Vol. 38 (Nº 14) Año 2017. Pág. 2

Breno Geovane Azevedo CAETANO 1; Rubicleis Gomes da SILVA 2

Recibido: 01/10/16 • Aprobado: 21/10/2016

ABSTRACT: Studies on the dependence on intergovernmental transfers help us not only understand the socio-economic development of entities involved in these relations, but also design more efficient public policies. The aim of this study is to diagnose the dependence that Estado do Acre municipalities have in relation to transfer payments from Estado do Acre and the federal government in 2010 and 2013; particularly the possible existence of a relation that binds the spatial distribution of dependence on federal and state transfer payments to the degree of employment formalization of these municipalities, by performing a spatial analysis. The results obtained showed that the Acre Valley mesoregion is less dependent on intergovernmental transfers than the Juruá Valley, while the Rio Branco microregion proved to be the least dependent. It has been demonstrated that as the degree of employment formalization increases in the given municipality, dependence is then reduced, as the economy grows and their resources increase. |

RESUMEN: Los estudios sobre la dependencia de las transferencias intergubernamental nos ayudan a entender el desarrollo socioeconómico de las entidades involucrados en esta relación y nos ayuda a la formular proyectos de políticas públicas más eficientes. El objetivo general del presente trabajo es diagnosticar la dependencia que presentan los municipios del Estado de Acre con relación a las transferencias proveniente del gobierno departamental y gobierno nacional entre los años 2010 al 2013. Al realizar un análisis espacial se han identificado la existencia de posibles agrupamiento entre la dependencia de las transferencias nacionales y departamentales y el desarrollo socioeconómico de estos municipios. Los resultados alcanzados muestran que la meso-región Vale del Acre es menos dependiente de las transferencias intergubernamentales que el Vale del Juruá, con relación a la micro-región de Rio Branco se evidencio menos dependencia con relación a los otras regiones. Se demostró también, que a medida que el grado de formalización del trabajo aumenta dentro de los municipios la dependencia se reduce, pues la economía crece y las recaudaciones propias aumentan. |

Historically, Estado do Acre was raised to the category of state in 1962, through the Federal Law n. 4,070, of June 15, 1962; it is located in the Western Amazon, occupying an area of approximately 164,123 km2, corresponding to 4.26% of the North region and 1.92% of the Brazilian territory. Currently, its political and administrative structure consists of 22 municipalities: Acrelândia, Assis Brasil, Brasiléia, Bujari, Capixaba, Cruzeiro do Sul, Epitaciolândia, Feijó, Jordão, Mâncio Lima, Manoel Urbano, Marechal Thaumaturgo, Plácido de Castro, Porto Acre, Porto Walter, Rio Branco, Rodrigues Alves, Santa Rosa do Purus, Sena Madureira, Senador Guiomard, Tarauacá and Xapuri.

Due to its location in the Brazilian Amazon, Estado do Acre is constantly mentioned during discussions of national development and environment. However, governments have left the regional development quite neglected.

To achieve regional development, states and municipalities require public revenues; resources provided by legislation and collected by the government to be expended in projects that meet the demands of society.

In this context, the resources of Estado do Acre municipalities have lower tax revenues in relation to Estado do Acre and the Union (União). Henceforth, dependence of municipalities is created, since they require the federal and state funds to reach development. The Estado do Acre municipalities have serious development problems, evidenced by the high dependence.

Socioeconomic indicators such as Gini Index, Williamson index of regional inequality, GDP per capita, infant mortality rate, Human Development Index (HDI), and Life expectancy at birth and average years of schooling (20 to 24), are statistics that portray the socioeconomic status of these municipalities and allow to know their level of socio-economic development.

In 2010, according to the Brazilian Institute of Geography and Statistics (IBGE) , Estado do Acre had an average human development index of 0.663, presenting the municipality of Rio Branco the highest IDHM of 0.727, while Jordão had the lowest result of 0.469. Bujari was the city that had the highest GDP per capita (R$ 19,295.00) and Santa Rosa do Purus the lowest (R$ 7,427.00). In terms of income inequality, according to the Gini index, Santa Rosa do Purus had the highest inequality (0.7758) and the municipality of Acrelândia the lowest inequality (0.5464).

On the other hand, municipal fiscal indicators, cash flow indicators (income and expenditure) and stocks (debt and credit), are measures for finance evolution that allow the evaluation of fiscal performance of a municipality over time.

In 2010, according to the National Treasury, Rio Branco had a revenue of R$ 376,501,721.49 and expense of R$ 358,717,715.85, and Santa Rosa do Purus had a revenue of R$ 13,146,629.08 and expense of R$ 12,800,000.59.

That same year, the world was still under the economic crisis that had began in 2008, however, Brazil managed to grow 7.5% in 2010 and only 2.3% in 2013, diminishing their growth due to the interest rate, debt, and investment failure that affected the intergovernmental transfers for Brazilian municipalities. Given this uncertain framework, the following question arises: Dependence on federal and state transfer payments affects the human development of the municipalities of Estado do Acre?

From this perspective, the objective of the research is to diagnose the dependence that municipalities of Estado do Acre present in relation to transfer payments from Estado do Acre and the federal government.

Afterwards, the possible existence of spatial distribution, between the dependence on federal and state transfer payments and the degree of employment formalization, of these municipalities is verified by performing a spatial analysis.

The hypothesis admitted to guide this study claims that dependence on intergovernmental transfers does not affect the socio-economic development in the municipalities of this state.

Several authors have addressed issues related to the dependence of municipalities, especially: Santos and Santos (2014), who studied the dependence on transfer payments of municipalities in the south of Bahia between 2008 and 2012; Brito and Penha (2012), who investigated the dependence on transfer payments to invest on education, health, and infrastructure in the municipalities of Rio Grande do Norte, comparing the years 2003 and 2007; Scur and Neto (2011), who diagnosed dependence on federal and state transfer payments of the city of Canela/RS; and Mendes et al. (2008), who analyzed intergovernmental transfers in Brazil, proposing a reform.

The study is considered as innovative since it performs the analysis of the dependence on intergovernmental transfers in regions pondered economically among the poorest in the country.

The present study is structured into four sections. The first, as seen, contains the introduction. The second presents the methodology used in the study, as well as the analysis of the variables to be used and the data source. The third section presents the results and the data is discussed. Finally, the fourth section contains the concluding considerations of this study.

Beyond the scope of this study, there is an extensive discussion on various issues involving development, since the concept of development does not have a clear definition among the various schools of economic thought. The various dimensions examined by scholars who studied a reality from different perspectives mainly give this lack of definition.

It is interesting to highlight that development often is treated as economic growth. By the early 1960s, the nations considered as developed countries were those who had accumulated large sums of capital through industrialization; and, those countries that did not reached an industrialization progress were considered underdeveloped. However, it was observed that, since 1950, the countries that conquered the industrial evolution did not show an increase in the access of material and cultural goods, for example, health and education, for poor population.

A controversy was perceived, and a worldwide debate began about development. Veiga (2005) stated that growth is an important factor for development, but growth is quantitative and development is qualitative.

According to Sen (2000), an adequate conception of development must go beyond the accumulation of wealth and the growth of gross national product and other variables related to income. Without ignoring the importance of economic growth, it is necessary to see beyond it. For a clearer understanding of the notion of development, it is inappropriate to position the maximization of income or wealth, as the single main objective of development. For the same reason, economic growth cannot seriously be considered an end in itself. Development must be related mainly to the improvement of the people’s living conditions and the freedoms they enjoy.

According to Sen and Mahbud (2000), development occurs only where the benefits of growth serve to expand human capabilities that, according to them, are four: having a long and healthy life, being educated, having access to the necessary resources and to a decent living standard, and being able to participate in community life.

From the contributions of several authors, Furtado (2000), in his work, proposes some basic concepts. Development would then consist in transformation, the introduction of new production methods, increasing the flow of goods and services available to the community, in addition to efficiency and wealth. The production is the formalized expression of stable relations between means of production and the result of production. The surplus is linked to social stratification, as this allows the emergency resources to have alternative uses, paving the way for wealth accumulation. The surplus is used for the reproduction of social stratification, the development of productive power, and the legitimation of social domination systems.

In this sense, Veiga (2005) affirms that Celso Furtado synthesizes the best the idea of development, describing that economic growth is based on the preservation of the privileges of the elite, but when resources are invested in a social project that prioritizes the improvement of the population’s life, that is when growth becomes development.

To analyze such complex development phenomena, it is essential to have a broad picture of quality of life indicators and human development, which translates into personal satisfaction or fulfillment of individuals from a country, being evident over time the existence of a positive variation of growth (MENDES, 2012).

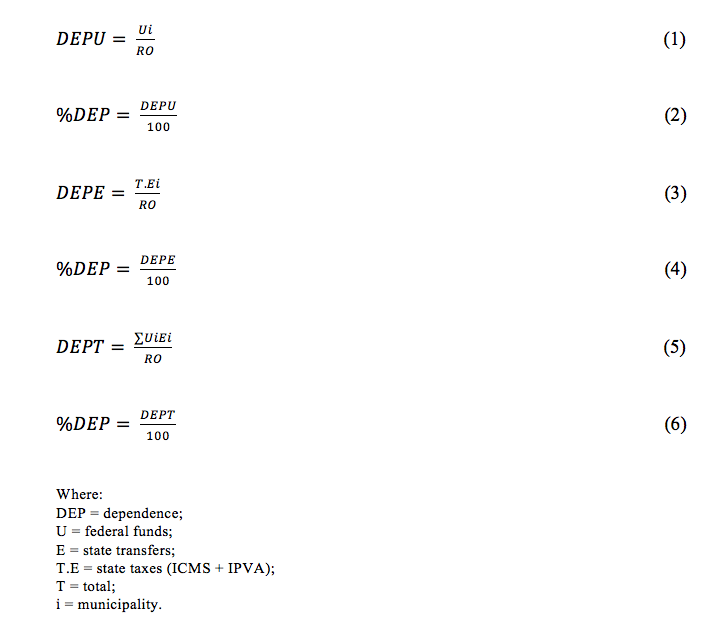

To analyze the level of dependence of Estado do Acre municipalities in relation to federal and state transfer payments, the following relation was evaluated, between the Revenue Budgets (RB) - current revenues (tax, contribution, property, industrial, agricultural, services, current transfers and other diverse income) and capital income (credit operations, such as loans and financing, disposal of assets, the sale of assets and rights) - in each municipality, and the transfer established in the Federal Constitution for the Federal Government (Participation of the Municipalities Fund - FPM , the Fund for the Development of Basic Education and Valuing of Education Professionals - FUNDEB , tax on rural property - ITR , royalties, CIDE-Combustíveis [fuels] and Financial Support to Municipalities - AFM ) and for the State Government (tax on operations related to the circulation of goods and the rendering of interstate and inter-municipal transportation and communication services, although operations begin abroad - ICMS - and tax on ownership of motor vehicles - IPVA ), as signaled in the formulas below:

According to Almeida (2012), exploratory spatial data analysis is a collection of techniques to describe and visualize spatial distributions, identify atypical locations (spatial outliers), discover patterns of spatial association (spatial cluster) and suggest different spatial regimes and other forms of spatial instability, with the primary goal of allowing the spatial data speak for itself.

The Univariate Moran’s I is a multivariate analysis used to calculate the global autocorrelation, as for obtaining local spatial autocorrelation statistical measures Moran’s I is used, known as Local Indicator of Spatial Association (LISA) univariate and multivariate represented by map clusters.

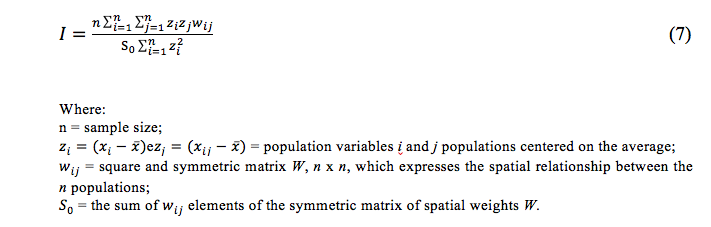

The Moran's I statistic is used to calculate the global spatial autocorrelation (BAILEY, GATRELL, 1995), which allows you to analyze the data randomly distributed in space, expressed by the following equation (7).

The Moran's I statistic has an expected value of - [1/(n-1)], meaning it shows the value that would be obtained if there were no spatial pattern data. Thus, the I values that exceed -[1/(n-1)] indicate positive autocorrelation, while the values bellow the I expected values indicates negative autocorrelation. Contrasting a correlation coefficient, this statistic is not centered on zero. While the number of regions or cities increases, the expected value of the Moran’s I statistic approaches to zero. Therefore, the Moran’s I statistic ranges between ± 1 (ANSELIN, 2005).

Using the example of social development, indicating positive spatial autocorrelation shows that there is a similarity between the municipalities. In other words, municipalities with high social development tend to be surrounded by neighboring municipalities that have a high social development and municipalities with low social development surround municipalities with low social development. On the contrary, the negative spatial autocorrelation has dissimilarity between the values of the studied attribute and spatial location of this attribute. Taking the same example, municipalities with low social development are surrounded by municipalities with high social development or municipalities with high social development surrounded by neighbors that have low values of this variable of interest.

The Moran Scatter Plot is a linear regression representation by Ordinary Least Squares – OLS (Almeida et al, 2005) by means of a graph in two variables x and Wx, where the coefficient of the regression curve gradient is given by Moran’s I statistic. The gradient of the curve provides the degree of adjustment, which is obtained by regression of Wx against x. This postulates the nature of spatial autocorrelation into four types corresponding to spatial clusters and spatial outliers.

The bivariate or multivariate global spatial autocorrelation examines the existence, through the Moran's I statistic, of a spatial association pattern between two variables. The main idea is, according to Almeida (2012), reveal whether values of a given variable in a region are related to another variable values in neighboring regions, expressed by the following equation (8).

The interpretation of the multivariate Moran’s I follows the same analysis pattern of the univariate Moran's I statistic, in positive case of the Iyx value of multivariate Moran, municipalities with high values (y) are surrounded by neighboring municipalities presenting high level (x). On the contrary, municipalities with low values (y) are neighbors of others with low level (x) (FERRARIO et. al.,2009).

The multivariate Moran scattergram differs from the univariate Moran scattergram regarding the vertical axis, as once the axis of ordinates is represented by Wx, which is the variable x lagged to neighbors, confronted with the variable y on the horizontal axis (ALMEIDA, 2012).

The Moran's I is a global measure, therefore it does not reveal local association standards, in other words, it can hide clusters and outliers due to a strong global autocorrelation or the absence of autocorrelation. Thus, a variant of global Moran's I should be used, as presented in the literature by Anselin (1995), called the Local Indicator of Spatial Association (LISA). A LISA is any statistic that satisfies two criteria: (i) an indicator LISA must have for each observation, an indication of significant spatial clusters of similar values around the observation; and (ii) the sum of the LISA values of all the regions is proportional to the global spatial autocorrelation.

This statistic is expressed by equations (9) or (10) for each observation i.

Where: zi and zj are standardized variables and the sum of j is such that only the values of neighbors j![]() ji are included. The ji set covers the neighbors of i observation, and by definition wij= 0.

ji are included. The ji set covers the neighbors of i observation, and by definition wij= 0.

The expected statistical value Ii in the statistical randomness is given by –wi/(n-1) where wi is the sum of the line elements of the matrix w. The statistical variance of Ii is given by ![]() , where V is the variance of I under the assumption of randomness.

, where V is the variance of I under the assumption of randomness.

The Moran's I is the gradient of the attribute regression in a given municipality according to the same neighboring municipalities (ALMEIDA, 2012).

Multivariate local spatial autocorrelation (LISA M) is expressed by the following equation (11).

Where: xi and yj are studied variables whose sum of j is such that only the value of neighbors j![]() ji are included. Comparing the formula calculation of Moran’s Ii, the set ji covers the neighbors of the municipality i, defined as the chosen spatial weight matrix.

ji are included. Comparing the formula calculation of Moran’s Ii, the set ji covers the neighbors of the municipality i, defined as the chosen spatial weight matrix.

The analysis of statistics (LISA M) represents an indication of the degree of linear association, positive or negative, between the value of a given variable in a given site I is the average data of another variable in neighboring locations (ANSELIN et. al., 2004).

Secondary data used for this study were extracted from the National Treasury Secretariat (STN) , through FINBRA - Finance of Brazil - Accounting Data of Municipalities (in relation to the Revenue Budget) and the revision of constitutional transfers - Municipalities (relative to FPM, FUNDEB, ITR, CIDE-Combustíveis, royalties and AFM). The data related to ICMS and to IPVA were provided by the State Treasury Secretariat of Estado do Acre (SEFAZ/AC) .

The values presented on employment formalization for working people were obtained from a secondary database published by the United Nations Development Programme (UNDP).

The sources of municipal revenues used in this study are derived from IPVA state transfers (50% of the collection on the ownership of automotive vehicles licensed in their territories) and ICMS (25% of the revenue product); as the sources of municipal revenue coming from federal transfers used in this study are the FPM (23.5% of tax over industrialized products + tax on income and earnings of any nature) FUNDEB, ITR (50% or 100% if there is an agreement), CIDE (25% of 25% transferred on to the states are transferred to municipalities), the “royalties” from oil exploration (25% for non-producing municipalities and 17% for producing municipalities), and AFM (sporadic feature that seeks to meet the exceptional demands of municipalities in times of transitory financial difficulties - in 2010, by Law No. 12058 of October 13, 2009, and in 2013, by Law No. 12859 of September 10, 2013), due to the importance and relevance of the composition of revenue budgets. There are other sources of federal transfer payments that are not subject of this study since their transference payment values are statistically irrelevant, they are: IPI-export (25% exporter municipalities), FEX (25% exporters municipalities), CFEM – Brazilian mining royalty (65% of collection in the municipality by the exploitation of mineral resources) and IOF-ouro (70% for the city of origin).

Table 1 shows the dependencies of the transfer payments of the Union and Estado do Acre and the total dependence on federal and state transfers payments of municipalities of Estado do Acre in the years 2010 and 2013.

Based on these results, the analysis of the 22 municipalities dependent on FPM transfers, FUNDEB, ITR, royalties, the CIDE-Combustíveis, AFM, ICMS and IPVA as the composition of the total revenue, for the years 2010 and 2013.

It has been observed that all municipalities of Estado do Acre in these periods, present dependence over 50% (fifty percent), that is, more than half of its budget revenues.

Additionally, it is important to consider that to calculate the FPM of municipalities within the states is taken based on the population of the municipalities, the population of the states,and the population of the country, as for the calculation of FPM quota for Brazilian capital and the completion of the reservation, the Factor Population and Factor Income are calculated.

It becomes evident that the values transferred by FPM, FUNDEB, royalties, AFM, ICMS and IPVA increased from 2010 to 2013 as well as the revenue budgets of all municipalities. On the other hand, there was a decrease in transfers of CIDE-Combustíveis, while the ITR fluctuated more or less depending on the municipality.

Table 1 shows that the municipalities of Acrelândia, Assis Brazil, Bujari, Feijó, Jordão, Manoel Urbano, Porto Walter, Santa Rosa do Purus and Sena Madureira increased their level of dependence from 2010 to 2013, supposedly for being essentially agricultural municipalities where there are no incentives for private initiatives that would create economic activities and therefore generate employment and income, while other municipalities would decreased their dependence on transfer payments.

The municipality whose dependence on federal and state transfer payments increased more was Manoel Urbano, while the municipality that decreased more its dependence on these transfers was Senador Guiomard. This is possibly because in this region there are no federal and state development and economic growth policies, since there were other state policies such as the creation of Acre Export Processing Zone (ZPE) , the improvement in the infrastructure of the highway AC-040 for the transportation of products directed, in both senses, towards Estado do Acre capital and for the Free Trade Areas of Epitaciolândia/Brasiléia destined for neighboring countries, Bolivia and Peru, as well as the installation of refrigeration industries causing an increase in employment and thereby increasing their own municipality revenue.

For instance, the reduction in dependence on interstate transfers in the municipality of Capixaba can be explained by the installation of an industry called Álcool Verde, incentivized by Law No. 2,445, of August 8, 2011, which caused the increase of direct and indirect jobs in this region.

Table 1: Dependence of the municipalities of Estado do Acre in 2010 and 2013

| Mesoregion, Microregion and Municipalities | Federal dependence % |

State Dependence % |

Total dependence % |

||||||

2010 |

2013 |

∆P.P. |

2010 |

2013 |

∆P.P. |

2010 |

2013 |

∆P.P. |

|

Totals |

54,21 |

52,27 |

-1,94 |

17,37 |

17,36 |

0,00 |

71,58 |

69,64 |

-1,94 |

Acre Valley |

52,02 |

50,14 |

-1,88 |

19,29 |

19,10 |

-0,19 |

71,32 |

69,24 |

-2,07 |

Brasiléia |

49,79 |

47,94 |

-1,84 |

22,22 |

22,55 |

0,34 |

72,00 |

70,50 |

-1,51 |

Assis Brasil |

44,85 |

53,19 |

8,34 |

17,49 |

21,61 |

4,12 |

62,34 |

74,80 |

12,46 |

Brasiléia |

47,49 |

42,12 |

-5,37 |

27,19 |

25,96 |

-1,22 |

74,68 |

68,09 |

-6,59 |

Epitaciolândia |

56,92 |

54,28 |

-2,63 |

14,10 |

14,46 |

0,37 |

71,01 |

68,75 |

-2,26 |

Xapuri |

49,89 |

42,17 |

-7,71 |

30,09 |

28,17 |

-1,92 |

79,98 |

70,34 |

-9,64 |

Rio Branco |

54,20 |

48,59 |

-5,61 |

18,82 |

17,44 |

-1,38 |

73,02 |

66,03 |

-6,99 |

Acrelândia |

50,14 |

53,97 |

3,83 |

10,63 |

12,95 |

2,32 |

60,77 |

66,92 |

6,15 |

Bujari |

52,09 |

52,31 |

0,21 |

17,88 |

19,40 |

1,52 |

69,97 |

71,70 |

1,73 |

Capixaba |

68,58 |

55,63 |

-12,95 |

20,08 |

16,85 |

-3,22 |

88,66 |

72,49 |

-16,17 |

Plácido de Castro |

52,95 |

46,69 |

-6,26 |

24,33 |

23,04 |

-1,29 |

77,28 |

69,73 |

-7,55 |

Porto Acre |

59,61 |

55,03 |

-4,58 |

13,43 |

13,61 |

0,18 |

73,04 |

68,64 |

-4,40 |

Rio Branco |

41,49 |

36,53 |

-4,96 |

20,56 |

16,77 |

-3,78 |

62,04 |

53,30 |

-8,74 |

Senador Guiomard |

54,51 |

39,95 |

-14,56 |

24,86 |

19,46 |

-5,41 |

79,37 |

59,40 |

-19,97 |

Sena Madureira |

49,94 |

56,71 |

6,77 |

16,49 |

18,37 |

1,88 |

66,43 |

75,08 |

8,65 |

Manoel Urbano |

46,17 |

55,90 |

9,73 |

15,62 |

19,17 |

3,54 |

61,79 |

75,07 |

13,28 |

Santa Rosa do Purus |

51,13 |

58,68 |

7,54 |

15,68 |

18,04 |

2,37 |

66,81 |

76,72 |

9,91 |

Sena Madureira |

52,51 |

55,56 |

3,04 |

18,18 |

17,90 |

-0,28 |

70,69 |

73,46 |

2,77 |

Juruá Valley |

58,05 |

56,00 |

-2,05 |

13,99 |

14,32 |

0,33 |

72,04 |

70,32 |

-1,72 |

Cruzeiro do Sul |

58,97 |

54,30 |

-4,67 |

14,22 |

13,92 |

-0,30 |

73,19 |

68,23 |

-4,96 |

Cruzeiro do Sul |

41,60 |

35,56 |

-6,04 |

21,26 |

17,78 |

-3,47 |

62,86 |

53,34 |

-9,52 |

Mâncio Lima |

57,17 |

52,47 |

-4,70 |

14,02 |

13,86 |

-0,16 |

71,19 |

66,33 |

-4,86 |

Marechal Thaumaturgo |

69,40 |

66,24 |

-3,17 |

8,97 |

9,70 |

0,73 |

78,37 |

75,94 |

-2,44 |

Porto Walter |

58,86 |

60,25 |

1,39 |

14,74 |

16,54 |

1,81 |

73,60 |

76,79 |

3,19 |

Rodrigues Alves |

67,83 |

57,01 |

-10,81 |

12,12 |

11,73 |

-0,38 |

79,94 |

68,75 |

-11,20 |

Tarauacá |

56,51 |

58,82 |

2,31 |

13,61 |

14,99 |

1,38 |

70,12 |

73,81 |

3,69 |

Feijó |

58,19 |

57,74 |

-0,46 |

13,85 |

15,25 |

1,40 |

72,04 |

72,98 |

0,94 |

Jordão |

52,81 |

60,76 |

7,95 |

12,57 |

15,31 |

2,74 |

65,39 |

76,08 |

10,69 |

Tarauacá |

58,52 |

57,96 |

-0,56 |

14,41 |

14,41 |

0,00 |

72,93 |

72,37 |

-0,55 |

Source: STN and Department of Finance. Adapted by the author.

It can be seen that the political and administrative change of the municipalities of Estado do Acre did not influence the dependence on intergovernmental transfers. Only five municipalities have maintained the same political party in the Executive Power: Senator Guiomard, Rodrigues Alves, Cruzeiro do Sul, Rio Branco and Mâncio Lima. All five municipalities decreased dependence. That is, a political and administrative change did not mean an improvement in dependence on transfer payments.

However, the conversion of the paradigm in economic policy adopted by the government of Estado do Acre, governor Binho Marques, by the end of 2010, lead to sustainable development based on the "florestania" concept, leading to the industrialization of Estado do Acre in the first governmental period of the governor Tião Viana, starting in 2011, contributing to the reduction of dependence of municipalities of Estado do Acre on intergovernmental transfer payments, evident when comparing the years 2010 and 2013.

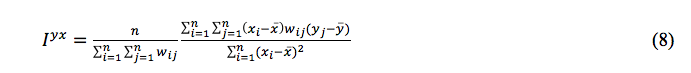

Figure 1 shows the percentage change in the total dependence of Estado do Acre municipalities between 2010 and 2013. It was found through the map analysis and Table 1, in 2013, that the Acre Valley mesoregion presented the less reliance on intergovernmental transfer payments while Juruá Valley mesoregion had the highest dependence. Among the micro-regions, Rio Branco had the lowest dependence on intergovernmental transfer payments while Sena Madureira had the highest dependence.

Figure 1 - Map of the percentage change in the total dependence of Estado do Acre municipalities between the years 2010 and 2013.

Source: Elaborated by the author and produced by geographer Damião Alves Serra, 2016. Collected from data of STN and SEFAZ/AC.

The statistics presented in Table 2 demonstrate the homogeneity of dependence on intergovernmental transfer payments in state municipalities of Estado do Acre in relation to the average.

It is also evident the reduction in dependence on the intergovernmental transfers as well as a reduction in the coefficient of variation, thus increasing the homogeneity in dependence on these transfers payments.

Table 2: Dependence statistics of Estado do Acre municipalities in 2010 and 2013

| Statistics | Years |

||

2010 (%) |

2013 (%) |

ΔP.P. |

|

Average |

71,58 |

69,64 |

1,94 |

Maximum |

88,66 |

76,79 |

11,87 |

Minimum |

60,77 |

53,30 |

7,47 |

Variance |

53,31 |

45,02 |

8,29 |

Coefficient of variation |

10,20 |

9,63 |

0,57 |

Source: Elaboration by the author, 2016. Collected from data of STN and SEFAZ/AC.

The Moran’s I univariate test was carried out with various spatial weights matrix settings (queen, rook, 4 neighbors and 6 neighbors), demonstrating that the rook convention is the best to evaluate the spatial dependence and to analyze the process of economic externality between the municipalities, as shown in Table 3. It was found a positive autocorrelation, proving that there is similarity between the municipalities. In other words, municipalities with high dependence on state and federal transfer payments tend to be surrounded by neighboring municipalities that have a high dependence.

As observed in Table 3, the dependence on intergovernmental transfers affect the socio-economic development in Estado do Acre municipalities, therefore, reject Ho with a 10% significance level. Consequently, it is concluded that the spatial dependence of the dependence indicator on intergovernmental transfers definitely has spatial components.

Table 3: Moran’s I univariate test for spatial dependence of the dependence indicator

on intergovernmental transfers of Estado do Acre municipalities for the year 2010

| Matrix | Moran’s I |

P-Value |

Queen |

0,2392 |

0,1045* |

Rook |

0,2392 |

0,1042* |

4 Neighbors |

-0,1742 |

0,1559NS |

6 Neighbors |

-0,0751 |

0,4500NS |

Source: Research results.

Legend: ** 5% Significant, * 10 % Significant, and NS not significant

The degree of employment formalization for working people was used to perform the correlation with the dependence of municipalities, since part of the working population is neither unemployed or employed in formal jobs, indicating the existence of a series of informal economic activities. The results show that the normal correlation is -0.40 with a 5% significance level; that is, when the degree of employment formalization increases in the municipality, the municipality reduces its dependence, as the economy grows and its own storage increases. It is noteworthy that the normal correlation does not list the municipalities spatially, therefore the Moran’s I bivariate test should be applied for spatial analysis.

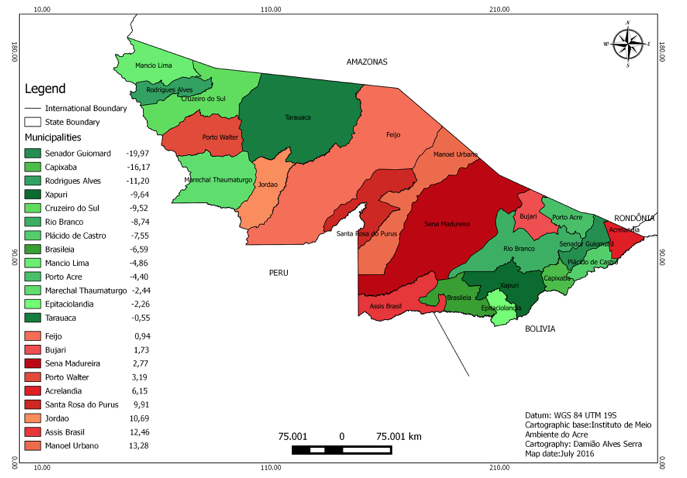

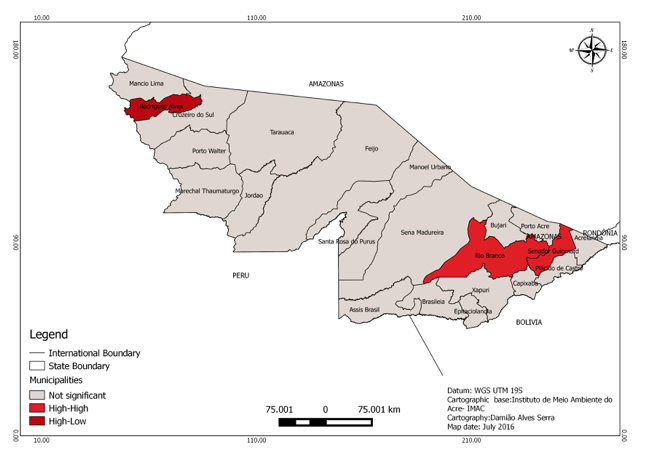

Table 4 presents the results of the Moran’s I bivariate test with spatial weights matrix settings: queen, rook, 4 neighbors and 6 neighbors; likewise Figure 2 shows spatial clusters between the total dependence on intergovernmental transfers and the degree of employment formalization for working people of Estado do Acre municipalities in 2010. It is palpable that much was not significant. The municipality of Rodrigues Alves has the High-High attribute, characteristic of positive externality, that is, a high degree of employment formalization for laborers, having a positive impact in the municipalities of the region with 1% of significance level.

On the other hand, the municipalities of Rio Branco and Senador Guiomard are municipalities with a high degree of employment formalization for working people, but they have neighbors with low degree of employment formalization for laborers, therefore, they present the High-Low attribute, featuring negative externality. These municipalities have a significance level of 5%.

Table 4: Moran’s I bivariate test for spatial dependence of the dependence indicator

on intergovernmental transfers and degree of employment formalization for working people.

| Matrix | Moran’s I |

P-Value |

Queen |

0,2081 |

0,0556** |

Rook |

0,2081 |

0,0556 ** |

4 Neighbors |

0,2081 |

0,0556 ** |

6 Neighbors |

0,2081 |

0,0556 ** |

Source: Search results.

Legend: ** 5% Significant, * 10 % Significant and NS not significant

Figure 2 – Bivariate cluster between total dependence on intergovernmental transfers

and the degree of employment formalization for working people of Estado do Acre municipalities in 2010.

Source: Research results.

Note: Bivariate significance (High-high, p = 0.01, and High-Low, p = 0.05).

Based on the secondary data and the results obtained in this study, it was observed that the maintenance cost for public administration of municipalities with low population and little socio-economic development in Brazil is high.

On the other hand, it is evident that the employment formalization, in the municipalities of Estado do Acre, generates positive externalities to neighboring municipalities with higher degree of employment formalization. In this sense, it is suggested that the government encourage the private sector initiatives in order to create new formal jobs, and thus, reduce dependence on intergovernmental transfers, resulting in a better regional development.

This study was limited to the verification of the dependence that Estado do Acre municipalities have in relation to transfer payments from the Estado do Acre and the federal government in the years 2010 and 2013, as well as the relationship this dependence has with employment formalization forworkers. This way possibilities are not exhausted for future analyzes of other socio-economic development variables for municipalities of Estado do Acre.

The analysis of intergovernmental dependence is very important to evaluate, for a better distribution of resources among municipalities, to provide public policies of quality and sustainable regional development for the population.

ALMEIDA, Eduardo. Econometria espacial aplicada. Campinas: Editora Alínea, 2012.

Almeida, E. S., Haddad, E. A. e Hewings, G. J. D. (2005). “The spatial pattern of crime in Minas Gerais: an exploratory analysis.” Economia Aplicada, vol. 9, n. 1.

ANSELIN, L.; SYABRI, I.; SMIRNOV, O. Visualizing multivariate spatial correlation with dynamically linked windows. Urbana-Champaing: Spatial Analysis Laboratory, Department of Agricultural and Consumer Economics, University of Illinois, 2004. 13 p. Disponível em: <http://www.real.illinois.edu/d-paper/01/01-t-10.pdf>. Acesso em: 31 mar. 2016.

ANSELIN, L. (2005). Exploring spatial data with geoda: a workbook. University of Illinois, Urbana-Champaing. Disponível em: <https://geodacenter.asu.edu/system/files/geodaworkbook.pdf>. Acesso em: 31 mar. 2016.

BAILEY, T. C; GATRELL, A. C. Interactive spatial data analyses. Essex: Longman Scientific, 1995. 413 p.

BRITO, Johnatan Rafael S. de; PENHA, Thales Augusto Medeiros. Dependência de transferência de recursos para gastos com educação, saúde e infraestrutura: uma análise de regressão para os municípios do Rio Grande do Norte comparando os anos de 2003 e 2007. Revista de Estudos Sociais, Cuiabá, v. 14, n. 27, pp. 79-96, 2012.

FERRARIO, M. N.; SANTOS, A. A. L.; PARRÉ, J. L.; LOPES, R. Uma análise espacial do crescimento econômico do estado do Paraná para os anos 2000 e 2004. Revista Brasileira de Estudos Regionais e Urbanos, Recife, v. 3, n. 1, pp. 154-177, 2009.

FURTADO, Celso. Introdução ao desenvolvimento: enfoque histórico – estruturalista. 3ªedição revisada pelo autor. Rio de Janeiro: Paz e Terra, 2000.

IBGE, Instituto Brasileiro de Geografia e Estatística [2016]. Cidades@. Disponível em: <http://www.cidades.ibge.gov.br/xtras/uf.php?lang=&coduf=12&search=acre>. Acesso em: 01/03/2016.

MENDES, Marcos; MIRANDA, Rogério Boueri; COSSIO, Fernando Blanco. Transferências intergovernamentais no Brasil: diagnóstico e propostas de reforma. Brasília: Consultoria Legislativa do Senado Federal, 2008. Textos para Discussão, n. 40. Disponível em:<http://www12.senado.gov.br/publicacoes/estudos-legislativos/tipos-de-estudos/textos-para-discussao/td-40-transferencias-intergovernamentais-no-brasil-diagnostico-e-proposta-de-reforma>. Acesso em: 13/04/2016.

MENDES, Maria da Luz da Silva. Evolução de alguns indicadores de desenvolvimento nos países subdesenvolvidos africanos. Dissertação (Mestrado em Métodos Quantitativos em Economia e Gestão) – Faculdade de Economia Universidade do Porto, 2012.

SANTOS, Karla Gabriele Bahia dos; SANTOS, Carlos Eduardo Ribeiro. Dependência municipal das transferências do Fundo de Participação dos Municípios: uma análise para os municípios do Sul da Bahia entre 2008 e 2012. Ilhéus: Universidade Estadual de Santa Cruz, 2014. Disponível em: <www.uesc.br/eventos/ivsemeconomista/anais/gt1-5.pdf>. Acesso em: 13/04/2016.

SCUR, Rosane Boelter; NETO, Orion Augusto Platt. Diagnóstico da dependência dos repasses federais e estaduais no município de Canela – RS. Revista Catarinense da Ciência Contábil, Florianópolis, v. 10, n. 29, pp. 53-68, 2011.

SEN, Amartya Kumar. Desenvolvimento como liberdade; Tradução Laura Teixeira Motta; revisão técnica Ricardo Doniselli Mendes. São Paulo: Companhia das Letras, 2000.

VEIGA, José Eli da. Desenvolvimento sustentável: o desafio do século XXI. Rio de Janeiro: Garamond, 2005.

1. Auditor da Receita Estadual do Estado do Acre e Mestrando em Desenvolvimento Regional na Ufac. E-mail: breno2m1@yahoo.com.br

2. Doutor em Economia Aplicada pela Universidade Federal de Viçosa (UFV), professor de Métodos Quantitativos Aplicados à Economia, do Curso de Ciências Econômicas e do Programa de Pós-graduação em Desenvolvimento Regional da Universidade Federal do Acre (Ufac). E-mail: rubicleis@uol.com.br

3. Instituto Brasileiro de Geografia e Estatística

4. Fundo de Participação dos Municípios

5. Fundo de Manutenção e Desenvolvimento da Educação Básica e de Valorização dos Profissionais da Educação

6. Imposto sobre a propriedade territorial rural

7. Apoio Financeiro aos Municípios

8. Imposto sobre operações relativas à circulação de mercadorias e sobre prestações de serviços de transporte interestadual e intermunicipal e de comunicação

9. Imposto sobre a propriedade de veículos automotores

10. Secretaria do Tesouro Nacional

11. Secretaria de Estado da Fazenda do Estado do Acre

12. Imposto sobre Produtos Industrializados-Exportação

13. Compensação Financeira pela Exploração de Recursos Minerais

14. IOF-Ouro ativo financeiro ou instrumento cambial = Financial Assetor Exchange Instrument

15. Zona de Processamento de Exportação do Acre