Vol. 39 (Number 26) Year 2018 • Page 25

Sonia SINGH 1; Subhankar DAS 2

Received: 26/02/2018 • Approved: 16/03/2018

3. Objectives & research methodology

ABSTRACT: This study was conducted to assess the impact of merger and acquisition activities on the performance of Banks in India. The paper reviews the trends in M&A’s in Indian banking and then impact of M&A’s has been studied in three leading banks of India. The study covers the area of performance evaluation of M&A’s in Indian banking sector during the period pre and post period of six years of Merger and Acquisition activity. The paper studied the post-merger financial performance of merged banks with the help of financial parameters like, Net Profit margin, operating Profit margin, return on Capital Employed, Return on Equity, earnings per share, capital adequacy ratio, dividend per share etc. The findings indicated that strategies and policies in procedural, physical and socio-cultural contexts were very important factors in the post-merger and acquisition process. In addition, the qualitative impacts of the post M&A activities such as accounting reports, market valuations and key informant descriptions are enormous and vital to improve the performance of the Bank and its capabilities. The study recommended that policies and strategies instituted by management, for instance the credit policy, should be re-visited in order to enhance internal and external operations, the logistical framework support should be improved; a more comprehensive approach to integrated marketing communications mix should be put in place in the promotion of the Bank’s existing and added products so as to gain more market share. |

RESUMEN: Este estudio se realizó para evaluar el impacto de las actividades de fusión y adquisición en el desempeño de los bancos en India. El documento revisa las tendencias en las fusiones y adquisiciones en la banca india y luego se ha estudiado el impacto de las fusiones y adquisiciones en tres de los principales bancos de la India. El estudio cubre el área de evaluación de desempeño de fusiones y adquisiciones en el sector bancario de la India durante el período pre y post de seis años de actividad de Fusión y Adquisición. El documento estudió el desempeño financiero posterior a la fusión de los bancos fusionados con la ayuda de parámetros financieros como, margen de beneficio neto, margen de beneficio operativo, rendimiento del capital empleado, rendimiento del capital, beneficios por acción, índice de adecuación del capital, dividendo por acción, etc. Los hallazgos indicaron que las estrategias y políticas en los contextos de procedimiento, físicos y socioculturales fueron factores muy importantes en el proceso posterior a la fusión y adquisición. Además, los impactos cualitativos de las actividades posteriores de fusiones y adquisiciones, como los informes contables, las valoraciones del mercado y las descripciones de los informantes clave, son enormes y vitales para mejorar el rendimiento del Banco y sus capacidades. El estudio recomendó que las políticas y estrategias instituidas por la administración, por ejemplo, la política crediticia, deberían ser re-visitadas para mejorar las operaciones internas y externas, el soporte del marco logístico debería mejorarse; se debe implementar un enfoque más integral de la combinación de comunicaciones de marketing integradas en la promoción de los productos existentes y agregados del Banco para obtener una mayor participación en el mercado. |

Banks play a crucial role in propelling the entire economy of any nation, of which there is need to reorder them to efficiently perform through reform processes geared towards forestalling bank distress. In India, the reform process of the banking sector or industry is part and parcel of the government strategic agenda aimed at repositioning and integrating the Indian banking sector into the global financial system. To make the Indian banking sector sound, the sector has undergone remarkable changes over the years in terms of the number of institutions, structure of ownership, as well as depth and breadth of operations.

Bank in general terminology is referred to as a financial institute or a corporation which is authorized by the state or central government to deal with money by accepting deposits, giving out loan and investing in securities. The main role of banks is the growth of economy by providing funds for investment. In recent times banking sector has been undergoing a lot of changes in terms of regulations and effects of globalization. These Changes have affected this sector both structurally and strategically. With the changing Environment, many different strategies have been adopted by this sector in order to remain efficient and to surge ahead in the global arena. One such profitable strategy is the process of consolidation of the banks. There are several ways to consolidate the banking industry; the most common adopted by banks is merger. Merger of two weaker banks or merger of one healthy bank with one weak bank can be treated as the faster and less costly way to improve profitability then spurring internal growth. The main motive behind the merger and acquisition in the banking industry is to achieve economies of scale and scope. Mergers also help in the diversification of the products, which help to reduce risk.

Over the last few decades, due to the intensification of competition, of the new financial possibilities and the changes in the regulating process in all the countries, M&A both the International and the National ones, have become strategic instruments favouring the increase of the product portfolios, the penetration of new markets and the purchase of new technologies. The decision to apply M&A operation often represent one of the most important actions subordinated to the strategy of an enterprise, having immediate financial implications yet, important consequences on long term development and survival. Recently, banks have sought expansion through waves of M&A along the years, starting with the United States (US) and Europe and then spreading to other countries around the world. Most studies of bank M&A have focused on the US as it was the first country to witness bank M&A in the late 19th century. Some studies have analysed bank M&A in Europe especially after the consolidation of the European economies and the unification of their currency.

The Indian banking sector can be divided into two eras, the pre liberalization era and the post liberalization era. In the pre liberalization era, Government of India nationalized 14 banks as 19 July 1965 and later on 6 more commercial banks were nationalized as 15 April 1980. In the year 1993 government merged the New Banks of India and Punjab National banks and this was the only merged between nationalized banks after that the number of Nationalized Banks reduces from 20 to 19. In the post liberalization regime, government had initiated the policy of liberalization and licenses were issued to the private banks which lead to the growth of Indian banking sector. The Indian banking industry has shown a sign of improvement in performance and efficiency after the global crises in 2008-2009. The Indian banking industry having far better position now than it was at the time of the crises. Government has taken various initiatives to strengthen the financial system. The economic recovery gained strength on the bank of variety of monetary policy initiatives taken by the RBI.

The Government of India has adopted the route of mergers among others with a view to restructure the banking system. Many small and weak banks have been merged with other banks mainly have to protect the interests of depositors. These may be classified as forced mergers. When a specific bank shows serious symptoms of sickness such as huge NPAs, erosion in net worth or substantial decline in capital adequacy ratio, RBI imposes moratorium under section 45(1) of Banking Regulation Act 1949 for a specific period on the activities of sick bank. In the moratorium period RBI identifies strong banks and asks that bank to prepare a scheme of merger. In the merger scheme, normally the acquiring takes up all assets and liabilities of the weak bank and ensures payment to all depositors in case they wish to withdraw their claims.

Bank M&A activity results in overall benefits such as improved revenue efficiency related benefits, return on Asset (ROA) which is decomposed into Total Asset Turnover (efficiency) and profit margin (effectiveness), Return on Investment (ROI), cash flows, reserves, liquidity, etc. to shareholders when the post-merger or post-acquired firm is more valuable.

Growth is the norm in the present times of cut throat competition. A firm can achieve growth either internally by expanding its operations, establishing new units or externally through mergers and acquisitions (M&As), takeover, amalgamations, joint venture etc. With the level of competition getting intense day by day, Mergers and Acquisitions have emerged as the most preferred long term strategy of corporate restructuring and strengthening in the present globalized world. The main rationale behind the Mergers and Acquisitions is to create synergy that is one plus one is more than two. Banking sector plays a crucial role in the economic growth and development of a nation. Globalization, deregulation of economies coupled with technological development has changed the banking landscape dramatically. With the fast changing environment, the banking sector is resorting to the process of consolidation, corporate restructuring and strengthening to remain efficient and viable. For this, Mergers and Acquisitions have become the preferred strategy for growth in the size of banks which in turn play a significant role in entering the global financial market. Besides Mergers and Acquisitions are widely used for achieving higher market share, overall productivity and profitability, expanding branch networks, strengthen their capital base, cost rationalization, economies of scale and manpower efficiency. Mergers and Acquisitions in Indian banking sector have been initiated in response to the various economic reforms introduced by the government of India since 1991, in its move towards liberalization, privatization and globalization. On the recommendation of Narshimam Committe I (1991), Narshimam committee II (1997) and Verma Committee (1999) policy makers cautiously introduced various reforms in the Indian Banking Sector. The main objective of these reforms was to improve the efficiency of the Indian banks and to promote a diversified and competitive financial system.

Merger

A particular activity is called a merger when corporations come together to combine and share their resources to achieve common objectives. In a merger, both firms combine to form a third entity and the owners of the combining firms remain as joint owners of the new entity.

Acquisition

An acquisition is an activity where a firm takes a controlling ownership interest in another firm, a legal subsidiary of another firm or selected assets of another firm. This may involve the purchase of another firm’s assets or stock. Acquiring all the assets rather than acquiring stocks or shares of the selling firm will avoid the potential problem of being the minority shareholder. However, the cost of transferring the assets is generally high.

Several studies have been carried out to examine the impact of M & A on different aspects of the banking sector. Further many studies have also highlighted the various motives behind such a strategic move.

Hearly et al. (1992)examined the post-merger cash flow performance for 50 largest US mergers and concluded that the operating performance of merging firms improved considered following acquisitions, in comparison with their industries, in the five years following mergers. The study observed that the development in post-merger cash flows was not attained at the expense of the merging firms’ long-term viability, since the sample firms maintained their capital expenditure and Research and Development (R&D) rates in relation to their industries. The study also suggested that the increase in industry-adjusted operating returns could be attributable to an increase in asset turnover rather than an increase in operating margins.

Berger and Humphrey (1994)reported that most studies that examined pre-merger and post-merger financial ratios found no impact on operating cost and profits ratios. The reasons for the mixed evidence are: the lag between completion of merger process and realization of benefits of mergers, selection of sample and the methods adopted in financing the mergers. Further, financial ratios may be misleading indicators of performance because they do not control for product mix or input prices. On the other hand they may also confuse scale and scope efficiency employed frontier X-efficiency gains. Recent studies have explicitly employed frontier X-efficiency methods to determine the X-efficiency benefits of banks mergers. Most of the US based studies concluded that there is considerable potential for cost efficiency benefits from bank mergers (since there exists substantial X-inefficiency in the industry), “but the data show that on an average, such benefits were not realized by the US mergers of the 1980”.

Huzifa Husain (2000)explained that takeovers (hostile or non-hostile) may be beneficial to the shareholders if they help unlock the hidden value of a company. Take overs also help the existing management to be more receptive to shareholders. Economically, takeovers make sense if the 'Private Market Value' of a company is higher than the market capitalization of the company. Further, if takeovers are used as a ploy to competition it becomes harmful for the economy. Therefore, proper checks and balances have to put in place to ensure that takeover facilitation is more to improve overall efficiency of the economy

Bhatnagar, R. G. (2001)study explored a heavy toll on the public sector banks plagued by NPA tainted balance sheets and burdened with the flab of endless bureaucratic interventions of the past. In the increasingly competitive industry, well managed, highly popular and innovative sectors banks are giving the PSBs a run for their money. The author offers a solution through merger and streamlined operations.

The history of M&As goes back more than 110 years and is divided in different periods or so-called waves (Sudarsanam, 2003). While most economic researchers speak about five major M&A waves in the history of the US and later the UK and Western Europe, others like Moeller and Brady (2007), as well as we do refer to a sixth wave which affected a big range of economies all over the world.

The First Three Merger and Acquisition Waves

The first M&A wave took place between 1890 and 1905 after a long stagnation of the economy. The mergers were mainly horizontal, what made the concerned industries extremely concentrated. Hence that wave is also considered as the time of merging for monopoly. The second wave came up in the 1920s after the First World War and a market collapse. The monopolies, which developed during the first wave, were forbidden and consequently more vertical than horizontal merger were accomplished, which confer the second wave the title of merging for oligopoly. The third wave of M&A started to evolve after the Second World War in the 1960s. The aim of mergers at that time was mainly growth and therefore the relation between the companies´ businesses did not really matter. For this reason the period of these conglomerate M&As is also generally known as merging for growth. In comparison with each other, all these three waves show similarities. All three of them emerged in a persistent period of economic prosperity and also mainly after tremendous changes in the economic infrastructure, such as the introduction of an electricity grid or a railroad system (Sudarsanam, 2003; Moeller and Brady, 2007).

The Fourth and Fifth Waves

The fourth wave occurred after a deep recession in the middle of the 1980s and was a bit different compared to the other three waves before. This wave started to concern also Europe and was supported by a trend of divestitures. At this time the word corporate raider was introduced in the business world. A lot of hostile takeover bids were made by companies, which were behaving like raiders, because they sold off different parts of a company after acquiring it. Also the average size and value of the acquired companies increased strongly among others due to leverage buyouts as a financial mechanism, which involved big debts. With a six times bigger added value than the wave before, the fifth wave was in terms of value and number of deals by far the biggest at this moment. This wave emerged in the 1990s and was strongly supported by the introduction of new technologies, such as cable television, satellite communication and Internet. Especially, technology-based industries gained fundamental growth at that time. Furthermore this period was shaped by a reorganization of major industries like the automobile and the food industry as well as the bank and finance sector, what led to significant deals for the M&A history, like Mannesmann-Vodafone or Daimler-Chrysler. Additionally, governmental regulations against deregulations in some markets contributed to the huge dimension of this wave (Sudarsanam, 2003; Moeller and Brady, 2007).

The Sixth Wave - A Global Wave

The sixth M&A wave occurred between 2002 until the financial crises hit the world economy in the end of 2007 (Moeller and Brady, 2007). In this period there was an apparent upward tendency for M&A within developed as well as emerging countries. In terms of value and volume of M&A deals, the sixth wave was the biggest one compared to the waves before. This can be explained through increasing globalisation, which has created much more dependence between countries all over the world as well as through a tremendous change of the type of acquisitions in the last 10 years. While in 1999 after the Asian financial crises, the western companies which were in better financial shape acquired well know Asian companies for dumping prices (ALB, 2009), emerging countries started to become an equal market player and began also to look for acquisitions in the developed countries in the last years. In the period between 2002 and

2007 the USA was the most active country in acquiring other enterprises, as well as the biggest target for acquisitions. Almost every fifth acquisition of firms in emerging countries was done by the US. On the other hand, the USA was the target in around 23% of acquisitions through companies from emerging countries. In the same period, India was the major acquirer in emerging countries, followed surprisingly by Malaysia. This can be explained through a big support of the government, such as tax incentives, in order to invest in high technology business deals and to strengthen the export. On the third place behind these two was China. Contrary to them, the Chinese government did not prepare the way for acquisitions done by private companies. Sometimes deals also had to challenge a lot of governmental obstacles. Nevertheless, the governments of emerging countries, also the Chinese government, had and still have a big interest in acquisitions in developed countries in order to get access to the developed market. On the other side, China was by far the biggest target for acquisitions through companies from developed countries. The second most companies were acquired in India between 2002 and 2007 (Moeller and Brady, 2007). Besides the increasing globalization and the influence of the fast growing economy of the emerging countries, the sixth M&A wave was characterized by new regulations, caused by the corporate governance scandal in the beginning of the millennium. In this period, strategic issues as merging for new market access, improved deals selection, better deal governance and post-merger integration on the M&A process were valid as the key for success (Moeller and Brady, 2007)

M & A IN BANKING INDUSTRY The banking industry is an important area in which mergers and acquisitions do make enormous financial gains. As a result of changes in the expectation of the corporate customer, banks are now constrained to rethink their business and devise new strategies. “The Indian banking sector is going through a process of restricting, mainly driven by pervasive trends such as deregulation, disintermediation, technological progress, innovation and severe competition.”3 To gain competitive cost advantage, consolidation of operation in the form of M&A is one of the effective strategies widely adopted by the bankers. Mergers in banks are considered for the purpose of:

1. Expansion/diversification

2. Upgradation of technology

3. Loss making bank merged with another healthy bank for revival

4. Healthy bank merged with another healthy bank to become financially stronger, to meet competitive pressures

5. Growth in profits

6. Increase market share, etc.

Banks allocate resources and control internal processes by effectively managing their employees, facilities, expenses, and sources and uses of funds while working to maximize earning assets and total income. M&A are not new to the Indian banking sector. Between 1961- 2004, 71 mergers took place among various banks in India. M&A deals undertaken in banking sector during pre and post financial sector Reform period are given in the table 1.

Table 1

Schedule of M & A deals of Indian Banks- Post Reform Period

1. |

New Bank of India |

Punjab National Bank |

04-09-1993 |

2. |

Bank of Karad Ltd. |

Bank of India |

1993-1994 |

3. |

Kashinath Seth Bank |

State Bank of India |

1995-1996 |

4. |

Punjab Co-op. Bank Ltd. |

Oriental Bank o fCommerce |

1996-1997 |

5. |

Bari Doab Bank Ltd. |

Oriental Bank of Commerce |

1996-1997 |

6. |

Bareilly Corp. Bank Ltd. |

Bank of Baroda |

03-06-1999 |

7. |

Sikkim Bank Ltd. |

Union Bank of India |

22-12-1999 |

8. |

Times Bank Ltd. |

HDFC Bank Ltd. |

26-02-2000 |

9. |

Bank of Madura |

ICICI Bank |

Mar. 2001 |

10. |

Benaras State Bank Ltd. |

Bank of Baroda |

20-07-2002 |

11. |

Nedungadi Bank Ltd. |

Punjab National Bank |

01-02-2003 |

12. |

Global Trust Bank Ltd. |

Oriental Bank Commerce |

24-07-2004 |

13. |

Centurian Bank |

Bank of Punjab Ltd. |

01.04.2005 |

14. |

United Western Bank Ltd. |

IDBI ltd. |

02.04.2005 |

15. |

The Ganesh Bank of Kurd. Ltd. |

The Federal Bank Ltd. |

02.09.2006. |

16. |

Bharat Overseas |

Indian overseas Bank |

31.3.2007 |

17. |

The Sangli Bank Ltd |

ICICI Bank |

19.4.2007 |

18. |

Lord Krishna Bank Ltd. |

Cent. Bank of Punjab Ltd. |

29.8.2007 |

19. |

Centurion Bank of Punjab |

HDFC Bank |

Feb 2008* |

20. |

Bank of Rajasthan |

ICICI Bank |

Aug 2010* |

Source: Lakshminarayanan, P., (2005), Consolidation in the Banking Industry through

Mergers and Acquisitions, Special Issue, Indian Banks Association Bulletin, Indian Banks

Association, (January), pp. 92-99.

Manoj kumuar “Efficiency Gains from Mergers and Acquisitions of Indian Banks: A Data Envelopment Analysis Approach * Ashvin Parekh, (3 December 2010) “Industry structure: M&A in Indian Banking” ERNST & YOUNG Quality In Everything We Do

Mergers and acquisitions are very older strategies. The reasons may be different from time to time and may vary from company to company. The tasks of combinations have become more convenient after the new economic policy (liberalization policy in 1991). There have been a greater need of studies in the area of mergers and acquisitions, but most of them focused on manufacturing sector. Further very few studies have focused to analyze the M&A activity in the service sector industry. Hence, there is a need for a study of the present nature.

The significance of this study cannot be overemphasized. It could be used as reference for further research into the trend in the banking industry.

The objective of the paper is to evaluate the effects of merger and acquisitions on the financial performance of the selected banks in India. Post-merger study is conducted on selected variables to analyse the effectiveness of mergers and acquisitions on the banks.

To identify the reaction of security prices to announcement of Mergers/acquisitions decision during the study period.

This study is based on Secondary data and used for the purpose of study. The financial and accounting data has been collected from the bank’s published annual reports to examine the impact of mergers and acquisitions on the performance of banks selected as sample. Also the data has been collected from the websites of Bombay Stock Exchange, National Stock Exchange and moneycontrol.com for the purpose of study. In addition, the other required data were collected from various journals and magazines.

This method involves the study of financial statements and ratios to compare the post-merger financial performance of the acquiring company. It is also used to study whether the acquirers out-perform the non-acquirers (Gaughan, 2007). Various ratios like return on equity or assets, liquidity and so on are studied.

Post-merger operating performance ratios of selected study units were computed and analyzed. These data were analyzed for trends and patterns in terms of performance ratios for a definite period of time frame. Analysis on the various ratios for post merger period of six years time intervals were using parametric t-test.

Uniform financial institutions rating system popularly called as CAMELS as advocated by Basel I & II norms has been also been used to measure the post merger performance of selected banks during the period of 2010-11 to 2015-16.

Banking sector play a very important role in every economy and is one of the fastest growing sectors in India. The competition is intense and irrespective of the challenge from the the multinational players, domestic banks - both public and private are also seen rigorous in their pursuit of gaining competitive edge by acquiring or merging with potential opportunities as present today. Indian commercial banks are witnessing sweeping changes in the regulatory frame work and environment, huge growth in off-balance sheet risk management financial instruments, the introduction of e-commerce and online banking, and significant financial industry exploration. Due to all of these forces have made the Indian banking industry highly competitive.

The researcher has used accounting ratios viz., liquidity ratios, activity ratio and profitability ratios to analyze the financial position of the banks during post acquisition periods.

The current ratio is the most commonly used ratio for measuring liquidity position of the banks. It expresses the relationship between current assets and current liabilities. A higher current ratio shows that the bank is able to pay its short term obligation maturing within a year. From the management point of view, a higher current ratio is an indication of poor planning since an extensive amount of funds would lie idle.

CR= Current Assets, Loans & Advances ÷ Current Liabilities & Provisions

and the consumers were asked to review either the print ads or the social media feeds for five minutes and then hand them back. During the last ten minutes of interaction the consumers were then administered a short survey to compare the credibility of the celebrity-endorsed ads between print and social media and their memorability of the celebrity.

In order to measure each of the variables presented in the research questions through 11 were belief statements where respondents were asked to judge the strength of their beliefs using an agreement scale. The 11 belief statements were presented to measure the differences in brand name credibility between print and social media. Not all of the belief statements pertained specifically to credibility, but to other categories that consumers would use in their judgments of credibility, such as the belief that celebrities are trustworthy spokespeople and if they were likely to purchase a brand endorsed by a celebrity. These questions are to judge how they belief the credibility of the brands & how they recall the celebrity associated with it.

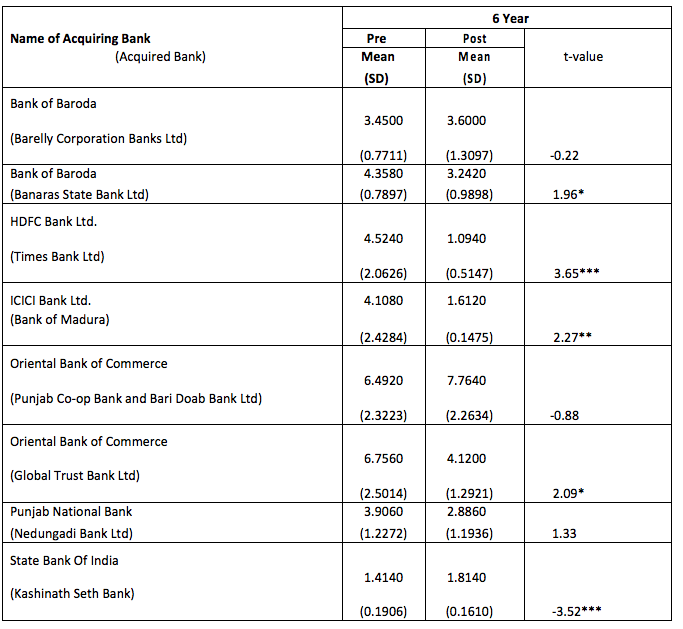

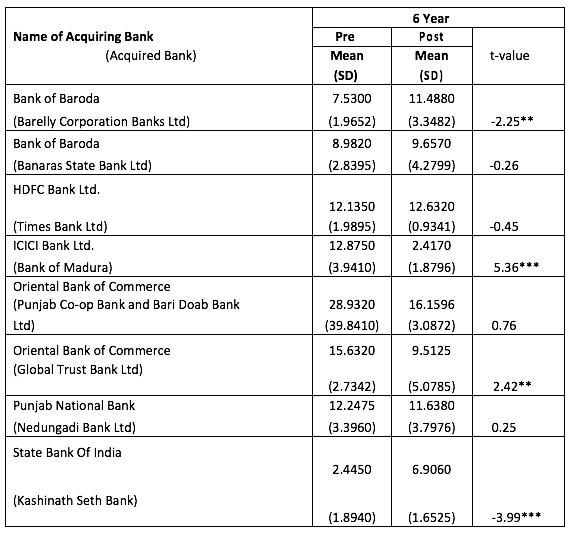

Source: Computed on the basis of CMIE Data Source.

Figures in parentheses are standard deviation ***Significant at 1% level; **Significant at 5% level; *Significant at 10% level

Analysis of 6-year mean CR for pre and post event period shows a huge decline in CR against acquisition deal of BOB with Banaras State Bank (t = 1.96, p < 0.10), HDFC Bank with Times Bank (t = 3.65, p < 0.01), ICICI Bank with Bank of Madura (t = 2.27, p < 0.05), OBC with Global Trust Bank (t = 2.07, p < 0.10) and State Bank of India with Kashinath Seth Bank (t = -3.52, p < 0.01).

However, there is no notable significance decline during the study period of 6 years. CR between pre and post-acquisition period in the case of OBC’s takeover of Punjab Co-op Bank and Bari Doab Bank Ltd but the scenario is just reverse in

the case of OBC’s takeover of Global Trust Bank. In the case of takeover activity

of SBI, there have been significant improvements in CR during 6 years after acquisition deal. With regard to acquisition activities of BOB (Bareilly Corporation Bank), OBC (Nedungadi Bank Ltd) and PNB, the 6 year mean CR about to sane between pre and post period, indicating very less improvement in the period of 6 years after acquisition activities.

Activity ratios are financial ratios that measure how efficiently and effectively a firm is using its current and fixed assets to convert into cash, Firms will typically try to turn their resources into cash as fast as possible because this will yield to generate high revenues. The ratios such as working capital turnover, asset turnover, etc are generally used to evaluate the activity of a firm. The activities of the public and private sector banks before and after their acquisition activities are evaluated using working capital turnover ratio, asset turnover ratio and fixed asset turnover ratios.

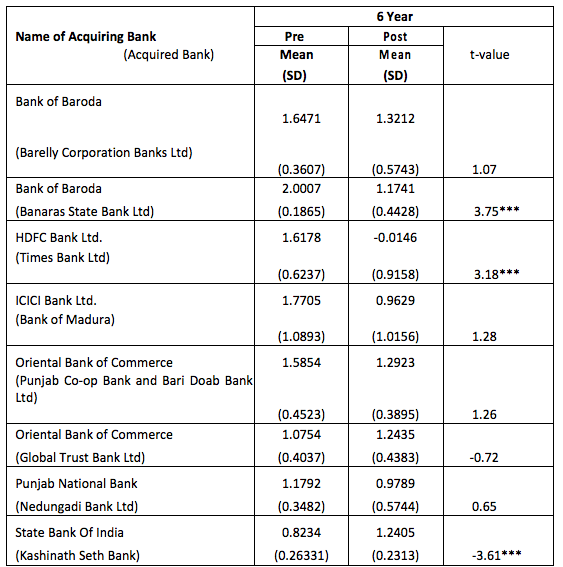

Source: Computed on the basis of CMIE Data Source

Figures in parentheses are standard deviation ***Significant at 1% level; **Significant at 5% level; *Significant at 10% level.

As per table, activities of acquiring banks in Working capital into income

of 6-year before and after acquisition event, WCTR is less for OBC (Global Trust Bank), and SBI and it is higher for the remaining banks. The working capital turnover ratio even becomes negative for HDFC during 6-year post-acquisition period, in turn indicating that the banks have been in possession of required current assets to its current liabilities. The decline in WCTR during 6-year post-period is significant at 1 per cent level of BOB (t-value = 3.75, p < 0.01) and HDFC (t-value = 3.18, p < 0.01). Similarly, increase in WCTR from 6-year pre period to post-period is significant at 1 per cent level for SBI (t-value = -3.61, p < 0.01)

The asset turnover ratio (Total asset turnover ratio) simply compares the turnover with the assets that the business has used to generate that turnover. In its simplest terms, we are just saying that for every rupee of assets, the turnover is ‘Y’ rupees.

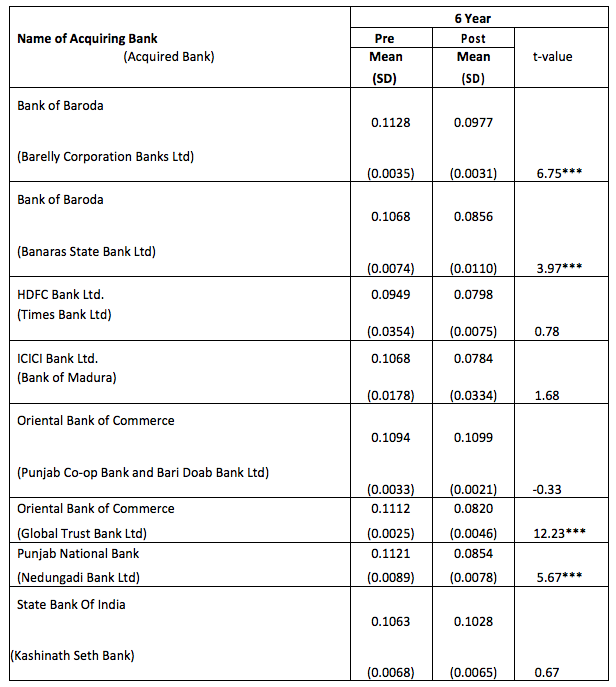

Table is presented with the results of t-test comparing 5-year.

Asset turnover ratio (ATR) between pre and post period for public and private sector banks’ acquisition activities. From the comparison of ATR between pre and post event period of 6 year, as per the from the table , it is understood that the decline in 5-year ATR during post-period is significant for Bank of Baroda acquiring Bareilly Corporation Banks (t-value = 6.75, p < 0.01) and Banaras State Bank (t-value = 3.97, p < 0.01), OBC acquiring Global Trust Bank (t-value = 12.23, p < 0.01) and PNB acquiring Nedungadi Bank (t-value = 5.67, p < 0.01),

Source: Computed on the basis of CMIE Data Source

Figures in parentheses are standard deviation ***Significant at 1% level; **Significant at 5% level; *Significant at 10% level

The foremost objective of any firms is to earn profits. Requirement of profits in banking sector not only for its existence but also for expansion and diversification in other financial areas also. Investors want adequate returns on their investments while employees want higher remunerations and the creditors want higher security for their interest and loan. So, the profitability ratios is used to test the efficiency of the management, as the measure of worth of their investment to the creditors, the margin of safety to employees as a source of benefits, to Government a measure of taxpaying capacity, etc. Here, the profitability ratios are used to ascertain whether there have been any remarkable change in profit making ability of the banks or not due to their merger and acquisition activities. The status of various profitability ratios in 6 year pre and post event period are compared for this purpose.

The Net Profit Margin (NPM) or simply called Profit Margin is mostly used for internal comparison. It is difficult to accurately compare the net profit ratio for different entities. Individual businesses' operating and financing arrangements vary so much that different entities are bound to have different levels of expenditure, so that comparison of one with another can have little meaning. A low profit margin indicates a low margin of safety: higher risk that a decline in sales (income in the case of non-manufacturing companies) will erase profits and result in a net loss. Profit margin is an indicator of a company's various policies & its ability to control costs.

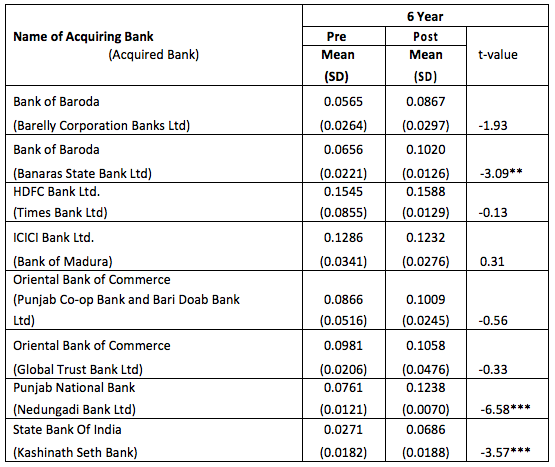

Source: Computed on the basis of CMIE Data Source

Figures in parentheses are standard deviation ***Significant at 1% level; **Significant at 5% level; *Significant at 10% level

From the observation of Table reveals that the level of significance for the difference in 6-year NPM has increased in the case of BOB (Banaras) and SBI and decreased for PNB. On an average, the NPM for 6 year 6.56 per cent, 7.61 per cent and 2.71 per cent in pre-event period has significantly increased to 10.20 per cent, 12.38 per cent and 6.86 per cent for BOB (Banaras) (t-value = -3.09, p < 0.05), PNB (t-value = -6.58, p < 0.01) and SBI (t-value = -3.57, p < 0.01) respectively.

For other banks, except BOB with Barelly Corporation, the difference in 6 year NPM between event periods is almost zero. In respect of BOB acquiring Barelly Corporation, NPM, on an average for 6 year, 5.65 per cent in pre period has increased to 8.67 per cent in post-period. The t-value of -1.93, though insignificant, is not trivial. So, it can be concluded that for longer time period also, the acquisition activity of BOB, PNB and SBI has impact on their left-over earnings.

Return on Capital Employed is used to indicate the efficiency and profitability of a company's capital investments. The Return on Capital Employed ratio (ROCE) tells us how much profit we earn from the investments the shareholders have made in their company. The ROCE is used in finance as a measure of the returns that a company is realizing from its capital employed. More commonly it is used for assessing whether a business generates enough returns to pay for its cost of capital or not. The status of ROCE for 5 year before and after acquisition activities of the public and private sector banks are shown in Table. From the comparison of 6 year ROCE in pre and post event period, the results of which are portrayed in Table----, it becomes evident that the acquisition activities of BOB with Barelly Corporation Banks and SBI with Kashinath Seth Bank has increased the ROCE by 3.958 per cent (11.4880 in post – 7.5300 in pre period) and 4.461 per cent (6.9060 – 2.4450) respectively. The above positive change in 5 year ROCE is significant at 5 per cent level for BOB (t value = -2.25, p < 0.05) and 1 per cent level for SBI (t value = -3.99, p < 0.01).

![]()

![]()

![]()

Source: Computed on the basis of CMIE Data Source

Figures in parentheses are standard deviation ***Significant at 1% level; **Significant at 5% level; *Significant at 10% level

With regard to acquisition activities of BOB (Barelly Corporation Bank), OBC (Nedungadi Bank Ltd) and PNB, the 6 year mean CR remains almost same between pre and post period, indicating no improvement in the period of 5 year after acquisition activities. It is found that the acquiring Banaras State Bank tend to reduce the efficiency of the Bank of Baroda in respect to using working capital properly for generating income whereas the SBI’s acquiring process increased its efficiency in term of turning working capital into earnings. The decline in WCTR during 6-year post-period is significant at 1 per cent level of significance BOB and HDFC Similarly, increase in WCTR from 6-year pre period to post-period is significant at 1 per cent level for SBI

However, 6-year ATR for HDFC bank experienced decline and an increase for OBC. For Punjab Co-operative Bank and Bari Doab Bank Ltd is not significant statistically. Hence, it is concluded that the efficiency in ATR for longer period is not as same as that of shorter period against banks’ acquisition event In respect of BOB acquiring Barelly Corporation, NPM, on an average for 6 year, has increased in post-period. The t-value though insignificant, is not trivial. So, it can be concluded that for longer time period also, the acquisition activity of BOB, PNB and SBI has impact on their left-over earnings. At the same time, the acquisition activities of BOB with Banaras State Bank, HDFC with Times Bank, OBC with Punjab Co-operative Bank / Bari Doab Bank and PNB with Nedungadi Bank do not have any impact on ROCE.

With regard to reactions to the announcement of merger, the market has initially tried to react negatively to the most of the banks’ acquisition announcement but overall there was either destruction or creation in shareholder wealth of investors of public and private sector banks. The merger announcements in the banking sector typically result in no (or slightly positive) cumulative abnormal returns on the stocks of acquiring banks and significantly positive abnormal returns on target bank stocks. But the results should be taken with caution. Although stock prices reveal the market's expectation of future cash flows, actual performance may differ from market expectations. This observation is especially true for bank mergers.

Results also suggest that the surviving employees of the merged banks positively perceive merger activity taken up by their employer. Though the employees were nervous initially about the information of merger, communication from the management helped them to cope with the change. In fact, the employees were very happy with the sufficiency of information and communication from their supervisors. By involving them in the process of change, the employees felt confidence in their employer and started appreciating the objectives of the merger strategy.

Amit Singh Sisodiya (edited) (2005) “Mergers and Acquisitions Strategies and

Insights” The Icfai University Press, Hyderabad.

Chandrashekar Krishnamurti, vishwanathan S.R (2008) “Merger, Acquisitions and corporate Restructuring” Response Books, Business Books from SAGE New Delhi.

Dr. J.C. Verma(1993) “Corporate Mergers and Acquisitions ( Concept, Practice and

Procedure) D.C. Purliani for Bharat Publishing House, New Delhi.

Dr. V.S.Kaveri (1998) “Financial Analysis of company mergers in India” Himalaya Publishing house, Bombay.

Gurminder Kaur (2006), “Corporate Mergers and acquisitions” Deep and Deep Publication Pvt. Ltd. New Delhi.

J. Fred Western, Kwang S. Chang, Susane E. Hoag (2009) “Mergers Restructuring and corporate control” PHI Learning Pvt., Ltd., New Delhi.

Joseph.C. Krallinger (1997) “Mergers and Acquisitions Managing the transaction” Mc Graw-Hill Companies New York.

Kamal Ghosh Ray (2010) “Mergers and Acquisitions, Strategy, Valuation and Integration” PHI Learning Pvt. Ltd., New Delhi.

Michael A. Hitt, Seffrey S. Harison, R. Duane Ireland (2001) “Mergers and Acquisitions” Oxford University Press-New York.

Rachna Jawa (2009) “Mergers, Acquisitions and corporate Restructuring in India” New century Publication New Delhi, India

Ravindhar Vadapalli (2007) “Mergers, acquisitions and Business valuation” Excel Books New Delhi.

S Shiva Ramu (1998) “Corporate growth valuation and Integration” Response Books, Sage Publication, New Delhi.

S. Ramanujiam (2000) “Mergers et al, Issues Implications and Case laws in corporate restructuring”, Tata McGraw-Hill Publishing company ltd. New Delhi.

Shiva Ramu (1999) “Restructuring and Break ups” Response Books Sage Publication, New Delhi

Berger, AN and Humphrey (1994) Bank scale economics, mergers, Concentration, and efficiency: The U.S. experience, center for financial institutions working papers 94-25, Wharton School center for financial Institutions, Univeristy of Pennsylvania.

Bhatnagar. R.G. (2001), “In Merger Lies the Salvation‟, treasury Management, II.4. 59-61.

Hearly P M, Palepu K G and Ruback R S (1992) “Does Corporate Performance Improve After Merger?” Journal of Financial Economics, Vol.31,pp. 135-175.

Huzaifa Husain, (Dec 2000), “M & A : Unlocking Value”, Chartered Financial Analyst, Vol. VI.No. IV. 65-66.

1. Director TOSS Global Management, India. Email: sonia23singh@gmail.com

2. *Corresponding author. Research Associate in Faculty of Management Studies, IBCS. SoA (Siksha ‘O’ Anusandhan University), Bhubaneswar, India. Email: info.subhankardas@gmail.com