Vol. 39 (Nº27) Year 2018. Page 16

Vol. 39 (Nº27) Year 2018. Page 16

Mikhail Samuilovich GASPARIAN 1; Irina Anatolievna KISELEVA 2; Dmitry Gennadievich KORNEEV 3; Sergey Arkadyevich LEBEDEV 4; Viktor Arkadyevich LEBEDEV 5

Received: 15/05/2018 • Approved: 08/06/2018

2. Investment project as a risk management object

3. Risks at the organization of the investment project implementation

4. Risk analysis methods of investment project

5. Application of project risks’ analysis methods in practice

ABSTRACT: The article makes an attempt to study the role of risk management when implementing investment projects. The primary purpose of the article is identifying main regularities, which determine features in the risk assessment in business as a key element facilitating the organization of investment projects. The research is based on cognition methods, retrospective and documentary analysis, as well as synthesis, generalization, and systematization of the information. The article describes the various types of investment and project risks, methods of risk analysis of investment projects, performance indicators of investment projects, as well as the analysis of risk factors and uncertainties in the course of investment projects’ development. The authors consider peculiarities of application of risk analysis methods when implementing projects. In modern economic analysis, different methods are used for risk management. Methods for risk assessment of an investment project help to assess the feasibility of the project, initial time period after which it will generate revenue, as well as the probabilistic size of future profits. |

RESUMEN: El artículo intenta estudiar el papel de la gestión de riesgos al implementar proyectos de inversión. El objetivo principal del artículo es identificar las principales regularidades, que determinan las características en la evaluación de riesgos en los negocios como un elemento clave que facilita la organización de proyectos de inversión. La investigación se basa en métodos de cognición, análisis retrospectivo y documental, así como síntesis, generalización y sistematización de la información. El artículo describe los diversos tipos de riesgos de inversión y proyecto, métodos de análisis de riesgos de proyectos de inversión, indicadores de rendimiento de proyectos de inversión, así como el análisis de factores de riesgo e incertidumbres en el curso del desarrollo de proyectos de inversión. Los autores consideran las peculiaridades de la aplicación de los métodos de análisis de riesgo al implementar proyectos. En el análisis económico moderno, se utilizan diferentes métodos para la gestión de riesgos. Los métodos para evaluar el riesgo de un proyecto de inversión ayudan a evaluar la viabilidad del proyecto, el período de tiempo inicial después del cual generará ingresos, así como el tamaño probabilístico de las ganancias futuras. |

To date, the performance of the overall economy of the Russian Federation is characterized by the development of market relations. The main role in this process belongs to investment projects. In line with this a need in investments is emerging.

This was most clearly observed after 1999 due to the favorable changes in the political environment, increase in demand in the hydrocarbon market, and devaluation of the ruble. These factors became the impetus to wide application of investment processes in the real sector that caused the need to attract various foreign resources (ecological, tax, social and other inputs). However, the experience of developing countries shows that foreign investors are interested solely in making a profit and investing in the most attractive industry sectors, such as for example, hydrocarbon sector, rather than technology sectors. Therefore, the question arises concerning the proper investment planning, consisting in the consideration of internal and external factors, which include political, environmental, tax, social and other issues.

Another problem in the investment project planning is the use of non-dynamic mechanisms in the project efficiency analysis, i.e. there is the probability of various risks occurrence.

Therefore, emphasis is made on analysis of risk factors and uncertainties in the course of the investment projects’ development, which, in turn, can be considered the core of an efficient economy.

The concept of "investment project" is displayed in the Federal Law No. 39 "On investment activities in the Russian Federation implemented in the form of capital investments" (Federal Law, 2017). It provides the substantiation of economic expediency, volume and terms of capital investments, including necessary design documentation developed in accordance with the legislation of the Russian Federation, as well as a description of practical deeds on investments’ implementation (business plan).

The investment project is characterized by the following features: a precise statement of the objective and solved tasks; project frameworks in terms of time and resources; project uniqueness, novelty, integrity, as well as legal and organizational support.

The implementation of the investment project is always associated with the risk management (Goncharenko and Filin 2006), which represents a set of solutions influenced by different kind of information. This problem can be solved by means of risk management (Gracheva and Sekerin 2009), the primary responsibilities of which are the collection, processing, management, and forecasting of the risk occurrence as well as timely adoption of the risk reduction mechanism.

The risk management process is closely linked to the definition of each specific project. There are many project classifications, however, the following ranking criteria are used for investment projects:

In the course of development, each project undergoes several stages (Vilensky, Livshits, and Smolyak 2002). Their combination is called the project life cycle or life period, that is, the period of time between the creation of the project and its completion. Each stage is characterized by its own set of risks.

There are several approaches to define stages of the project life cycle, one of which is characterized by four phases, namely concept, development, implementation, and completion (Kiseleva and Tramova 2010, p. 242). The initial stage of this approach includes gathering information, setting goals and objectives, risk identification, setting deadlines and amount of finance. The second stage (development) involves creating a team, establishing contacts, defining learning objectives, preparing project content, developing timing and budget schedule, subcontracting, and the like. The next stage is directly associated with the project launch. The final stage consists in the summarizing and analysis of the obtained results.

Another common approach to the project life cycle is associated with the definition of six functions, namely substantiation, planning, implementation, monitoring, evaluation, and completion.

The substantiation phase involves the selection of the most effective project given the shortage of resources, costs and the need for alternative choices of certain needs and ignoring others to achieve set goals. At this phase it is also important denoting the norm of indicators deviation that shows the project effectiveness.

The planning stage is carried out during the whole period of the project implementation. It consists of the following components: preliminary planning, as well as formal and detailed planning. Great attention is paid to the development of a preliminary plan, because it constitutes the basis of project planning. Formal and detailed planning can be started only in case the preliminary plan is adopted. In the course of the project implementation the previously approved plan undergoes certain modifications due to the occurrence of various contingencies.

The implementation (realization) of the project occurs after adoption of the plan and involves the implementation of defined actions.

Controlling is one of the important stages of the project life cycle to evaluate the obtained actual results and compare them with the previously approved plan. The detected deviations are compared to predetermined norms. This allows minimizing the project risk.

The next stage (evaluation) is closely linked to controlling, as it is the feedback element. At that, there are some differences between controlling and evaluation. So, controlling displays the project monitoring, while evaluation means drawing interim results.

The final stage of the project reflects the result of the work done.

Despite the fact that there are quite many approaches to life cycle, it is important to note that the initial stage is always associated with the identification of the best available option of the project implementation, i.e. most effective, less risky, and profitable alternative.

The effectiveness of any project (Korolev, Bening and Shorgin 2007) is understood as the criterion reflecting the comparison of project outcomes and costs with its objectives and needs of the participants involved in the project.

The effectiveness of the investment project can be achieved resulting from investments that provide the greatest attractiveness of the project, because during the implementation of the investment project it is necessary to pay attention to the fact that today’s funds will have lower cost than the future investments (Lapchenko 2007).

Therefore, in order to display how the value of money changes, it is necessary to calculate the discount rate, which is determined along with the following indicators (Moskvin 2004):

The above performance indicators (Northcott 1997) of investment projects, as a rule, are used when analyzing project efficiency and enable making the right decisions when choosing the best business plan. At the same time, these criteria reflect the process of making investment decision in the presence of risk and uncertainty.

When implementing investment projects, one should always take into account the probability of occurrence of risk situations (Ostrovskaya 2004). Therefore, first and foremost, it is necessary to consider the following types of risks:

Despite the existence of a huge number of risk varieties that can arise in any time point of the investment project's life cycle (Teplova 2012), there is a science, which studies management of risks, and is called risk management. It is based on the application of specific tools, the number of which may be quite large.

In the risk management theory, several ways of influencing risk are identified. These are risk reduction, risk retention, and risk absorption. Risk reduction involves the minimization of possible damage that may occur during the implementation of the investment project, or reducing the probability of occurrence of adverse events. Risk retention, in turn, covers the self-insurance (creation of reserve funds) and obtaining financial resources (loans and borrowings). Risk absorption tools include the transition of responsibility for the risk to third parties provided the same level of risk. These tools include financial guarantee, surety commitment, and insurance against risks.

Depending on the stages of the project life cycle, the total volume of risks and their variety may vary. Therefore, the set of tools available for risk management varies along with the risks (Chereshkin 2014). Thus, each stage of the investment project life cycle is characterized by its own set of tools.

At a stage, where funds have not yet been invested, certain measures of project risk assessment are applied. At the same time, contractual, legal, insurance and other tools can also be used.

At the phase of direct financing, the main role is played by measures such as ensuring the timely completion of the project, the exact implementation of the contract terms for construction and installation works and supply of fixed assets, insurance, etc.

During the production phase, assets insurance is carried out, and timely payments of loan obligations and hedging against commercial risks are provided, etc.

The final phase of the investment project cannot be imagined without the use of emergency reserve funds, prevention of ecological damage caused by company activities, as well as payment of obligations to third parties by the project participants.

In practice, when analyzing risk of investment projects, quantitative and qualitative methods are applied.

The qualitative approach begins with identification of the project risks at the stage of plan preparation and is based on the necessity of preliminary research to collect information before the analysis of actual risks. The primary objective of this approach is identifying the types of project risks according to the above classification (Chernova and Kudryavtsev 2003). The method of analysis consists in investigation of the possible causes of risk occurrence and different criteria which contribute to risk dynamics. After evaluating the alleged damage, at the last stage of the analysis, measures are prepared to combat the identified risks. A qualitative approach is determined by the application of subjective values. It has a close relationship with the terms of the project itself and is based on the more complicated processes of information processing and analysis in comparison with quantitative approach.

As a rule, the qualitative analysis leads to quantitative assessment, where the risk is assessed in value terms (McGrath 2013).

The essence of quantitative approach consists in a numerical measurement of the impact of changes in project factors. Therefore, the analysis of project risks, when using this method, is based on application of mathematical statistics, probability theory, and other mathematical tools. Unlike the qualitative approach, a quantitative assessment is characterized by the application of unbiased findings, needs proper use of mathematical analytical tools, and is based on statistical samples and time-based series. Project risk analysis is often based on application of mathematical statistics methods, which include concepts such as variance, statistical expectation, and coefficient of variation. Statistical analysis enables assessing the risk of not only a project, but also the organization. The undeniable advantage of the statistical approach to project risk analysis is ease of mathematical calculations, while the downside is the need for a large number of observations (Prahalad and Ramaswamy 2006).

In practice, when analyzing investment project risks, the following tools are used as well: method of expert assessment, SWOT-analysis, method of analogies, method of adjusting the discount rate, critical value method, and others.

The method of expert assessment is directly related to the activity of an expert (specialist), who processes the information and makes a decision based on conducted analysis. The main information sources are the organization or other enterprises’ staff members, the corporate accounting statements, and industry related information. When carrying out the expert assessment, the following tools are used: interviews, questionnaires, Delphi method, and brainstorming (Teece, Pisano and Shuen 2003).

The SWOT analysis represents a Table, which shows strengths and weaknesses, opportunities and threats of the external environment.

The method of analogies consists in consideration of all data associated with the execution by the company of previous similar projects with the aim of measuring probability of occurrence of losses, and studying available information of the similar projects. When using this method, it is important to take into account that each organization is characterized by a number of specific features. Practical implementation of this method is not easy, because it is associated with certain problems, such as difficulties in finding a similar project, the lack of a set of probabilistic failures of the project, the complexity of evaluating the accuracy at which the risk of previous similar project can be used for assessing the risk of the current project. Most often, this method is applicable in those areas, where it is necessary to evaluate the risk of recurring projects, for example, in the construction sector.

Method of adjusting the discount rate is quite simple in calculations and is based on the adjustment of the discount rate corresponding to risk-free project or minimally acceptable risk. Correction of the discount rate is done by adding the risk premium, while then the calculation and estimation of the investment project efficiency criteria are carried out. The main disadvantage of the method consists in the fact that conducting calculations requires the transformation of future flows to the current time period, but calculations do not take into account the probability of deviation from the obtained result, i.e. the extent of risk. Another problem of this method is the limited number of options of models that leads to the fact that resulting analysis does not go beyond the calculation of efficiency criteria at changing just a single factor which is the discount rate. The critical values method is used in the course of investment project management, because it allows determining the level of stability to the various changes in the implementation period. The essence of this method consists in determining the values of the factors influencing project risk, which are reduced to the limiting value.

Calculation of the probability of project risks and potential damage can be done using the following (qualitative) methods (Shapkin and Shapkin 2013):

The most common quantitative risk analysis mechanisms involve building the decision tree, sensitivity analysis, Monte-Carlo method, as well as scenario-based method and statistical approaches (Shapkin and Shapkin 2014).

The essence of the decision tree building method is determining the most optimal option among the possible outcomes.

A sensitivity analysis is applicable to the evaluation of single-factor models, and deals with measurement of certain criteria of the project by changing just one factor. Thus, to assess the level of risk, the successive change of all quantities is conducted. Every time just one variable can change its value by a few percent, and in line with this, the evaluated criterion takes on a new meaning. After that, all variables are ranked depending on their impact on evaluated criterion to identify the most critical indicators influencing the risk occurrence. The disadvantage of this method is the lack of consideration of the correlation coefficient (Foss 2007).

During the scenario based approach, project risks’ analysis is similar to the sensitivity analysis. The difference is that this approach is applicable with multifactor models. Therefore, the method is a consideration of the influence of the simultaneous change in all variables affecting risk level. The peculiarity of this approach is the accounting for the correlation coefficient when calculating variances. The disadvantage of the approach is the need of selecting and processing information to form multiple forecasts, as well as a limited number of variables’ combinations, because the increase in their number leads to significant complication of the process (Morrow, Sirmon, Hitt and Holcomb 2007).

In the course of statistical approach, the calculation of indicators such as variance and root-mean-square deviation is carried out.

Monte-Carlo method helps accounting the effects of uncertainty on the investment project efficiency (Lambin 1996; Nelson and Winter 2002; Porter 2016). In practice, this method is not easy and has no disadvantages typical for the sensitivity analysis and the scenario based approach. This analysis method is based on building a mathematical model of the studied indicator, which directly characterizes the investment project consisting of variables and parameters. In this case variables are random elements of the project, while parameters are represented by other elements in need of determination. The mathematical model is recalculated each time, when a kind of simulation experiment is carried out, in which the variables are set absolutely randomly using random numbers’ generation. Further, all results obtained in the experiments are combined into the sampling to perform the statistical analysis aimed at achieving the required probability distribution of the indicator and measuring the investment project risk. Monte Carlo simulation allows assessing and managing project risks, as well as simulating an optimal risk management option.

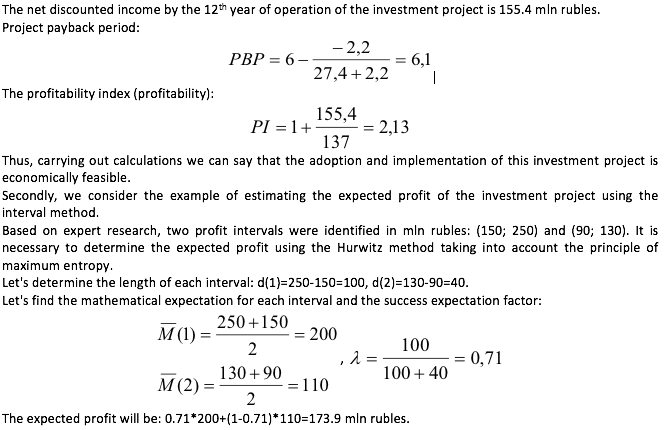

Below we give some examples of application of investment projects’ risk analysis methods.

First, consider the method of adjusting the discount rate. It is necessary to carry out performance indicators’ calculation of the project designed for 12 years, if the amount of income equals to 60 mln rubles per year. Starting from the third year, the current expenses amounted to 20 mln rubles per year. Capital expenditures in the first year of project operation amounted to 80 mln rubles, while in the second year – to 60 mln rubles. Discount rate was 5%.

As already mentioned, key performance indicators of the investment project are net present value (NPV), payback period (PBP), and profitability index (PI). The calculation results are given below in Table 1.

Table 1

The calculation of the net discounted income, mln rubles

Year |

CIF |

COF |

Cash flow СF |

|

СF* |

NPV |

|

Current charges |

Capital costs |

||||||

1 |

0 |

0 |

80 |

-80 |

1 |

-80.0 |

-80.0 |

2 |

0 |

0 |

60 |

-60 |

0.95 |

-57.0 |

-137.0 |

3 |

60 |

20 |

0 |

40 |

0.91 |

36.4 |

-100.6 |

4 |

60 |

20 |

0 |

40 |

0.86 |

34.4 |

-66.2 |

5 |

60 |

20 |

0 |

40 |

0.82 |

32.8 |

-33.4 |

6 |

60 |

20 |

0 |

40 |

0.78 |

31.2 |

-2.2 |

7 |

60 |

20 |

0 |

40 |

0.74 |

29.6 |

27.4 |

8 |

60 |

20 |

0 |

40 |

0.7 |

28.0 |

55.4 |

8 |

60 |

20 |

0 |

40 |

0.67 |

26.8 |

82.2 |

10 |

60 |

20 |

0 |

40 |

0.64 |

25.6 |

107.8 |

11 |

60 |

20 |

0 |

40 |

0.61 |

24.4 |

132.2 |

12 |

60 |

20 |

0 |

40 |

0.58 |

23.2 |

155.4 |

Thus, the formation of the investment project development process is an important element of the financial policy of any organization, the effective implementation of which allows increasing the profitability of the company and its investment attractiveness.

Execution of the investment plan contributes to the successful adjustment of the company to changes in the external environment. Therefore, when developing the investment business plan, it is necessary to consider not only the internal characteristics of a particular enterprise, but changes in the external conditions and factors influencing the project adoption process.

In turn, methods for risk assessment of an investment project, considered in the present work, help assessing the feasibility of the project, initial time period after which it will generate revenue, as well as the probabilistic size of future profits.

Chereshkin, D.S., 2014. Upravlenie riskami i bezopasnost'yu [Risk management and safety] [Text]. St.Petersburg: Lenand, 200 p.

Chernova, G.V. and Kudryavtsev, A.A., 2003. Upravlenie riskami [Risk management] [Text]. Moscow: Prospekt.

Federal'nyj zakon “Ob investicionnoj deyatel'nosti v Rossijskoj Federacii, osushchestvlyaemoj v forme kapital'nyh vlozhenij” [Federal Law "On investment activity in the Russian Federation implemented in the form of capital investments"] [Text] (No. 39 dated 26.07.2017).

Foss, N.J., 2007. Scientific progress in strategic management: The case of the resource-based view. International Journal of Learning and Intellectual Capital (IJLIC), 4(1/2).

Goncharenko, L.L. and Filin, S.A., 2006. Risk-menedzhment [Risk management] [Text]. Moscow: Knorus.

Gracheva, M.V. and Sekerin, A.B., 2009. Risk-menedzhment investicionnogo proekta: uchebnik dlya studentov [Risk management of investment project: Textbook for students] [Text]. Moscow: YUNITI-DANA, 544 p.

Kiseleva, I.A. and Tramova, A.M., 2010. Modelirovanie investicionnoj privlekatel'nosti turisticheskoj otrasli regional'noj ehkonomiki (na primere Kabardino-Balkarskoj Respubliki) [Modeling the investment attractiveness of the tourism industry of the regional economy (evidence from the Kabardino-Balkar Republic)] [Text]. Audit and Financial Analysis, 5, 241-246.

Korolev, V.Yu., Bening, V.E., and Shorgin, S.Yu., 2007. Matematicheskie osnovy teorii riska [Mathematical background of risk theory] [Text]. Textbook. Moscow: FIZMATLIT, 544 p.

Lambin, J.-J., 1996. Strategicheskiy marketing. Evropeyskaya perspektiva [Marketing strategy: A new European approach] (Trans. from French). Saint Petersburg: Nauka.

Lapchenko, D.A., 2007. Ocenka i upravlenie ehkonomicheskim riskom: teoriya i praktika [Economic risk assessment and management: Theory and practice] [Text]. Minsk: Amalfeya.

McGrath, R., 2013. Uspekh na chas – novaya norma dlya biznesa [The success for an hour is a new standard for business]. Harvard Business Review, Russia, November, pp. 56-65.

Morrow, J.L., Sirmon, D.G., Hitt, M.A., and Holcomb, T.R., 2007. Creating value in the face of declining performance: Firm strategies and organizational recovery. Strategic Management Journal, 8(3), 271-283.

Moskvin, V.A., 2004. Upravlenie riskami pri realizacii investicionnyh proektov [Risk management in the implementation of investment projects] [Text]. Recommendations for enterprises and commercial banks. Moscow: Finance and Statistics.

Nelson, R.R. and Winter, S., 2002. Evolyutsiya teorii ekonomicheskikh izmeneniy [An evolutionary theory of economic change]. Moscow: Delo.

Northcott, D., 1997. Capital investment decision-making. Moscow: YUNITI.

Ostrovskaya, E., 2004. Risk investicionnyh proektov [Risk of investment projects] [Text]. Moscow: Ekonomika.

Porter, M., 2016. Konkurentnoe preimushchestvo. Kak dostich' vysokogo rezul'tata i obespechit' ego ustoychivost' [Competitive advantage. Creating and sustaining superior performance]. Moscow: Alpina Publisher.

Prahalad, C.K. and Ramaswamy, V., 2006. Budushchee konkurentsii. Sozdanie unikal'noy tsennosti vmeste s potrebitelyami [The future of competition: Cocreating unique value with customers]. Moscow: Olimp-Biznes.

Shapkin, A.S. and Shapkin, V.A., 2013. EHkonomicheskie i finansovye riski. Ocenka, upravlenie, portfel' investicij [Economic and financial risks. Assessment, management, and investment portfolio] [Text]. 9th ed. Moscow, "Dashkov and K" Publishing and Trading Company, 544 p.

Shapkin, A.S. and Shapkin, V.A., 2014. Teoriya riska i modelirovanie riskovyh situacij: Uchebnoe posobie dlya bakalavrov [Theory of risk and simulation of risk situations: Textbook for bachelors] [Text]. "Dashkov and K" Publishing and Trading Company, pp. 880

Teece, D.J., Pisano, G., and Shuen, A., 2003. Dinamicheskie sposobnosti firmy i strategicheskoe upravlenie [Dynamic capabilities and strategic management]. Bulletin of St.Petersburg State University, 8, Menedzhment, 4(32).

Teplova, T.V. 2012. Investicii : ucheb. dlya bakalavrov [Investments: Textbook for bachelors] [Text]. Moscow: Yurayt, pp. 724.

Vilensky, P.L., Livshits, V.N., and Smolyak, S.A., 2002. Ocenka ehffektivnosti investicionnyh proektov: teoriya i praktika [Assessment of investment projects’ efficiency: Theory and practice] [Text]. Moscow: Delo.

1. Plekhanov Russian University of Economics, 117997, Russian Federation, Moscow, Stremyanny Lane, 36

2. Plekhanov Russian University of Economics, 117997, Russian Federation, Moscow, Stremyanny Lane, 36, E-mail: kia1962@list.ru

3. Plekhanov Russian University of Economics, 117997, Russian Federation, Moscow, Stremyanny Lane, 36

4. Plekhanov Russian University of Economics, 117997, Russian Federation, Moscow, Stremyanny Lane, 36

5. Plekhanov Russian University of Economics, 117997, Russian Federation, Moscow, Stremyanny Lane, 36