Agenda. Journal of Personal Selling and Sales Management, 16(4): 1-16. DOI: 10.1080/08853134.1996.10754070.

MLM Laboratory. (2006-2017). Popularity rating of MLM companies in Russia. Available from: http://mlmlaboratory.com/mlmraiting.html. [in Russian]

Safonova, T.A. (2007). Sociological analysis of social practices of multilevel marketing. Author’s abstract of Candidate Thesis in Sociology: 22.00.04. Nizhnij Novgorod. [in Russian]

Saks, A.M. (2006) Antecedents and Consequences of Employee Engagement. Journal of Managerial Psychology, 21(7): 600–619. DOI: 10.1108/02683940610690169.

Shokareva, T. (2015). Stability in the Period of Crisis. Official data of the Direct Selling Association (DSP). Available from: http://www.rdsa.ru/smi/320/399. [in Russian]

Sidorchuk, R. (2015). The Concept of “Value” in the Theory of Marketing. Asian Social Science, 2015, 11(9): 320-325. DOI:10.5539/ass.v11n9p320.

Sidorchuk, R., Skorobogatykh, I., Meshkov, A., Ivashkova, N., Musatov, B. (2016). Do Coalition loyalty programs really work? Analyzing the effect of coalition loyalty program. Indian Journal of Science and Technology, 9(14), 91093. DOI:10.17485/ijst/2016/v9i14/91093

Skorobogatykh, I.I. (2011). Marketing of relationships in the network interoperability of the industry in the luxury class. PhD Thesis. Moscow: Plekhanov Russian University of Economics. [in Russian]

Srilekha, V., and Suma Rao, U. (2016). Distributor Motivations in Joining Network Marketing Company, AMWAY. Imperial Journal of Interdisciplinary Research, 2(11): 2042-2049. Available from: http://www.onlinejournal.in/IJIRV2I11/325.pdf

Top – 100 network companies in terms of turnover over 2015. (2016). Available from: http://wikimlm.ru/top-100-2015.html. [in Russian]

Vasyukov G. (2015). Sales of cosmetics in Russia: trends of 2014-2015 against the crisis. Available from: http://cosmetology-info.ru/5773/news-Prodazhi-kosmetiki-v-RF-tendentsii-2014-2015-na-fone-krizisa/. [in Russian]

Keep, W.W., and Van der Nat P.J. (2014) Multilevel marketing and pyramid schemes in the United States. An historical analysis. Journal of Historical Research in Marketing, 6(2): 188-210. DOI: 10.1108/JHRM-01-2014-0002.

Zueva D.S. (2005). Network marketing as an unconventional form of economic organization. Economical Sociology, 6(4): 67-92. Available from: http://cyberleninka.ru/article/n/setevoy-marketing-kak-netraditsionnaya-forma-hozyaystvennoy-organizatsii [in Russian]

Discovery Research Group. (2017). Analysis of the Russian market of cosmetics and perfumery over 6 months of 2016. Available from: http://drgroup.ru/492-issledovanie-rossiiskogo-rinka-parfuma.html [in Russian]

Nielsen. (2015) Situation and tendencies: Russian market of cosmetics and personal care in 2015. Available from: http://www.nielsen.com/ru/ru/insights/news/2015/home-personal-care-market-overview-2015.html

Millward Brown. (2012) Brand and Advertising Awareness Tracking 2012 - Report for Oriflame Russia

Millward Brown. (2013) Brand and Advertising Awareness Tracking 2013 - Report for Oriflame Russia

Millward Brown. (2014) Global Brand Tracking - Country report for Oriflame Russia. Warsaw

Millward Brown. (2015) Global Brand Tracking - Country report for Oriflame Russia. Warsaw

1. Plekhanov Russian University of Economics, Moscow, Russia

2. Plekhanov Russian University of Economics, Moscow, Russia, Email: professor_sidorchuk@mail.ru

3. Plekhanov Russian University of Economics, Moscow, Russia