Vol. 39 (Number 32) Year 2018 • Page 13

Irina Ivanovna GLOTOVA 1; Elena Petrovna TOMILINA 2; Lubov Vasilevna AGARKOVA 3; Yuliya Evgenievna KLISHINA 4; Olga Nikolaevna UGLITSKIKH 5

Received: 08/06/2018 • Approved: 30/06/2018

ABSTRACT: In the context of new risks to the development of the Russian economy due to economic and political instability and the imposition of sanctions against Russia, the lessors’ attention to the process of forming and monitoring the quality of leasing portfolios is growing. The compounding effect on the overall risks of Russian leasing companies is relevant for all credit institutions, since the main systemic risk is the lack of macrostability. That is why it is so important to review the attitude to the correlation of market and credit risks and to develop new systems for the formation and monitoring of portfolio quality, based on the concept of concentration risk management. The purpose of this paper is to analyze the influence of concentration risk on the portfolio risks of a financial institution and develop a methodology for forming the optimal portfolio of a leasing company by putting emphasis on concentration risk as one of the most serious threats to the financial sector's stability during a crisis. The retrospective analysis, applied in the study, helped identify the weaknesses in the formation of the optimal portfolio and risk management of a leasing company. With the help of mathematical transformations, an optimization model and its necessary limitations were obtained, which allowed the previously identified shortcomings in risk management to be eliminated. The proposed methodology can be applied in a leasing company for the formation and monitoring of the effective portfolio of leasing transactions in an unstable economic situation. It is proved that the competent accounting of concentration risks makes it possible to most effectively manage the portfolio risks of a leasing company, especially during the periods of crisis and the lack of macrostability. |

RESUMEN: En el contexto de los nuevos riesgos para el desarrollo de la economía rusa debido a la inestabilidad económica y política y la imposición de sanciones contra Rusia, la atención de los arrendadores al proceso de formación y monitoreo de la calidad de las carteras de arrendamiento está creciendo. El efecto de capitalización sobre los riesgos globales de las compañías de leasing rusas es relevante para todas las instituciones de crédito, ya que el principal riesgo sistémico es la falta de macroestabilidad. Por eso es tan importante revisar la actitud hacia la correlación de los riesgos de mercado y de crédito y desarrollar nuevos sistemas para la formación y el control de la calidad de la cartera, basados en el concepto de gestión del riesgo de concentración. El propósito de este trabajo es analizar la influencia del riesgo de concentración en los riesgos de cartera de una institución financiera y desarrollar una metodología para formar la cartera óptima de una empresa de leasing poniendo énfasis en el riesgo de concentración como una de las amenazas más serias para la financiera la estabilidad del sector durante una crisis. El análisis retrospectivo, aplicado en el estudio, ayudó a identificar las debilidades en la formación de la cartera óptima y la gestión del riesgo de una empresa de leasing. Con la ayuda de las transformaciones matemáticas, se obtuvo un modelo de optimización y sus limitaciones necesarias, lo que permitió eliminar las deficiencias previamente identificadas en la gestión del riesgo. La metodología propuesta se puede aplicar en una empresa de leasing para la formación y el seguimiento de la cartera efectiva de operaciones de leasing en una situación económica inestable. Está demostrado que la contabilidad competente de los riesgos de concentración permite gestionar de forma más efectiva los riesgos de cartera de una empresa de leasing, especialmente durante los períodos de crisis y la falta de macroestabilidad. |

The lack of macroeconomic stability is the main systemic risk for credit institutions. In these conditions, it becomes relevant to determine the compounding effect on the overall risks of Russian leasing companies. In the context of the worsening portfolio quality of Russian leasing companies and the manifestation of the compounding effect, the issues of risk correlation are particularly important.

At the same time, the formation of the optimal portfolio is a classical task of financial management. It was first formulated and solved by G. Markowitz, one of the founders of the modern portfolio theory (Sharpe, Alexander and Bailey, 1997; Markowitz, 1952). The main difficulty of this algorithm is to determine the indifference curve, as an objective assessment of the investor's risk propensity. An alternative is the approach developed by D. Marshall, which is aimed at choosing a portfolio by the criterion of allowable losses (Marshall and Bansal, 1998). The advantage of the method is the rejection of the abstract utility criterion and the choice of the optimal portfolio taking into account the allowable level of portfolio losses. Its disadvantage is the need to build a set of one-period and multi-period efficient portfolios. W. Sharpe suggested using the expected income minus the deduction of risk payment as a utility measure for a particular asset composition. Risk payment was defined as the square of the risk measure (variance), divided by the measure of the investor's risk tolerance (Sharpe, Alexander and Bailey, 1997). However, this approach also uses quite an unclear concept – a measure of the investor's risk tolerance.

The approach to choosing the optimal portfolio, taking into account the shortcomings of these methods, which does not require the construction of a set of efficient portfolios and the determination of indifference curves, was suggested by V. Ignatochkin. He proposed using the ratio of the square of mathematical expectation of the portfolio return to its variance as an optimization criterion, which is actually the square of Sharpe's criterion (Ignatochkin, 1998). The disadvantage of this method is that it does not take into account the level of allowable losses when optimizing the asset portfolio.

Analyzing the portfolio theories of the above researchers and taking into account the current state of the Russian economy, we determined that in the context of significant volumes of portfolios of leasing companies it is necessary:

- to refuse to build a set of portfolios, because it is quite difficult to implement in practice;

- to refuse to define indifference curves and risk tolerance measures, which strengthens subjectivity in solving the problem of constructing the optimal portfolio.

In our opinion, when forming a portfolio, one must rely on the concept of accounting for allowable losses. Particular attention should also be paid to the correlation of credit and market risks.

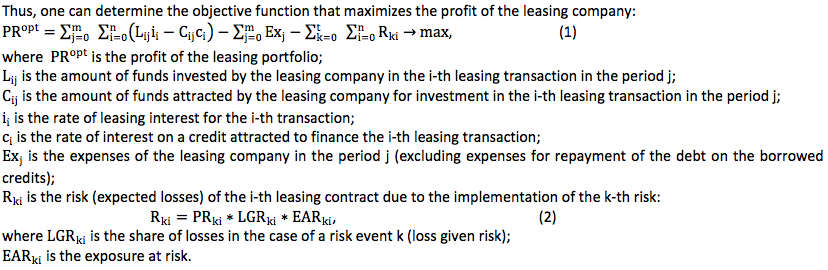

A literature review on the management of commercial banks’ credit portfolios (Borodin, 1998; Mandrovsky, 2001; Morsman, 2004; Kolokolova, 2017; Kimber, 2004) allowed us to conclude that the indicators of the optimal leasing portfolio should be determined by using the linear programming problem – finding the extremum of the objective function of the form F (a, b, c, e) → extremum. Thus, to find the optimal leasing portfolio, we need to determine the objective function. Taking into account the main objective of the leasing company when carrying out leasing operations – profit making, we believe that its maximization should act as a criterion for solving the optimization problem of leasing portfolio formation. Within the framework of this work, the profit is understood as the difference between the amount of funds received from the lessee and the amount of funds paid by the lessor in the process of realizing this leasing transaction without taking into account taxes and fees received by the leasing company for a certain period of time (planning horizon). In this case, taxes and fees paid by the leasing company as well as the claims of shareholders to its profitability are not taken into account. In the future, the model can be expanded by including a tax component in the analysis, as well as taking into account a specially defined "risk-free" rate, which will solve the complex problem of risk management of the leasing portfolio and optimize taxation.

For successful implementation in practice, this optimization function must satisfy certain obvious and arbitrary limitations. Let us take the list of limitations on the objective function proposed by A. Panteshkina (2009) as a basis:

- the probability that the leasing company will receive losses above a certain level should not exceed the specified value;

- the amount of expected and unexpected losses for each leasing contract should not exceed the established value;

- the amount of funds invested by the leasing company in each transaction should not exceed the established standard;

- the total amount of funds invested by the leasing company in leasing transactions should not exceed its stability threshold;

- the leasing portfolio should be well diversified, i.e. the established standards of the debt limit for one lessee, for a group of related lessees, for the industry, etc. should be observed.

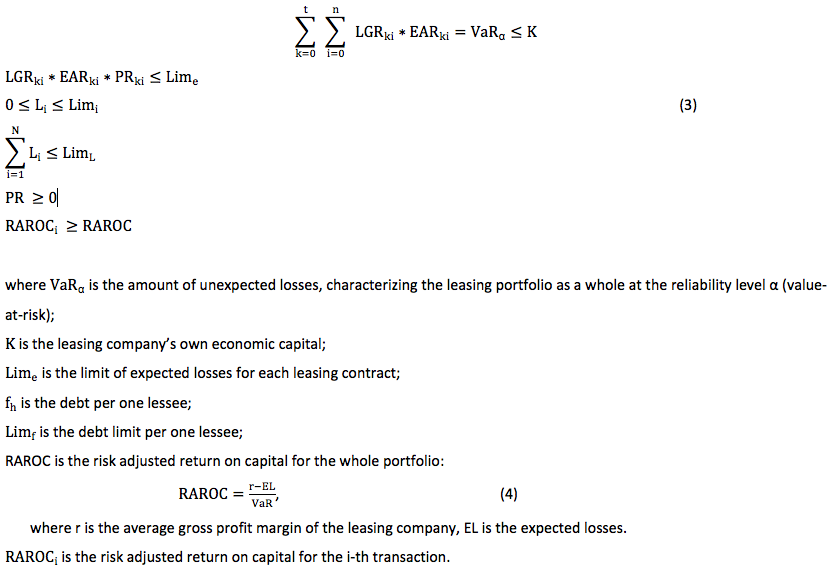

In our opinion, the following limitations should be added to the listed ones: the established rate of leasing interest should ensure the condition: the risk adjusted return on capital for each transaction should not be less than the risk adjusted return on capital for the portfolio as a whole. In view of this limitation, the general system of limitations will look like this:

However, this system of limitations does not meet the current requirements of financial organizations and leaves some problems of leasing portfolio formation unsolved or even unspecified.

Currently, when forming the optimal portfolio, leasing companies do not apply methods that give an accurate assessment of the degree of credit portfolio diversification and the definition of investment limits in the transaction. The principle of diversification is at the heart of the business of any financial institution and implies a deep understanding of the relationships (correlations) between borrowers, which in turn is crucial for many purposes, including such as setting the requirements for the leasing company’s capital and the pricing of leasing products. In practice, portfolio diversification is carried out by the spheres of activity, by products, etc., taking into account only the accumulated historical experience and the data and knowledge of experts. Moreover, there are no methods for calculating the efficiency of a segmentation in advance and, as a consequence, diversifying the portfolio in credit institutions. In this regard, in spite of the fact that many researchers consider optimization models, similar to the above formulated, viable and relevant for risk management of leasing companies, we believe that they do not fully reflect the current state of the Russian economy.

Since the credit risk is dominant in the system of financial risks of leasing companies, it seems appropriate to consider in more detail the correlation of credit and market risks against the background of the compounding effect.

The compounding effect is the effect of the non-linear interaction of credit and market risks (Sokolov, 2014a). For a deeper understanding of the compounding effect, let us turn to the conclusions of the Basel Committee on Banking Supervision. Analyzing the outcomes of the global financial crisis of 2008, the working group of the Basel Committee came to the conclusion that banks which use a conservative model of risk aggregation providing for an ideal positive correlation do not always overestimate the risks undertaken. Moreover, risk assessments using a conservative model can be understated up to 7.5 times due to the so-called compounding effect. The size of the compounding effect is determined by the non-linearity of the interaction of market and credit risks and depends on the degree of market volatility (Sokolov, 2014a).

Obviously, the extent of the effect depends on the susceptibility of individual borrowers. Companies with a low rating, being closer to default, have a chance to be in default sooner due to the direct influence of market factors. In other words, the underestimation risk increases with a decrease in the borrower's rating.

During the emergence of new risks to the development of the Russian economy due to the unstable political and economic situation and the imposition of sanctions against Russia, the lessors' attention to the process of monitoring the quality of portfolios is growing, while as early as early 2010, credit institutions were concentrated mainly at the first stage – transactions. However, from the point of view of the very possibility of continuous monitoring of the portfolio of leasing transactions, these portfolios are incredibly large.

In our opinion, this problem can be solved by reconsidering the attitude to the objectivity of correlations of market and credit risks and implementing modern systems for the formation and monitoring of portfolio quality. As it was noted earlier, the principle of diversification is the basis of the business of any financial organization and is of decisive importance for establishing requirements for capital and pricing. Therefore, the concept of correlation underlies all risk models, and the assessment of the correlation of credit risks (default risks) is the most difficult part of statistical modeling.

Errors in correlation assessment can be much more sensitive than errors in assessing the default probability of a particular lessee, which was vividly confirmed by the global financial crisis of 2007-2008 revealing the failure of most risk assessment models to take into account such correlations. When external influences lead to the fact that originally independent system components begin to correlate, and this results in a risk for the entire system, the effect of endogenous correlation factors is fully manifested.

The European Central Bank notes that the correlation of defaults can be both positive – when firms in one industry are exposed to the same factors (suppliers, raw materials, exchange rate) – and negative – for example, the liquidation of a competitor increases the potential market share of a borrower (European Central Bank, 2007). In this case, the correlation determines the degree to which the credits "migrate" or go into default together.

The used credit risk models are based on the assumption of the conditional independence of defaults, according to which it is implied that the correlation of defaults can be determined by the dependence of all credits in the portfolio on the factors used in the model. The situation in which risk assessment models are based only on available data, rather than on economic reality, is called "data dependency". This increases the convenience of modeling, but at the expense of accuracy.

Li (2000) in his approach to defining a correlation structure noted that “the default rate for a group of credits tends to be higher in a recession and lower when the economy is booming. This implies that each credit is subject to the same set of macroeconomic influences, and that there is some form of positive dependence among the credits” (Li, 2000).

The Russian practice of risk management is represented by an approach different from most European models of credit risk management. It is based on the expediency and necessity of using correlation in a wider range: from -1 to +1 (Sokolov, 2014b).

The calculation and modeling of negative correlations used in risk factoring with regard to the endogenous behavior of borrowers are necessary for accounting for compounding effects and reducing the volatility (risk) of portfolios.

The approach presented was developed taking into account the specifics of the Russian economy and implies the active use of information on foreign trade transactions of customers and cash flows associated with foreign economic activity by financial organizations. Accordingly, the company's solvency is sensitive to general macroeconomic factors, but with a variable correlation sign.

In addition, there are direct business and legal links between companies in the portfolio, which provide a channel for the spread of financial problems in the portfolio. Such microstructural dependencies go beyond the influence of macrofactors on borrowers and can lead to so-called "contagion". Default contagion can increase credit risks in the portfolio, i.e. the default of one borrower can cause the default of dependent borrowers. Microstructural interdependencies can also be positive or negative.

Egloff et al. (2006) expanded the studies on large homogeneous credit portfolios, analyzing the cyclical dependence of defaults rather than credit contagion issues. Despite the abovementioned theoretical provisions on a correlation sign, they specified a microstructural dependence exclusively in the context of positive correlation. In turn, this approach seems justified to us, since the situation when the default of one borrower has a direct positive effect on the solvency of another borrower is rare (Egloff, Leippold and Vanini, 2006).

As known, the rationale for correlations in the credit portfolio is part of the concept of concentration risk management. At the same time, speaking about credit portfolio management, it should be noted that there is still no formal methodology to measure risk concentrations.

S. Kealhofer notes that banks segment the credit portfolio into subportfolios, or "baskets”, according to some practical criteria that are somehow related to how they conduct business. For credit risk in general and for concentration risk in particular, it is advisable to adopt a different criterion. One of the most difficult tasks is to timely identify potentially dangerous concentrations, which may not be related to the organizational structure of the bank.

In emerging markets, the relationships (correlations) between borrowers are more variable, which is once again confirmed by experience in the context of the sanctions economy. Under these conditions, it is not advisable to follow the previously established level of portfolio correlation. As for the danger of the compounding effect (the emergence of uncontrolled risk concentration), one of the most serious threats to the financial sector's stability during a crisis is concentration risk (Sokolov, 2014a).

Its importance is confirmed by the Basel Committee (2004), defining concentration risk as the risk associated with any single exposure or group of exposures with the potential to produce large enough losses to threaten a bank's core operations. Concentration risks can constitute a significant share of the portfolio credit risk of all financial and credit institutions, including leasing companies. The absence of the necessary and correct consideration of concentration risks can lead to a significant underestimation of the value of the overall credit risk accepted by the leasing company and, as a result, to an inadequate assessment of the required level of economic capital (Sokolov and Morya, 2012). Given the trends in the world economy, the Basel Committee's assumption that risk concentration is the most important cause of major problems of credit institutions is very relevant for the Russian economy as well.

Taking into account the current situation in the banking sector and the recommendations of the Basel Committee (2009), one can transfer the main conclusions regarding the accounting of financial risks to the portfolio of leasing companies. Thus, leasing companies need to have internal policies, control systems and mechanisms to identify, measure and monitor credit risk concentration to which a company may be exposed, both in a narrow and broad sense –concentration that arises from the interaction of market and credit risks. An example of concentration in a narrow sense is group concentration - risk concentration per borrower or a group of related borrowers.

Kealhofer made the assumption that there is no method to accurately assess the degree of diversification of the credit portfolio. He noted that “portfolios have "concentrations"; ex post we see them. Ex ante, lenders must look to models and software to quantify concentrations. Until recently, these types of models have not been generally available” (Kealhofer and Bohn, 2001).

The system for managing credit risk concentrations should be clearly documented and include a description of the method for calculating this concentration and the corresponding limits. In addition, the limits should be defined in relation to the company's capital, with acceptable measurement methods – to the general level of risk. At the same time, despite all the advantages of setting limits in the form of a percentage of capital, this formulation gives insufficient information about the true credit concentration in the portfolio.

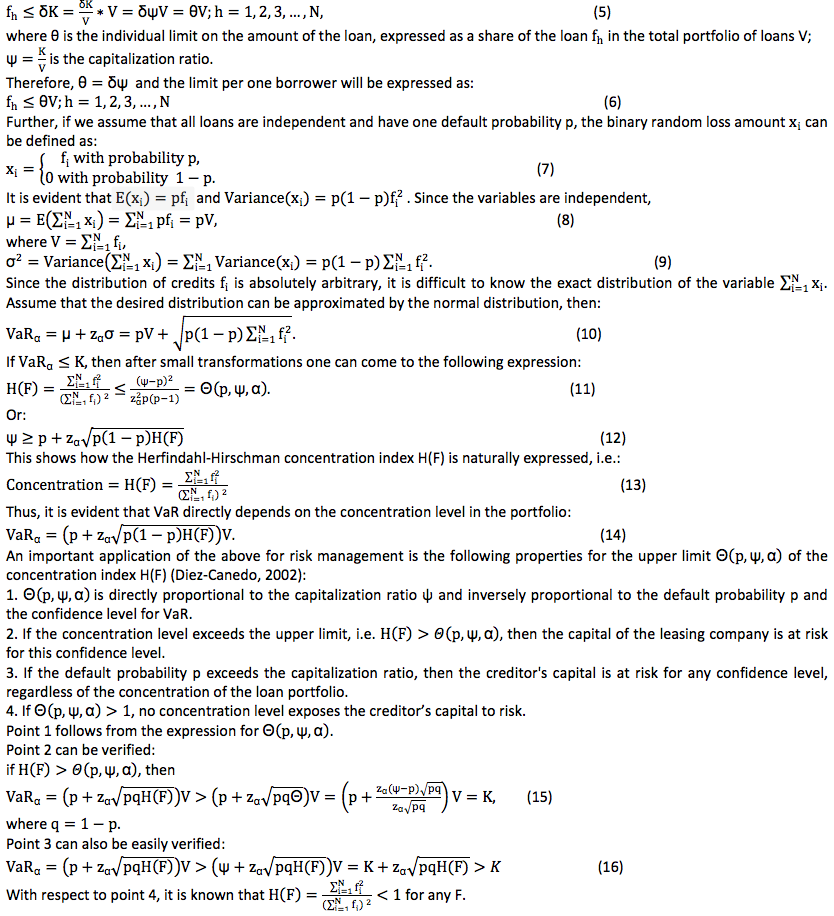

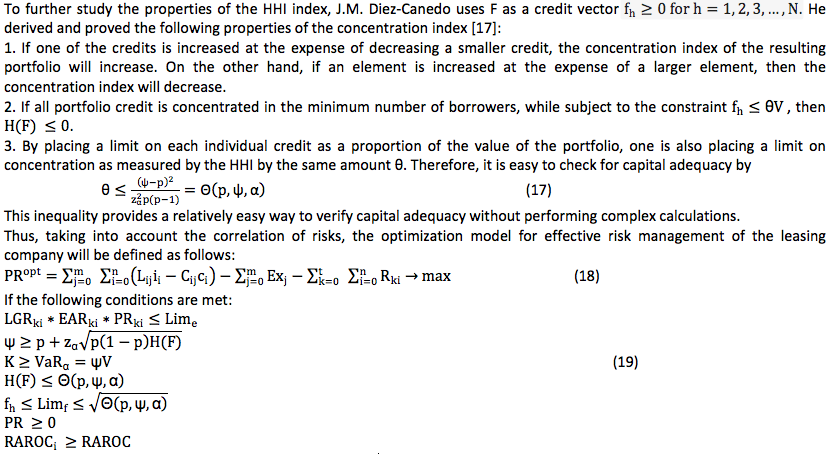

Further, it is advisable to consider in more detail the relationship between the limit per one borrower and the concentration index. Diez-Canedo investigated the properties of the HHI concentration index (Diez-Canedo, 2002). One of the main properties of this approach is that the relationship between the risk and the concentration measure in the credit portfolio arises naturally. Through applied research, A. Kadnikov confirmed this relationship. Using imitation modeling, Kadnikov investigated the effects of portfolio concentration on the distribution of losses (and credit VaR). As a result, different approaches to changing the portfolio structure led to a single conclusion. Dependence on the HHI index (as a concentration measure) has the form of a root function (Kadnikov, 2012).

Understanding the relationship between the limit per one borrower and the concentration index is important for risk management and for regulating the activities of the leasing company. Traditionally, all credit organizations struggle with risk concentration, imposing limits on the maximum amount that can be given to one borrower in different sections, where concentration may occur, such as industry, geographic region, credit product, country, etc. Usually, the limit per one borrower is expressed in a share of δ from the capital of the credit organization. Investigating this problem, one should determine the share of credit debt concentrated in one borrower or a group of borrowers, in the total portfolio. Diez-Canedo [17] focuses on the measurement of concentration relative to the total value of the loan portfolio:

The above properties provide some useful rules for the risk manager and for the regulator. First of all, one can determine capital adequacy, since it is possible to get the exact amount of the adjustments in the capitalization ratio, which arise due to changes in the default probability and (or) the concentration of the loan portfolio. Then, depending on the degree of control of the leasing company over the default probability and the concentration level, one can also calculate the adjustments in the default probability and the concentration of the loan portfolio necessary to maintain capital adequacy. Thus, if the concentration of the loan portfolio exceeds the boundary at the desired confidence level, the inequality for the capitalization ratio is used to adjust the parameters p and H(F), so that capital is not exposed to credit risk. Of particular interest is that if the default probability of the portfolio exceeds the capitalization ratio, the risk manager and the financial regulator are alerted that capital is exposed to risk, regardless of the concentration of the loan portfolio and the confidence level assumed.

Evidently, the maximum concentration occurs when all credits belong to the same borrower, and the minimum concentration occurs when all borrowers have the same amount of credits.

From the above conditions it follows that:

The obtained results can be used by leasing companies to manage group concentration risk, since they provide clear formulas for determining risk, which allows for an accurate quantitative analysis of the necessary regulatory measures to maintain capital adequacy.

As part of the periodic assessment of the company's systematic risk concentration, it is possible to use the HHI by industry – the industry index, as well as the concentration index by type of security, the factor concentration index. The value of the industry index, for example, is defined as the sum of squares of the shares of loan indebtedness of all industries (for industry concentration) in the total value of the corresponding overall activity indicator of the leasing company as a whole or in a separate region. The index takes a value from 0 (when infinitely many industries are covered, each of which has a very small share of the credit portfolio) to 1 (when all loans are concentrated in one industry).

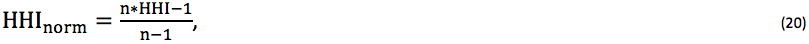

To compare different concentration sections, it is advisable to normalize each index so that the section index changes in the range 0-1. The computed indexes will be reduced to the normalized form using the following expression:

where n is the number of groups in the section.

This ability to monitor concentration levels in combination with a relatively simple method of verifying capital adequacy without performing complex calculations allows for a quantitative analysis of the necessary measures to regulate capital adequacy.

In the considered model of risk management, certain assumptions were made (Adelman, 1996):

A further study of risk management of the leasing portfolio is possible provided that these limitations are removed.

Thus, the application of the portfolio approach to risk management of the leasing company in practice will help to solve the following tasks:

The proposed optimization model makes it possible to determine the amount of economic capital of the leasing company with regard to group concentration risk for the formation and monitoring of the effective leasing portfolio in the context of economic uncertainty.

Adelman, M.A. (1996). Comment on the H concentration measure as a numbers-equivalent. Review of Economics and Statistics, 1(51): 99–101.

BCBS. (2004). International Convergence of Capital Measurement and Capital Standards. A Revised Framework, BIS.

BCBS. (2009). Findings on the interaction of market and credit risk. Working Paper No. 16, BIS.

Borodin, A.V. (1998). Mathematical models for managing the commercial bank’s credit portfolio. Yoshkar-Ola: Mari State Technical University.

Diez-Canedo, J.M. (2002). A simplified credit risk model for supervisory purposes in emerging markets. BIS Papers No. 22: 328–360.

Egloff D., Leippold M. and Vanini M. (2006). A simple model of credit contagion. Journal of Banking & Finance, 8(31): 2475-2492.

European Central Bank. (2007). The use of portfolio credit risk models in central banks. Occasional Paper Series No. 64.

Ignatochkin, V. (1998). Is an effective set necessary for portfolio optimization? The Securities Market Journal, 8(119). http://old.rcb.ru/archive/articles.asp?id=852

Kadnikov, A. (2012). Dependence of the credit portfolio’s VaR on the concentration level. Risk Management in a Credit Institution, 1: 56-65.

Kealhofer, S. and Bohn, J.R. (2001). Portfolio Management of Default Risk. San Francisco: Moody’s KMV.

Kimber, A. (2004). Credit risk: From transaction to portfolio management. Amsterdam: Elsevier Butterworth-Heinemann.

Kolokolova, O.V. (2017). Optimization modeling of the credit portfolio. Retrieved from: http://www.hedging.ru/stored/publications/522/download/Kolokolova.doc

Li, D.X. (2000). On Default Correlation: A Copula Function Approach. Working Paper Number 99-07. The RiskMetrics Group. New York.

Mandrovsky, S.S. (2001). System risk theory in optimizing the commercial bank's credit portfolio management. Moscow: State University of Management.

Markowitz, H. (1952). Portfolio selection. Journal of Finance, 1(7): 77-91.

Marshall, J.F. and Bansal, V.K. (1998). Financial Engineering: A Complete Guide to Financial Innovation. Moscow: INFRA-M.

Morsman, E.M. (Jr.). (2004). Credit Portfolio Management. Moscow: Alpina Biznes Books.

Panteshkina, A.A. (2009). A portfolio approach to risk management in the leasing company during a crisis. Financial and Risk Management in a Leasing Company, 4: 3-5.

Sharpe W., Alexander G. and Bailey J. (1997). Investments. Moscow, INFRA-М.

Sokolov, Yu.I. (2014a). Compounding effect in the credit portfolio as a challenge to the Russian banking system. Risk Management in a Credit Institution, 3: 82-88.

Sokolov, Yu.I. (2014b). Correlation in credit risk: from concept to solution. Risk Management in a Credit Institution, 4: 78-84.

Sokolov, Yu.I. and Morya, O.A. (2012). Risk management of credit portfolio concentration. Risk Management in a Credit Institution, 2, 80-91.

1. Federal State Budgetary Educational Institution of Higher Professional Education “Stavropol State Agrarian University”, Russia.

2. Federal State Budgetary Educational Institution of Higher Professional Education “Stavropol State Agrarian University”, Russia.

3. Federal State Budgetary Educational Institution of Higher Professional Education “Stavropol State Agrarian University”, Russia.

4. Federal State Budgetary Educational Institution of Higher Professional Education “Stavropol State Agrarian University”, Russia.

5. Federal State Budgetary Educational Institution of Higher Professional Education “Stavropol State Agrarian University”, Russia.